Budget not realistic: analysts

The proposed budget for the next fiscal year is unrealistic, as it lacks significant structural and policy changes, analysts said in their immediate reaction yesterday.

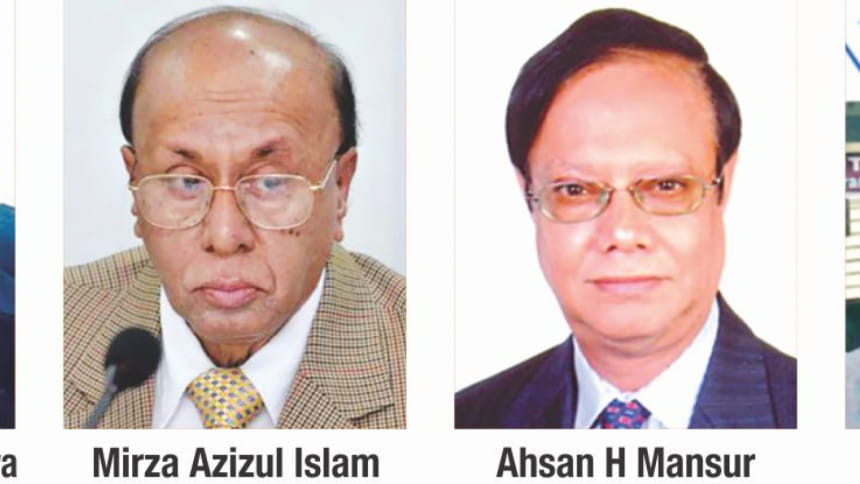

"The new budget is completely unrealistic," said Mirza Azizul Islam, a former finance adviser to a caretaker government.

He said the size of the proposed budget is 25 percent higher than the revised budget of the outgoing fiscal year, whereas the increase in the size of the budget was 17-18 percent in the last few years.

"There are no significant changes in the fiscal measures. So, how can we expect that the government will be able to implement such a huge budget?"

Islam said the GDP growth target of 7.8 percent is also an unrealistic expectation. In order to achieve the growth, the investment to GDP ratio will have to be risen by 4 percentage points to 35 percent.

"It is absolutely impossible to improve the investment by 4 percentage points in a year."

The former adviser welcomed the increase in the allocation for social safety net programme but it is still short of the desirable allocation.

He called for giving special attention to minimise leakages, as many deserved beneficiaries could not make way to receive the benefits of the schemes.

"The budget has no significant change," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

He said the budget will not be implemented due to unrealistic tax goals.

"The tax collection will have to be raised by 40 percent to implement the new budget. But there is no reform in the tax system to achieve the expected revenue collection," he said.

Mansur said the main challenge for the budget will be to increase the private sector investment, which has remained stagnant for a few years, affecting job creation negatively.

"No measure has been taken to create employment opportunities for the educated segment," he added.

Different measures are needed to be taken to implement this type of budget, said the Centre for Policy Dialogue (CPD).

The budget lacks special measures which could boost revenue collection, increase expenditure, bring reforms to narrow deficit and to keep the situation stable ahead of elections, the local think-tank said. The budget has maintained all the positive and negative tendencies of the past, the CPD said. "There is no structural and policy change and there is no surprise."

Debapriya Bhattacharya, a distinguished fellow of the CPD, called the budget "status quo" because it largely reflected the economic policies and tendencies seen in the last one decade.

"We have not seen much sensitivity about the existing new situations and new pressures being built up on the economy."

The CPD said pressure is building up in the external trade. This deficit is widening while prices of oil, food grains and fertiliser are rising globally.

"If the consistency in exports and remittance is not maintained, it will affect the exchange rate, the rate of interest and inflation."

But there was no plan in the budget to maintain the consistency, it said.

Bhattacharya said the biggest issue in the financial sector is the promise to introduce a uniform value-added tax after a year.

"But we have not seen anything about the plan related to its preparation."

The noted economist said the banking sector is facing a huge crisis, but Muhith said nothing about it in the budget.

The CPD said the higher revenue generation target as well as the expenditure target will not be achieved as they are still confined to the same old structures and thoughts and the status quo.

Bhattacharya, however, said the budget is not that ambitious when it comes to the annual development programme (ADP) compared to the "ambitious" ADPs in the previous years.

The CPD said it would be wiser to borrow from the banking sector in the coming days by way of cutting reliance on the national savings certificates.

The CPD welcomed the finance minister's proposal to impose 28 percent duty on rice imports.

It should have been done much earlier and the government should not have waited until budget and in that case farmers would have got higher prices for their produce, the centre said.

The CPD also welcomed the finance minister's decision to increase the number of beneficiaries under the social safety net programmes and increase the payment they receive.

Bhattacharya said a number of things have unnerved the CPD. One of them is the cut in corporate tax for listed and non-listed banks and insurance companies.

"We don't see any logical economic and administrative reason for the cut because this benefit will not affect the interest rate. It will only increase the profit for the owners. No depositors and borrowers will benefit from the tax cut."

There is no logic to grant the tax benefit at all, he said. "This type of system is completely immoral and useless when there is chaos in the banking sector."

The CPD has repeatedly said the income tax ceiling of Tk 2.5 lakh for individuals should be raised to protect the real income of the people because their income has eroded because of inflation.

But it was not changed. Rather, the government has increased the perquisite benefit for the rich from Tk 4.75 lakh to Tk 5.50 lakh.

"What type of economic policy is it that we can increase the perquisite benefit for the rich but won't give protection to the incomes of the poor? It is not acceptable to us."

Bhattacharya also criticised a tax move that raised the VAT on apartments below the size of 1,100 square feet and lowered the rate for the apartments over 1,100 sq ft to 1,600 sq ft.

"Through this, a major pressure is being created for the low income group. On the other hand, rebate has been given to the rich."

Zaid Bakht, chairman of Agrani Bank, termed the budget expansionary, saying the implementation and the financing will be challenging for the government.

He said the optimistic thing in the budget is that the public sector investment is growing significantly. Though, the private sector investment remained stagnant for a few years, some measures have been taken in the new budget to accelerate the investment, he said.

Bakht said the budget has not increased the tax rate or brought more people under the tax net. As a result, it will be challenging to finance the budget.

Inflation will be another challenge and there was no measure in the budget to manage it, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments