Gas price move faces uproar

The proposal to double the gas price because of liquefied natural gas (LNG) imports is being met with fierce resistance as the increase stands to hit the economy, make businesses uncompetitive and fuel inflation.

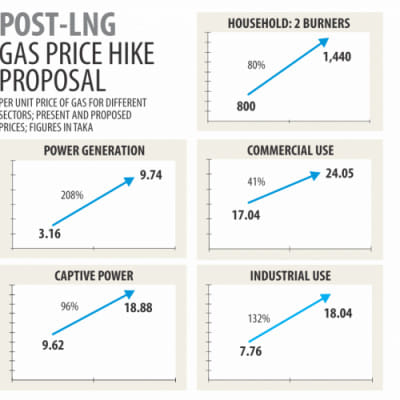

State-run Petrobangla and its distribution companies are demanding the Bangladesh Energy Regulatory Commission (BERC) raise the gas price for end consumers to Tk 12.19 per cubic metre from Tk 8.63 now.

This comes after all six gas distribution companies -- Titas, Bakhrabad, Jalalabad, Pashchimanchal, Karnaphuli, and Sundarban -- proposed the hike as their production costs increased following the blending of LNG with locally produced gas.

Experts, consumers rights activists, industrialists, trade bodies and left-leaning politicians have opposed the proposal.

“There is no legal scope to increase the gas price at the moment as the BERC cannot raise the price twice in a single fiscal year as per its laws,” said M Shamsul Alam, energy adviser of the Consumer Association of Bangladesh.

The most recent gas hike came in October last year. Some, however, have come forward in defence of the state-run companies considering the reality of fast depleting gas reserves amid growing demand and no new discoveries.

“There is no alternative to LNG imports to ensure reliable supply in order to meet the energy requirement of consumers and industries,” said Nurul Islam, a former professor of the Bangladesh University of Engineering and Technology.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, echoed the same.

“This is the price for short-term energy solution.”

But, it must be ensured that the cost of corruption and inefficiency of companies like Titas are not included in the proposed gas prices, he said.

“Cost of inefficiency must not be passed on to consumers,” he added.

The industries are not in a position to afford any gas price hike, said Shafiul Islam Mohiuddin, president of the Federation of Bangladesh Chambers of Commerce and Industry. “The cost of production will go up in the industrial sector, affect our competitiveness and increase inflation,” he added. LNG is costing the country Tk 39.086 per cubic metre. In contrast, similar amount of gas from state-run Bangladesh Gas Fields cost Tk 0.7097, from Bangladesh Petroleum Exploration and Production Tk 3.0414, from Sylhet Gas Fields Tk 0.2028 and from international companies operating in Bangladesh Tk 2.55, according to Petrobangla. Prof Islam said gas price hikes are inevitable.

The government used to realise a lot of tax from the gas sector, but the tax incidence has come down to only 15 percent from 120 percent, he said.

“So, the government has no scope to provide funds. And exploring gas resources offshore takes time,” he added.

When the gas price was last revised up to Tk 8.63 per cubic metre from Tk 7.17 percent in October, the supply of 450 million cubic feet of gas per day (mmcfd) was taken into consideration, Prof Alam said.

An assessment paper of the technical committee of the BERC showed that LNG imports added 400mmcfd gas to the network in March and it would go up to 650mmcfd in May and 850mmcfd in October. Already consumers are paying for the LNG when its supply has not reached 450mmcfd of gas yet, Alam said.

“So, the next phase of the price will have to be added when the new LNG will be added. You can't charge me for the product that hasn't been delivered yet.”

The CAB's adviser said thanks to the hike in October, the transmission and distribution companies have about Tk 1,500 crore in surplus after meeting their revenue requirement.

If corruption, illegal connections and inefficiency at the distribution companies are rooted out, about 15 percent of the gas could be saved, he said.

“This would easily meet the Tk 4,500 crore deficit in the gas sector.”

Had onshore and offshore potential been explored, the price would not have to go up at the current pace and the increments would have been tolerable, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments