Gillette: A Two-part Pricing Success

Have you ever wondered why the price of the ink (toner) of a printer is a large part of the price of the printer itself? Have you ever asked why a game console is so cheap compared to the CDs you need to play games? Have you ever thought why your grandfather uses a basic mobile phone and probably won't change to a smartphone? The answers take us to what's known in economics as 'two-part pricing' and 'switching costs'. Since this isn't an economics class, I'll try to tell you a story.

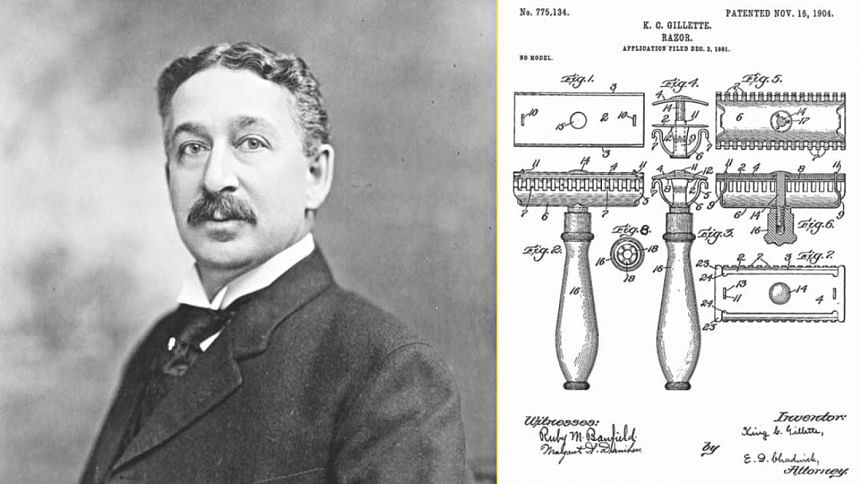

King Camp Gillette patented the world's first safety razor in 1904. He devised a clever way to make the razor small and strong, and yet the blade thin to reduce manufacturing costs. Gillette's innovation was revolutionary. It saved the hassle of going to a barbershop to shave because razors were heavy and shaving on your own wasn't always a good idea. Disposable blades meant people could avoid sharpening the blade each time it lost its sharpness. There were shouts. Barbers were going to become unemployed. Those who could afford the safety razor, didn't listen.

Gillette had a patent on manufacturing the safety razor. Thus Gillette priced both components – the razor, and the blades – high. The high price made it attractive to the richer end of the market only.

Patents are given to innovators as an incentive to develop new products and enjoy a monopoly to recover their innovation costs. Other manufacturers can't make cheap alternatives within the patent period. But, patents don't last forever. Cheap alternatives do emerge. However, if the patented product becomes a brand, the business model may survive after the patent finishes. The model may also survive if 'switching costs' to alternatives is difficult. This is how the two-part pricing model emerged with the Gillette experience.

Gillette's patent expired in the 1930s. Rival companies manufactured their safety razors. Once the patent expired, Gillette priced the first component, the razor, low while keeping the price of the blades high.

Why did this two-part pricing model make sense?

First, many could now afford to buy Gillette razors that had become a trusted brand. Second, once you buy the razor for cheap, would you very easily change to a rival manufacturer once blades run out? You probably won't. Such changes involve 'switching costs'. These costs don't always have to be financial. They can also be psychological.

If you've gotten used to Apple IOS, would you switch to Android next time you change your mobile? If you do, it will involve time to get used to the new platform. Same goes for Adobe PDF reader consumers who'll think before they change to say Foxit PDF reader.

Two-part pricing is simple. Price the first part cheap to attract the customer. Once the customer pays for the first part, price the second and latter parts high if switching is difficult. Theme parks and cinema halls are good examples. Ticket prices at entrance may be attractive. After entering, you find the food and drinks are over-priced, or they sell specific soft drinks. You're not allowed to bring food and drinks from outside. What will you do? You can't leave. Your long-awaited movie or fantasy rides are waiting for you.

The Gillette experience showed why two-part pricing makes sense. It helps recover costs and make an extra. It also helps retain old customers because of switching costs. You may now appreciate why your grandfather uses a basic mobile, and why you may not change the brand of your printer even though the toners aren't cheap.

Asrar Chowdhury teaches economic theory and game theory in the classroom. Outside he listens to music and BBC Radio; follows Test Cricket; and plays the flute. He can be reached at: [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments