Paradise Papers: The names we know so far

Dubbed the Paradise Papers, a trove of 13.4 million records exposes secret ties, dealings and the offshore interests more than 120 politicians around the world.

Also READ: Mintoo family named

The leaked documents show how deeply the offshore financial system is entangled with the overlapping worlds of political players, private wealth and corporate giants that avoid taxes through increasingly imaginative bookkeeping maneuvers, according to International Consortium of Investigative Journalists.

Read More: Secrets of global elite

The leak -- rivalling the Panama Papers in size and scope -- was obtained by German newspaper Sueddeutsche Zeitung and shared with the International Consortium of Investigative Journalists and a network of more than 380 journalists in 67 countries.

Two firms -- Bermuda’s Appleby and Singapore’s Asiaciti with 19 tax havens across the world -- helped the global rich and powerful, including from India, to move their money abroad.

READ more: Names of some 'firms linked to Bangladesh' come up

Politicians & celebrities

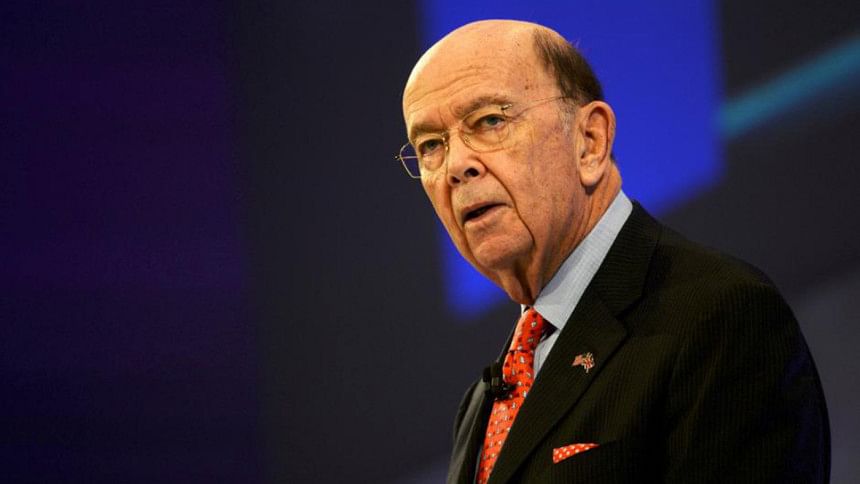

US Commerce Secretary Wilbur Ross

US Commerce Secretary Wilbur Ross has business ties to a shipping firm linked to Vladimir Putin's inner circle, according to the leak.

Read Also: ‘Paradise Papers’ expose Pak ex-PM Shaukat Aziz’s offshore holdings

Ross's ties to Russian entities raise questions over potential conflicts of interest, and whether they undermine Washington's sanctions on Moscow.

The commerce secretary insisted that "there is no impropriety".

In an interview with the BBC yesterday, Ross defended personal business links to Russia revealed by the Paradise Papers. In a separate interview with Bloomberg, Ross indicated he could end the links but not because of any wrongdoing.

Queen Elizabeth II

Queen Elizabeth II's investments in tax havens were revealed.

In the case of Queen Elizabeth's private estate, critics may question whether it is appropriate for the British head of state to invest in offshore tax havens.

The Queen's financial advisers have been criticised for bringing the “monarchy into disrepute” after it was revealed she had £10m invested in an offshore tax haven.

The Duchy of Lancaster -- which provides the Queen with a private income -- holds funds in the Cayman Islands and Bermuda.

This money is divested into accounts which are sheltered from the UK tax, which then makes investment decisions on their behalf.

Trudeau's top fundraiser

Besides, Canadian Prime Minister Justin Trudeau's top fundraiser and senior advisor Stephen Bronfman, heir to the Seagram fortune, moved some $60 million to offshore tax havens with ex-senator Leo Kolber.

The revelations about Bronfman could spell trouble for Trudeau, who was elected two years ago riding on the coattails of promises to reduce economic inequality and tax avoidance.

There is no suggestion that Ross, Bronfman or the queen's private estate acted illegally.

US secretary of state Tillerson

Rex Tillerson, the US secretary of state, is named in the files as a director of an offshore firm used in a multibillion-dollar oil and gas venture in the Middle East that became embroiled in controversy.

Tillerson was a director of Marib Upstream Services Company, incorporated in Bermuda in 1997. The company was tied to ExxonMobil, the American oil and gas corporation that Tillerson later led as chief executive.

Others

Other names that surfaced in the Paradise Papers include former PMs of Pakistan and Japan, president of Colombia, ex-deputy minister for defence of Saudi Arabia, the Queen of Jordan and Brazilian politicians.

Other royals and politicians with newly disclosed offshore ties include Queen Noor of Jordan, who was listed as the beneficiary of two trusts on the island of Jersey, including one that held her sprawling British estate; Sam Kutesa, Uganda’s foreign minister and a former UN General Assembly president, who set up an offshore trust in the Seychelles to manage his personal wealth; Brazil’s finance minister, Henrique de Campos Meirelles, who created a foundation in Bermuda “for charitable purposes”; and Antanas Guoga, a Lithuanian member of the European Parliament and professional poker player, who held a stake in an Isle of Man company whose other shareholders included a gambling mogul who settled a fraud lawsuit in the United States.

Wesley Clark, a one-time Democratic presidential hopeful and a retired four-star US Army general who served as NATO’s supreme commander in Europe , was a director of an online gambling company with offshore subsidiaries, the files show.

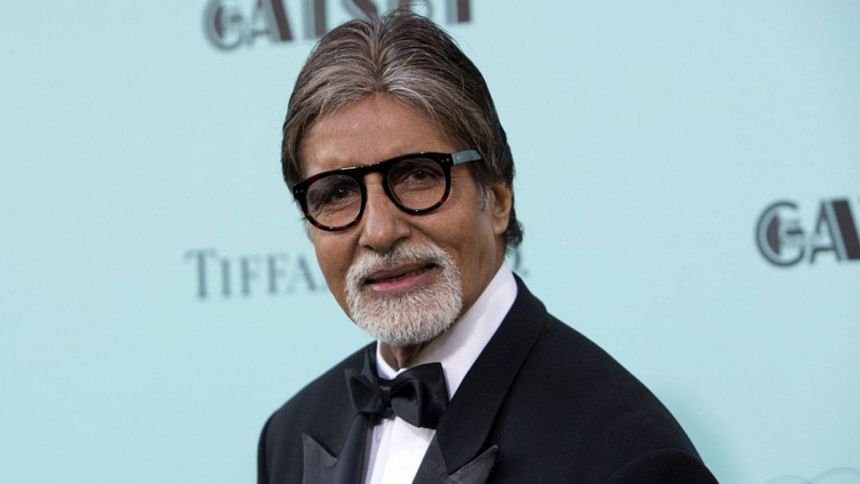

Celebrity icons like Madonna, Bono and Amitabh Bachchan have also been named in the documents.

Madonna and Allen did not reply to requests for comment. Omidyar, whose Omidyar Network donates to ICIJ, discloses his investment to tax authorities, a spokeswoman said. Bono was a “passive, minority investor” in the Malta company that closed down in 2015, a spokeswoman said.

In addition, the files reveal details about the financial lives of the rich and famous and the unknown including Microsoft co-founder Paul Allen’s yacht and submarines, eBay founder Pierre Omidyar’s Cayman Island investment vehicle, and music star Madonna’s shares in a medical supplies company. Pop singer and social justice activist Bono – listed under his full name, Paul Hewson – owned shares in a company registered in Malta that invested in shopping center in Lithuania, company records show. Other clients listed their occupations as dog groomer, plumber and wakeboard instructor.

Indians also included

There are 714 Indians in the tally. An Indian company, Sun Group, founded by Nand Lal Khemka, that figures as Appleby’s second-largest client internationally, with as many as 118 different offshore entities.

Amitabh Bachchan

Among the Individuals: Amitabh Bachchan’s shareholding in a Bermuda company acquired before the 2004 Liberalised Remittance Scheme kicked in.

Corporate lobbyist Niira Radia and film star Sanjay Dutt’s wife who figures under her former name Dilnashin. Minister of State for Civil Aviation Jayant Sinha’s name figures in the records because of his past association with the Omidyar Network. Records of offshore companies linked to BJP Rajya Sabha MP and founder of Security and Intelligence Services (SIS) R K Sinha appear in the Malta list.

Spy planes and super guns

There are also confidential details of offshore traces of spy planes purchased by the United Arab Emirates and a Barbados explosives company of a Canadian engineer who tried to build a “super gun” for Iraqi dictator Saddam Hussein

The leaked files also include documents from government business registries in some of the world’s most secretive corporate havens in the Caribbean, the Pacific and Europe, such as Antigua and Barbuda, the Cook Islands and Malta. One-fifth of the world’s busiest secrecy jurisdictions are represented in these databases.

Companies

The Paradise Papers leak also includes: Apple, Nike, Uber and other global companies.

Apple

The ICIJ says the leaked documents expose the tax engineering of more than 100 multinational corporations, including Apple, Nike and Botox-maker Allergan.

Apple chose Jersey as a new haven to continue avoiding billions in taxes after a 2013 crackdown on its controversial tax practices in the Republic of Ireland.

Nike

Nike shifted billions of dollars of profits to a Bermuda subsidiary by holding trademarks for its logo and shoes in offshore entities, the Paradise Papers reveal.

Facebook and Twitter

Though the social media companies are not directly implicated in offshore activity by what we know about the Paradise Papers so far, the documents have revealed that Kremlin-linked VTB Bank helped fund purchases of large stakes in the company.

Glencore

The world’s biggest commodity trader was one of Appleby’s top clients and the law firm even had a “Glencore Room” at its Bermuda office that kept information on the trader’s 107 offshore companies, according to the ICIJ.

Everton FC

The Paradise Papers also question whether Everton football club in UK has broken Premier League rules over ownership.

Farhad Moshiri has insisted his stake in Everton was bought with his own money after questions were asked about his link to Arsenal investor Alisher Usmanov.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments