Bangladesh's growing middle class

According to a new report titled 'The Surging Consumer Market Nobody Saw Coming' published by the Boston Consulting Group (BCG), the middle class of Bangladesh is emerging as one with purchasing power that values foreign brands and is hopping on to the digital bandwagon in their millions. Obviously this opens up new opportunities for foreign firms hoping to cash in on the spending spree Bangladeshi consumers have embarked upon.

The report and its findings reveal some interesting data. For instance, the average income of targeted families which falls squarely into the 7 percent of the population that constitutes the middle class have an average annual income of US$5,000. The consumer product revolution that is being witnessed in this class, especially with the proliferation of banking facilities like credit purchases and easy installment / higher-purchase forms of payment and affordable loans have seen the consumer market record stupendous sales in consumer products ranging from foreign cosmetics, air-coolers, refrigerators to passenger vehicles.

Seven percent of the population with purchasing power translates into roughly 11 million people who are "middle and affluent consumers" (MAC) are seen as confident consumers with an expectation of seeing their incomes increase positively in the next fiscal. Yet, there is also another undercurrent that differentiates the Bangladeshi average consumer from their Asian counterparts i.e. the aversion towards accumulating debt which they may or may not be able to repay. Despite reservations on affordability, Bangladeshis are hopping on to the digital bandwagon at a stupendous rate.

It is estimated that more than 50 million people use internet services on their cell phones. There is also a shift in consumer preferences being witnessed when it comes to shopping habits which had long been dominated by traditional convenience stores and supermarkets. That more and more people are using the internet to buy and sell products from household products to cars and even land, houses and apartments, the latter three being most valued of fixed assets, is another very interesting development. In urban centres, "plastic" (debit / credit cards) is making inroads into the purchase and sales of consumer products.

As stated by Vivek Nauhbar, a BCG consultant and another co-author. "Companies should start building robust e-commerce platforms designed for interacting with consumers through small digital screens to meet growing mobile-enabled demand." Companies' marketing strategies need to be reoriented to factor in consumer traits that revolve around fear of accumulating debt – which means offering affordable financing in terms of loans and lower interest rates.

So how is a country that is ranked by the World Bank of having a sub-Saharan category per capita income of approximately US$1,100 per annum manage to find itself as an emerging market for consumer products? The country has experienced an average GDP growth rate of around 6 percent for the last decade. Its apparels industry (RMG) has emerged as number 3 in the global market riding high on low wages and an abundant pool of labour. The strong growth of inward remittances by the hundreds of thousands of expatriate Bangladeshi workers amounting to billions of dollars annually are all contributing factors to the rise of the Bangladeshi middle class.

Companies, both local and foreign, need to wake up and take notice of these trends if they wish to be companies of choice to whom Bangladeshi consumers will turn when they go shopping. The average consumer in Bangladesh is very value-conscious. Whilst, more money may be available for expending on a new product (which is viewed as a step-up from the current "model") consumers can truly be bought over to adopt a product which gives the notion of "good value for money".

This explains why the middle class of major urban centres like Dhaka and Chittagong have opted for brands like Walton, which makes everything from motorcycles to smart phones, is making a killing; or why a Chinese-packaged Bangladeshi company named Symphony has captured around 50 percent of the internet-enabled smart phone segment. These companies understand what motivates the customer: Good value for money and a relatively decent shelf life while sporting technology that is second to none.

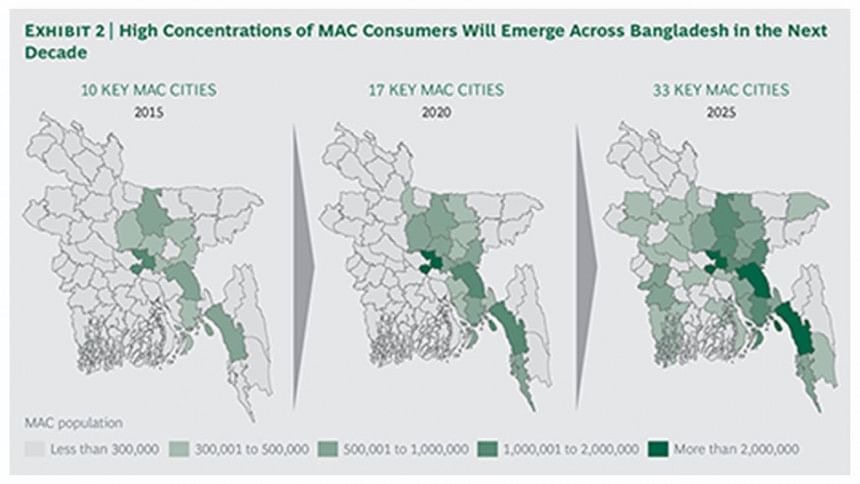

The biggest thing going for the country is its population – a young, vibrant and growing population will help propel the country's growth engine and a rising consumer base for many years to come. It is estimated that the poor segment of the population that currently stands at 84 million will nearly halve to 44 million by 2025 and the emerging middle class will have risen from the current 17 million to 27 million in the coming decade. The rise in purchasing power will not be limited to major cities like Dhaka and Chittagong, but spill over to witness even greater impact in cities like Khulna (an emerging industrial hub), Gazipur (already a major RMG centre), to other cities that will see similar growth of urban populations and consumer bases. It is estimated that in Bangladesh, by 2025, there will be "63 cities will have MAC populations of at least 100,000 compared with 36 now."

The writer is Assistant Editor, The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments