Banks blame influential quarter for rising bad loans

Habitual and influential defaulters are the main barriers to bringing down delinquent loans in the state-owned commercial banks, according to the assessment of the lenders.

The banks placed separate reports to the finance ministry last month articulating the major reasons behind their rising defaults loans and ways to bring them down.

On December 26 last year, the reports were discussed in presence of Banking Division Secretary Asadul Islam at a meeting held at the finance ministry. Managing directors of the six banks were also present there.

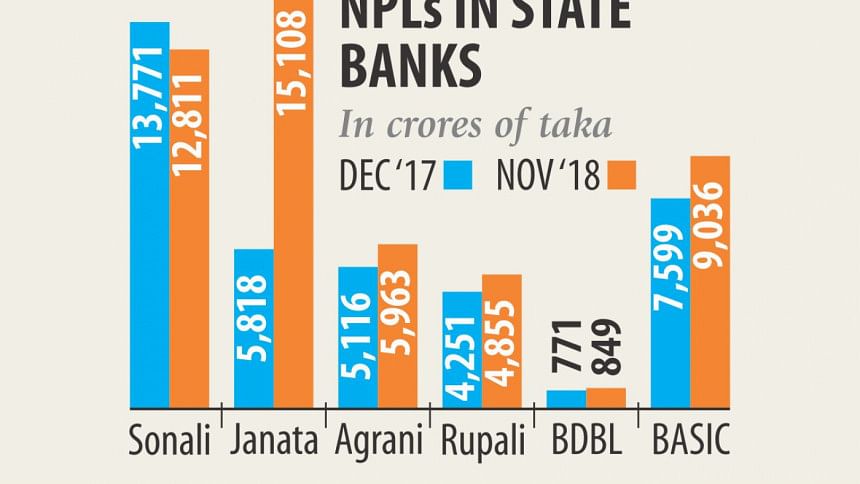

In the first 11 months of 2018, classified loans in the six state-run banks -- Sonali, Janata, Agrani, Rupali, Bangladesh Development and BASIC -- escalated by Tk 11,297 crore to Tk 48,623 crore.

In its report, Sonali Bank said that 52.33 percent of its outstanding default loans of Tk 12,811 crore were stuck with the top 100 defaulters. The majority of the defaulters are habitual and they have been continuing to show unwillingness to return the depositors' money, it said.

The long drawn-out process for resolving the court cases with the Artha Rin Adalat (money loan court) has also created an impediment to cutting down its default loans.

Sonali has already started a special drive for loan recovery, said its Managing Director Md Obayed Ullah Al Masud recently.

"We have instructed our 15,000 officials to recover at least one overdue loan last year," he added.

Only the branch managers were earlier assigned to recover default or overdue loans.

Janata Bank has frequently failed to realise instalments of restructured and rescheduled loans from defaulters. In many cases, despite offering interest rate waiver, the bank failed to recover the sums.

Some borrowers did not invest the loan amount in the sector mentioned in their credit proposal.

In its report, Janata said that the amount of down payment set by the central bank for rescheduling non-performing loans (NPLs) should be relaxed. Influential borrowers are one of the core problems behind the rising default loans in Agrani.

"The bank can arrest the rising default loans if it could sanction loans without facing pressure from influential corners," said the bank in its assessment report.

To recover the default loans the bank has recently taken several initiatives, said Mohammad Shams-Ul Islam, managing director of Agrani Bank.

He is hopeful that the NPLs would not go up this year because of the ongoing recovery drive.

Rupali Bank said the habitual defaulters should be sent to jail. The lender has also suggested introducing strict regulations for defaulters.

The rescheduled loans of BASIC Bank frequently get defaulted as majority of the defaulters did not have strong business position to pay installments.

Some defaulters fled the country, forcing the lender to face difficulties in recovering classified loans, according to its report.

Bangladesh Development Bank is on the same boat as the other five when it comes to tackling NPLs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments