Income tax rates, tax-free limit to stay unchanged

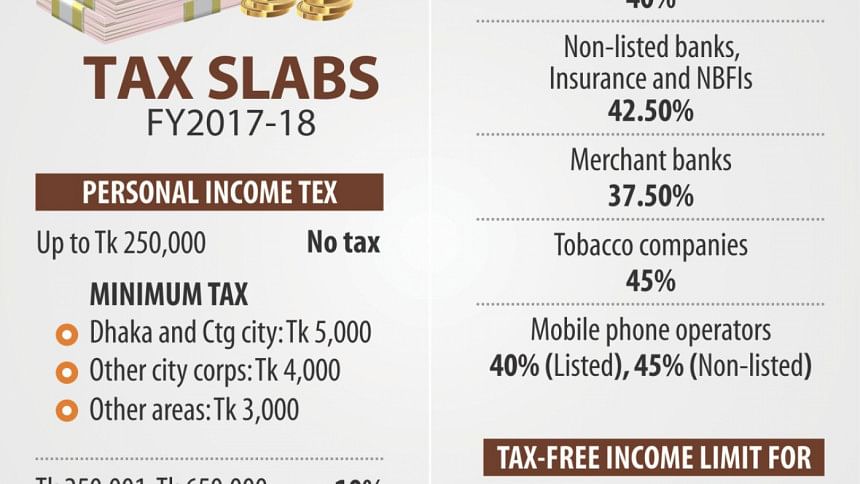

The government's move to keep tax-free income threshold and the tax rates on individuals and firms unchanged in the next fiscal year is likely to affect many low and middle income people who would be new to income taxes.

For example, if income tax-exempt earning limit remains at Tk 2.50 lakh a year for individuals, it may reduce many people's disposable income.

“Many low income people will come into the tax net just because of spike in their annual income. This will reduce their disposable income,” said Masud Hasan, who works at the finance and control department of a private company.

Tax burden on many individuals will rise just because of increment in their salaries, he added.

The government should have increased tax free income threshold considering inflation, he stressed.

Various quarters, including businesses, have been demanding a rise of the tax-free threshold since the cost of living is rising with inflation.

Finance Minister AMA Muhith, on several occasions, said he favoured maintaining a fixed tax-free income threshold for several years instead of raising the tax-free income limit every year.

“What should be the ideal tax exemption threshold is a subject of interesting and enlightening intellectual debate in our country. There should be a philosophy for determining the tax exemption threshold,” he said in yesterday's speech.

He added that per capita income and the rate of inflation might be important determiners in this case.

He also said inflation rate was low at the moment, with point-to-point inflation measuring at around 5 percent only.

The minister's view comes at a time when inflation is on the rise mainly due to the increasing prices of rice. In addition, application of a single and uniform VAT rate is also feared to raise the cost of many goods and services in the coming days.

Also, continuation of 10 percent tax on the income of up to Tk 6.50 lakh a year also eats into the disposable income of people at the bottom of the income tax slab.

The Centre for Policy Dialogue (CPD) earlier urged the government to slash the personal income tax rate for the lowest threshold to 7.5 percent from 10 percent.

A reduction in personal income tax will help boost people's disposable income, especially of the middle-class, said Debapriya Bhattacharya of CPD in April when the think-tank unveiled its proposals for the next fiscal year.

“This cut will bring more revenue to the state as it will increase domestic consumption,” he said.

To encourage compliance and inspire new taxpayers, Muhith yesterday proposed giving the title “Kor Bahadur” to families, in which all members have been paying taxes for a long time.

In addition to individual taxpayers, all corporate tax, except the tobacco processors', including cigarettes makers', are also going to remain unchanged.

Tobacco processors will have to count 2.5 percent surcharge on their income on top of paying 45 percent corporate tax.

Affluent people will continue to face similar net wealth surcharge structure. Muhith said this should be maintained until an effective wealth tax act is enacted.

Some measures, making it mandatory for employees serving in an executive or a management position in private firms to submit tax returns, are going to bring more people under the tax net.

“We will focus on compliance of laws in the coming year to ensure increased collection of tax,” Muhith said, adding that the tax authority will go for auditing firms to see whether they have properly deducted tax at source.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments