Complacency to spoil the broth

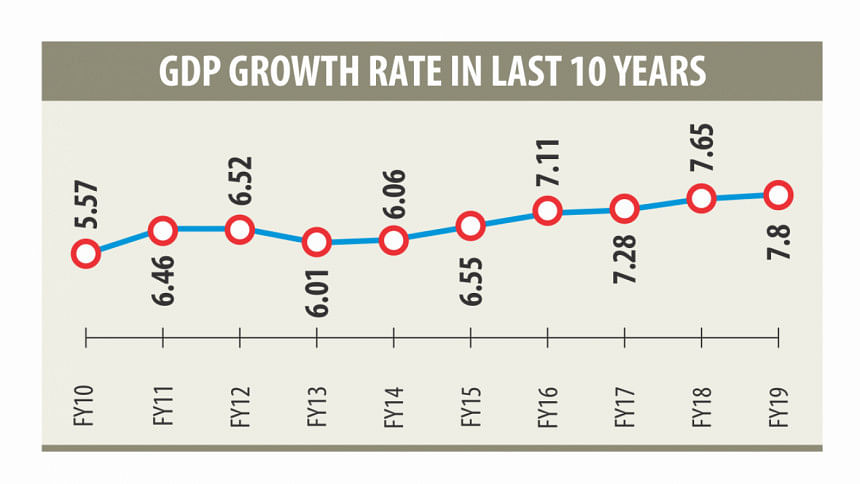

Logging in more than 7 percent GDP growth for three consecutive fiscal years is a feat that definitely deserves to be lauded. After all, it is one of the highest in the region and the world.

But, the GDP growth rate is just one indicator; it does not reflect the true health of the economy: tensions are brewing.

Stagnant private investment, inadequate job growth, deteriorating health of the financial system, rising interest rates on lending and the cost of doing business, depreciating exchange rate, low tax receipts, widening trade and current account deficit, nosediving stock prices and the waning capacity of the authority to implement the budget are matters of concern.

Last but not the least, the uncertainty centring the upcoming national election may force entrepreneurs to shelve their fresh investments plan.

There are challenges on the external front too.

The ongoing turbulence on the global political and economic fronts, including trade war between the US and the EU and China and instability in the Middle Eastern economies, may affect the Bangladesh economy in the days to come.

Amid this context, Finance Minister AMA Muhith will place the budget for fiscal 2018-19 today, his 10th budget in a row. This will also be the last budget of the incumbent government's present 5-year tenure.

The budget for the incoming fiscal year would be about Tk 464,530 crore, about one-fourth more than the outgoing year's, according to finance ministry officials.

The development budget is likely to be Tk 179,669 crore, an increase of about 17 percent from the current fiscal year's.

Officials hinted that the revenue collection target for the incoming fiscal year may be set at Tk 343,331 crore, which is 30 percent more from fiscal 2017-18's.

How will the finance minister earn such hefty growth in revenue amid so many tensions in the economy?

INVESTMENT AND EMPLOYMENT:

Out of every Tk 100 investment made in the economy in fiscal 2009-10, the private sector accounted for Tk 82.36 and the public sector the rest, according to the Bangladesh Bureau of Statistics. In fiscal 2017-18, the private sector's share has come down to Tk 74.19 and the public sector's rose to Tk 24.81.

Declining private investment has become a matter of concern as it plays the key role in creating jobs to absorb the 27 lakh fresh faces entering the workforce every year.

Though the share of the government in total investment has been increasing incrementally every year, it cannot create permanent jobs for such a huge workforce.

TROUBLED BANKING SECTOR:

Bangladesh's banking system, which is saturated with 57 banks, is now weighed down by toxic loans and liquidity crisis.

Many banks were compelled to tighten their lending activities, and in so doing, made it trickier for the private sector to raise funds.

Some Tk 14,286 crore of loans defaulted only in the first three months of the year, punching banks further into a corner in their uphill fight against non-performing loans.

The non-performing loans accounted for 10.78 percent, or Tk 88,589 crore, of the total outstanding loans in the banking sector, up from 9.31 percent three months earlier, according to central bank statistics.

Of the total default loans, the six state banks alone accounted for Tk 43,685 crore, which is almost half the total figure.

In addition to the toxic loans, high interest rates have become an extra burden for banks and businesses as well.

In recent months, the interest rates on all sorts of loans, be it industrial, SMEs or trade financing, have increased, jacking up the cost of doing business. The increase is by 2 to 4 percentage points, according to data of a number of banks.

RECORD CURRENT ACCOUNT DEFICIT:

Bangladesh's current account deficit recorded an all-time high of $7.08 billion in the first nine months of the current fiscal year as the country's capacity to export is failing to keep up with the appetite for imports.

At this point last fiscal year, the deficit was only $1.37 billion. The previous highest deficit was registered in fiscal 2015-16, when it stood at $4.26 billion.

The record current account deficit has already weakened the local currency against the dollar.

The interbank exchange rate reached close to Tk 84 per dollar, up from Tk 80.50 a year earlier, according to data from the central bank.

The dollar will appreciate further if the deficit is not reversed in the months to come.

DECLINING EXPORTS

IN TERMS OF GDP:

Exports accounted for 14.36 percent of the country's GDP in the outgoing year, in contrast to nearly 19 percent in fiscal 2013-14. The declining trend is a matter of grave concern.

DEMOGRAPHIC DIVIDEND:

About 65 percent of Bangladesh's population is between the ages of 15 and 64, which is considered the working age.

Such a large number of working age population is called the demographic dividend. This window of opportunity spans about 50 years: it started in 2001 and will end in 2051. However, after 2031 the window will start narrowing.

Experts said Bangladesh is unable to exploit the full potential of the demographic dividend as it cannot create adequate number of jobs for the working age population.

ACHIEVING SDGs IS A BIG CHALLENGE:

Bangladesh's remarkable success with millennium development goals may not be replicated in sustainable development goals (SDGs) if it fails to mobilise resources internally.

The country needs about $62 billion a year to meet the targets in SDGs by 2030, according to the planning commission.

Given the present pace of internal resource mobilisation, the SDGs look to be quite unattainable, experts said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments