Favouring the defaulters

A Global Financial Integrity (GFI) report released three years ago said that USD 75 billion was lost from our economy because of trade misinvoicing and other unrecorded outflows between 2005 and 2014. USD 6-9 billion, equalling 9-13 percent of Bangladesh's total trade for that year, was lost through illicit money outflows in 2014 alone. Coincidentally (although I wouldn't bet on it), this massive capital flight was preceded by (or ran parallel to) some of the biggest financial/loan scams to have ever hit our banking sector.

In response…the government refused to bail banks out for their corrupt practices, jailed the banksters who had committed frauds, injected large sums of money directly into the economy to protect domestic deposits and keep the currency from devaluing, which ultimately led to a miraculous economic recovery within years. Oh wait, no, that was Iceland. We didn't do that in Bangladesh!

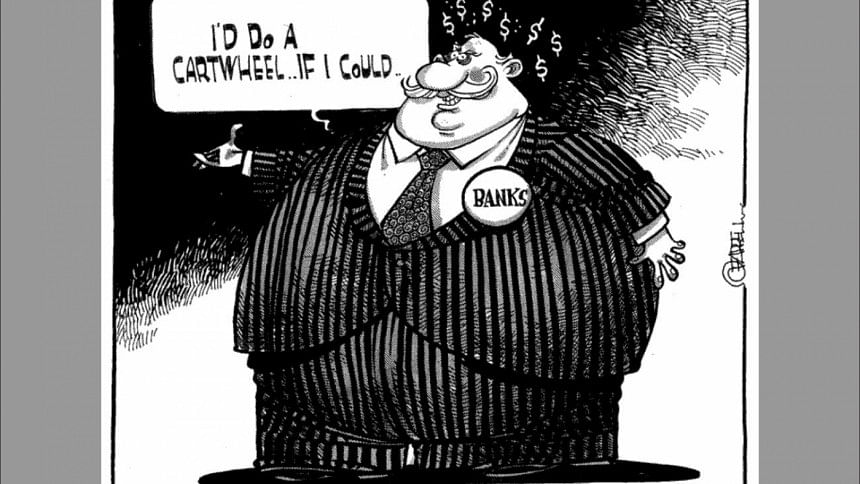

…the government in Bangladesh, instead of holding bankers accountable, bailed out the fraud-riddled banks using thousands of crores worth of taxpayers' money, year after year, despite repeated scandals hitting the banking sector and defaulted loans skyrocketing ad infinitum (as predicted would happen by those who opposed the bailouts). Today, even after the country's seven state-run banks wrote off Tk 2,041 crore worth of defaulted loans in between 2012 and 2016, eight state-run banks still hold 56.39 percent (Tk 41,399.70 crore) of the total defaulted loans in the banking sector. And, according to the Bangladesh Bank data, overall defaulted loans in the banking sector again rose in the first three months (January-March) of this year by a mammoth Tk 11,236.68 crore.

Despite this, the authorities have again proposed to allocate thousands of crores of taka to "recapitalise" the "ailing" banks in the upcoming budget— euphemism for: bail out 'zombie' banks suffering from liquidity crises having given out dubious loans (or worse). Compare this to what economist and professor Michael Hudson wrote in his book Killing the Host: "Banks have gained control of government and their central banks to create money…to bail out creditor losses, not to finance public spending"—a common theme across the world (except for in Iceland and a few other countries).

This new trend or "financial alternative to classical economics", he says, is what "calls itself 'neoliberalism' but…is the opposite of what the Enlightenment's original reformers called themselves," largely because its advocates conveniently leave out the "original critique of landlords, bankers and monopolists…out of the current political debate in favour of what is best characterised as trickle-down junk economics." In fact, "The classical reform program of Adam Smith and his followers," according to Professor Hudson, "was to tax the income deriving from privileges…and to make land, banking and monopolies publicly regulated functions." Yet, what we see today are drastic reductions in banking regulations.

"But the inequality created by neoliberal policies is not only the more obvious 'inequality of outcome' (e.g. wealth), but also the 'inequality of opportunity' which classical economists most vigorously opposed.

Here, for example, we have the government approving a proposal to amend the Banking Companies Act which would extend the tenure of bank directors from six to nine years and allow four members from a family, from only two now, to become directors of a bank's board. Whereas, according to a former deputy governor of the central bank, these decisions go "against the interest of the depositors" and a much better alternative to enforce financial discipline and circumspection would have been to give 'more' power to the central bank to 'regulate' other banks.

Going back to what Professor Hudson said: "Neoliberals have re-defined 'free markets' to mean an economy free for rent-seekers, that is, 'free' of government regulation or taxation of unearned rentier income." And governments have, willingly or unwillingly, obliged, creating mass inequality wherever neoliberal policies have been applied.

Thus, "the main substantive achievement of neoliberalism" described by Distinguished Professor of Anthropology and Geography at the Graduate Centre of the City University of New York, David Harvey, has been "to redistribute, rather than to generate, wealth and income" through "accumulation by dispossession [e.g. bailing banks out using taxpayers' money]" using "imperial processes of appropriation of assets and usury, the national debt and, most devastating of all, the use of the credit [banking] system" (A Brief History of Neoliberalism, Oxford, 2005).

But the inequality created by neoliberal policies is not only the more obvious 'inequality of outcome' (e.g. wealth), but also the 'inequality of opportunity' which classical economists most vigorously opposed. The Bangladesh Institute of Bank Management (BIBM) director general was quoted as saying for example, by newspapers, that banks were "charging good borrowers high interest on loans to mitigate the losses they suffer from the defaulted loans."

So not only are the mass of people not bailed out like the corrupt banks. Not only do they have to pay to bail out the corrupt banks. But they also have to end up on the wrong side of the interest rate 'apartheid' created by bad lending practices of the corrupt banks (and bankers) creating inequality of opportunity by decreasing the ordinary person's access to finance.

And the latest round of economic and financial discrimination against ordinary citizens to support neoliberal policies (of giving banks handouts) was the doubling of excise duties on their bank deposits. The Finance Minister even justified it by saying that "whoever has 1 lakh taka in the bank is rich". Simultaneously, let us not forget that he had also said in parliament that what had happened in the banks was "robbery" (dacoity). This should make one wonder, if the (supposed) rich have to pay higher taxes on their deposits, why didn't the dacoits have to pay anything? Surely dacoity is a crime, whereas the last time I checked, being rich (accumulating wealth legally) is not.

The truth is that all of these policies are the same neoliberal hodgepodge which has wreaked havoc in other countries of the world and is now doing the same in ours. And the only way to save ourselves from the same fate of economic ruin is to dump neoliberalism for real (classical economic) liberalism. A basic concept of which is less restrictions and impositions on the individual and more regulations on banking and other financial institutions. Which also means, no bailing out banks using taxpayers' money (by imposing austerity measures on citizens) when bankers have either willingly allowed fraud to happen—in which case they deserve to go to jail—or were too incompetent to stop it from happening—in which case they deserve to lose their job.

The writer is a member of the Editorial team at The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments