Time to adopt a visionary approach

There has been a healthy debate as to whether Bangladesh should open up Foreign Direct Investment (FDI) in the apparel sector where, until now, the majority of investors are local entrepreneurs, with the exception of some foreign companies who have invested in garment businesses inside the Export Processing Zones (EPZs). Before analysing the arguments in this regard, we need to explore why and when FDI is necessary and also consider the advantages and disadvantages of adopting this practice.

Many will find it surprising that the fledgling apparel industry of Bangladesh flourished in the hands of the first-generation businessmen who got the opportunity to start their business ventures only after the independence of Bangladesh in 1971. They didn't have much knowledge of the business per se. Even Noorul Quader, the man largely credited with the revolution of the apparel business in Bangladesh, was a bureaucrat with sound knowledge on how to keep government services functioning smoothly; he was by no means an expert in the apparel field. The spirit of innovative entrepreneurship combined with a diligent workforce are the dominant forces behind the development of the country's apparel industry. Local entrepreneurs have put their efforts and made huge investment to expand the sector both vertically and horizontally, making Bangladesh the second largest readymade garment exporter in the world.

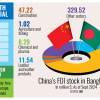

However, Bangladesh's share in the global apparel market is still relatively insignificant—only 6.36 percent—whereas China's share is 36.37 percent. In addition, most of our apparel items are cotton-based while 65 percent of global apparel is non-cotton. The majority of Bangladesh's apparel export items are concentrated in five basic product categories—trousers, t-shirts, sweaters, shirts, and jackets. We have to consider manufacturing more non-cotton apparel items where Bangladesh has huge potential. So investment in non-cotton textile is a highly feasible proposal as we have a captive market and a skilled workforce. It will, however, be necessary to continue to find methods to reduce our production lead time.

If we continue to keep our export products limited to a small number of categories, the growth in our industry runs the risk of stagnating or may even take a negative turn. Moreover, with the increasing socioeconomic development of Bangladesh, the living standards of people are improving also. In line with improvements in living standards, it is inevitable that wages will also gradually increase. To manage the demand for increased wages, the industry needs to start focusing on the production of higher valued apparel items. Upgrading of product in order to achieve a higher purchase price is an approach that needs to be adopted in order for our apparel industry to sustain its growth.

For value-added products, we need factories equipped with the most advanced machinery and staff with sound technical knowledge, for which we need huge investment. Value-added items like blazers, jackets, swimwear, lingerie, sportswear, uniforms, raincoats, and fishing wear require manmade fibres (MMF) including viscose, rayon, spandex, polyester and so on. But the MMF production capacity of our existing textile mills is still insignificant. MMF production is complex and constantly requires sophisticated machinery and regular research and development (R&D). Presently, we lack expertise in this area. However, knowledge and guidance can be gained by allowing foreign companies to set up the necessary textile mills in Bangladesh. The benefits of this approach are two-fold: our readymade garment factories will be able to procure the necessary materials from these mills, and lead times will be greatly reduced as our dependency on importing materials from China and India will be significantly reduced. In addition, it will facilitate knowledge transfer as local people, recruited in these fabric mills, will get the opportunity to work with, and learn from, experts in their field—the same way we had developed our garment industry in the 1980's with technical assistance from South Korea. So, foreign direct investment in the apparel and textile industry offers the prospect of good returns.

However, we must remember several things while considering FDI in the apparel industry. If we want to attract companies that produce higher valued items, we need to refine our regulatory system in such a way that the majority of investors will find manufacturing high-end products in Bangladesh beneficial, as too many restrictions may discourage the investors. Additionally, if we want to obtain FDI in a particular type of apparel item, we may have to consider setting up an apparel business park with facilities such as fabric and accessories suppliers, testing labs, consultants, etc.—all conducive to manufacturing that particular product type. Here, we need to remember that it is not possible to fully dictate what a manufacturer is going to produce. A winter jacket factory will produce basic items for about 5-6 months a year during the summer delivery period. Likewise, a swimwear manufacturer may produce lightweight basic blouses during winter delivery period.

An investment-friendly policy and environment is required to attract FDI in Bangladesh. The investment regime will need to be credible and predictable while it should be ensured that there are no frequent changes in policies and regulations. Facilities like infrastructure, energy supply, double tax deduction, etc., should be provided by the government to bring in investment. Tax incentives for machinery import are very important for the apparel industry as automated machines will improve productivity and, at the same time, the quality of the products. When a factory increases its investment, it will feel empowered to take orders of higher value products to cope with its higher overheads. A rule can be enforced to allow the import of only new machines or machines less than an agreed age, so that FDI will not attract companies wishing to dump outmoded machinery in Bangladesh. It should be ensured that foreign investors can bring in their own managers and supervisors. However, the government must be strict to ensure that license will be issued only if a company complies with all the FDI rules.

New factories should install all necessary equipment to control pollution and any negative environmental effects. The rising production cost in China and their shifting to higher-value goods and services has created opportunities for other countries to take the shifting orders. But we have to be very cautious, as there are reports that some apparel manufacturers in China, whose standards were not up to the mark and were notorious for polluting the environment, are now trying to scatter their production plants in different parts of the world. So, it will be necessary for the concerned departments of our government to strictly monitor the issue.

Adaptability to the changing trends is a must to sustain growth in our apparel industry in the long run. We must keep pace with the demands of the time. Our industry has now arrived at a juncture where we need to move up the value ladder by shifting from basic to higher-end products to sustain our growth. Foreign investment, therefore, will be key to opening the window to a brighter future for our apparel industry.

Mostafiz Uddin is Managing Director of Denim Expert Limited, and Founder & CEO of Bangladesh Apparel Exchange (BAE). Email: [email protected]

Comments