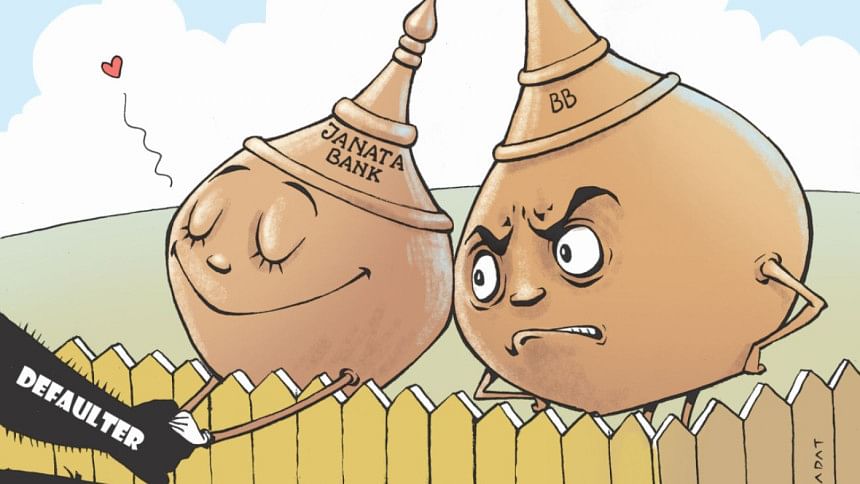

Ghosts within Janata Bank

Everything is happening at Janata Bank, and in the latest case it deliberately did not mark Tk 2,643 crore of its Tk 5,508 crore loans given to a single group -- AnonTex -- as classified, ignoring Bangladesh Bank's instructions.

In an investigation into Janata in January this year, BB unearthed the matter along with a number of irregularities involving AnonTex Group, a garment producer and exporter, and asked the state-owned bank to mark the loans as classified.

But for mysterious reasons, Janata defied repeated instructions from the central bank to classify the loans.

The central bank had first asked Janata to classify AnonTex's loans by May this year as the Group, which owns 22 firms, didn't pay instalments regularly. But Janata didn't care to comply with the instructions.

Two months later in July, Janata sought three months from the central bank to classify the Group's loans. The BB outright rejected the request.

Janata's deliberate hiding of loans becoming classified is worrisome as it destroys the financial discipline of a bank, having huge implications on the balance sheet because of the mandatory obligation of provisioning any classified loan.

On the other hand, if a business group's loan is classified, it cannot get further loans.

In AnonTex's case, the Group continued to enjoy loans as Janata hid its bad loan status, ballooning its total loan beyond the level allowed by the central bank.

Seeking anonymity, a senior executive of Janata told The Daily Star that the Group's loans were not classified as the client paid its due instalment of March. Janata will request the BB not to classify the loans, he said.

His statement, however, does not reflect the fact that the company had defaulted on the December instalment and paid the March instalment only when the BB launched its probe.

Contacted, Mostofa Sarwar, a director of AnonTex Group, claimed that they have been paying the loan instalments regularly.

According to a Memorandum of Understanding with the BB, Janata was allowed to lend up to 10 percent of its capital or Tk 423 crore to a single borrower as of December last year. But the bank lent 13 times the limit.

But now the situation has reached the extent that the AnonTex's loans are posing a serious threat to Janata's existence.

A BB probe report said, “If the huge amount of loan is classified, the existence of the state-owned bank will be in threat.”

In this perspective, the BB probe team recommended that the board of the state-owned bank take up an exit plan to recover the loan.

Contacted, BB Deputy Governor Abu Hena Mohd Razee Hassan said that though Janata was asked to classify the loans of Tk 2,600 crore, it was yet to do that.

He, however, didn't say why the BB didn't take any action against the state-owned bank for not complying with its instructions.

“Meetings and discussions on the issue are taking place ... let's see when they carry out the instructions,” he added.

This correspondent tried to reach Janata's Managing Director Md Abdus Salam Azad over the phone several times, but he didn't pick it up. A text message was sent to his mobile phone on August 28, but he was yet to respond.

Janata has been at the centre of such dubious activities for quite some time, which have led to drastic deterioration in its health.

For example, the BB last year detected another loan scandal at Janata's Imamganj corporate branch that gave 98.4 percent of its total loans to one client, Crescent Group.

The BB has also unearthed that in violation of its instructions, Janata had purchased export bills worth a few hundred crore taka from Crescent, a leather company, without verifying whether the export proceeds could be repatriated.

Janata's loans to Crescent account for about 55 percent of the bank's equity capital. It's a complete violation of the Banking Company Act which says a bank can in no way give more than 25 percent of its capital as loans to an individual or group.

Beximco was another group for which Janata Bank faced a fine of Tk 10 lakh from the BB in May this year for providing undue facilities.

JANATA'S IRREGULARITIES INVOLVING ANONTEX

The BB has investigated the loans given to AnonTex and found a number of irregularities.

It has found that Janata had violated the laws by giving loans 13 times the ceiling set by the BB with the approval of Janata's board.

Though AnonTex couldn't repay instalments regularly and failed to complete most of its projects within the scheduled time, Janata's board approved further loans of Tk 150 crore for the Group in December last year.

At a meeting in 2011, the board okayed loans of Tk 95.28 crore against a project of Simi Knit, a concern of AnonTex.

As per the loan conditions, the project was supposed to be completed in November 2012, but it was not finished till January this year, found the BB probe team.

By this time, the board approved another loan of Tk 92 crore for AnonTex Knit Tex, a concern of the Group, at another meeting on August 6, 2014.

This project was supposed to be completed by November, 2016, but that too was not completed till January this year, the report mentioned.

The board also allowed the Group to have its loans rescheduled several times. The state-owned bank sent rescheduling proposals to the BB, hiding the overall loan status of the Group, it mentioned.

Besides, AnonTex had restructured its loan of Tk 1,094 crore from Janata in 2015 under the large loan restructuring package offered by the BB.

But the Group failed to pay loan instalments regularly and requested Janata last year for further rescheduling of the loans. Janata then sent the rescheduling proposal to the BB but it was rejected.

FORCED LOANS

Since 2013, Janata continued to provide LC (Letter of Credit) facilities to six firms of the Group to import raw materials though the entities had forced loans with the state-run bank.

A bank creates a forced loan when a client fails to make LC payments to the foreign bank concerned in due time.

The total forced loan against the Group stood at Tk 1,720 crore as of December last year.

Moreover, Janata allowed the Group to convert its forced loans into term loans which later became classified, the report said.

The probe even found serious mismatch between the import value and imported goods kept at the Group's warehouse.

For instance, the total loan against imported goods of Suprov Composit, a concern of the Group, stood at Tk 526 crore as of December last year.

But the stock value of imported goods was found to be at Tk 198 crore which meant the client sold goods but didn't deposit money to the bank, according to the report.

MEETING WITH MUHITH

On August 20, high-ups of Janata Bank and AnonTex Group met Finance Minister AMA Muhith to convince him that the Group is running well and making significant contribution to the country's export earnings.

The Group even sought fresh loans at the meeting to run its business activities.

The minister also appeared impressed by the business Group as he highly praised its plant after the meeting.

“I visited the group and it is a first-class unit. The units are there,” the minister told reporters soon after the meeting that day.

“It is not that they took the money and got away. It [the Group] exports products to many European countries, including Germany.”

JANATA'S FINANCIAL HEALTH

The bank faced a capital shortfall of Tk 161.48 crore in December last year whereas it had a surplus of Tk 278 crore in the same month of the previous year.

Its defaulted loans went up to Tk 9,702 crore in March this year from Tk 5,818 crore in December last year.

The bank also saw a sharp decline in net profit to Tk 96.77 crore last year from Tk 260.55 crore in the previous year, according to BB data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments