Big target, tricky route

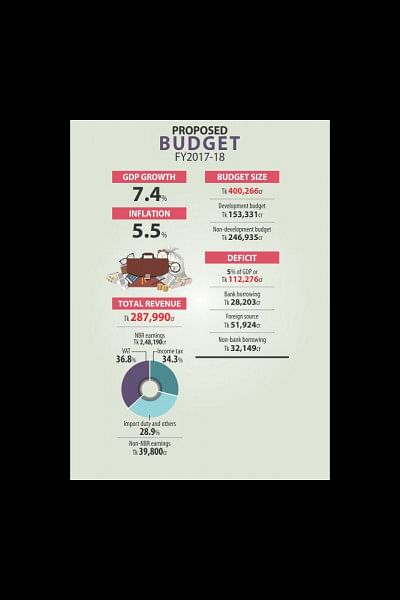

Mega dreams require mega shake-ups, sometimes crushing ones, especially if you have little control over costs and transparency. Finance Minister AMA Muhith's proposed budget has come with the same impact -- putting the people through the VAT machine to take out every mint possible to be spent on a budget that is bigger by a quarter than the present one.

No doubt that a middle income country will need to use VAT to collect revenue, but what has made the case questionable here is the rate and coverage of the tax in a country which has just crossed the threshold of achieving that middle income status.

Moreover, Muhith's budgetary measures will cause price increases at various levels from production to cost of living, as supplementary duty will be applicable to producers and VAT to the consumers.

The middle class will feel the pinch of VAT in every way to reduce their quality of life. However, the finance minister has somehow tried to compensate it with wider social safety net programmes.

His two nagging new challenges -- fall in remittance and poor growth in exports -- remain unanswered in the budget. A forecast of economic recovery next year is probably his best hope as he has mentioned frequently throughout the budget speech.

But much of the readymade garment export is now our own structural problem including the lack of malleability of exchange rate. The finance minister has dwelled less on the issue before offering a reduced corporate tax to the sector.

The fact is, reducing corporate tax may increase investible capital for the investors but will not go to create market demand. He could have rather added some incentives to the existing ones to make products competitive.

And his hope on remittance is likely to remain elusive as oil price forecast still looks bleak, spelling further dark days for the petro-economies.

Muhith wants a higher growth rate of over 7 percent. And for that he hopes to rope in private investment. Low bank interest rate is a vital component to spur and sustain such initiative as Muhith has rightly pointed out. But he remains silent on putting the tattered banking system back into form again. As long as the banks remain in the present sorry state, more and more loans will go bad and cost of funds will remain higher. Hence, his hope of lowered interest rate will remain unmet.

On the contrary, Muhith has once again proposed Tk 2,000 crore to recapitalise the banks. Last time he did that after the massive banking scandals as thousands of crores of taka were siphoned off the state-owned banks by some unscrupulous business groups. So every year, the taxpayers have to feed those who regularly rob our banks.

One of his growth mantras -- to generate consumption demand -- is also debatable because it mostly depends on public spending. Remittance that plays a vital role to spike consumption across the country is fizzling out. The across the table VAT imposition will have a choking effect on private expenditures too. These facts in no sense explain how internal demand will rise.

Rather, he could have thought of increasing disposable income of the people by either increasing the tax-free slab in income tax or reducing the lowest tax rate. He did neither.

Apart from more VAT collection, Muhith's other source of collecting money to fund mega projects is foreign financing, which he has projected to increase by 68 percent from that in this year's revised budget. It is beyond our perception since when and how Bangladesh suddenly achieved this kind of superb implementation capacity. And if the figures are only for the sake of figures, the consequence will be a budgetary mismatch, a huge deficit, a bigger bank borrowing, and all the other knock-on effects.

Half of the foreign finance will come from institutional lenders and that makes good sense. But the rest comes from untested and little tested non-conventional sources. Costs of such funds are high and projects conceived with such funds are often costlier. When such factors meet, the economic returns become weak.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments