Recovery fails to keep pace with default loan spike

The pace of recovery of banks' nonperforming loans (NPL) was much lower than the rate at which their NPL increased last year -- an ominous development for the sector.

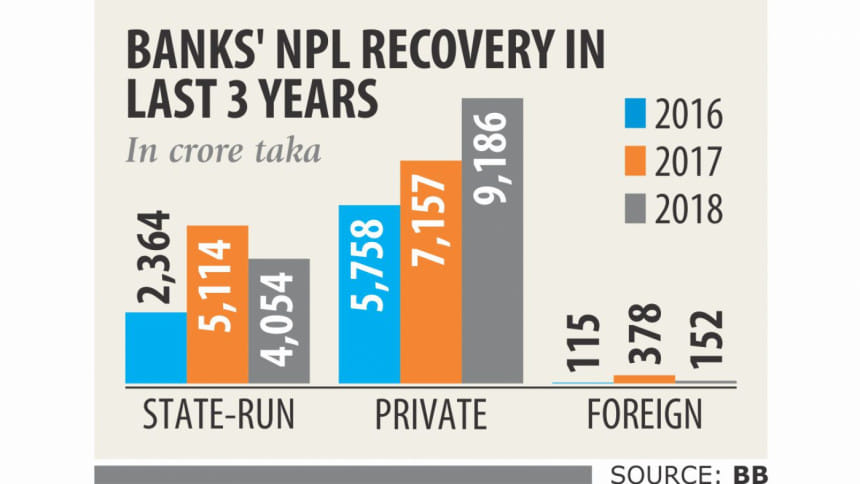

In 2018, banks recovered Tk 13,392 crore of NPLs, up 5.86 percent from a year earlier, while delinquent loans in the sector soared 26.38 percent to Tk 93,911 crore, according to data from the sector.

Given the trend, the latest government move to amend the existing loan rules to extend more facilities to defaulters will only exacerbate the situation, said Khondkar Ibrahim Khaled, former deputy governor of the central bank.

Last week, the government announced that defaulters would be allowed to reschedule their loans for 12 years after furnishing 2 percent down payment under a special package.

Both small and large borrowers will be able to get the rescheduling facility and a 7 percent simple interest formula instead of existing compound formula will be applied.

If their payments are regular, borrowers will also be able to get fresh loans from the same bank after rescheduling.

"Only those with genuine reasons for becoming defaulters can avail the facility," Finance Minister AHM Mustafa Kamal told reporters last week after the meeting where the decision to amend the rescheduling rules was made.

The discretionary measure will only widen the scope for unethical bankers to facilitate delinquent borrowers in exchange for favours, said experts.

"Recovery of bad loans is a very tough job in Bangladesh and it is tougher for state-owned banks," said Khaled, also a former chairman of state-owned Bangladesh Krishi Bank.

Data also validated his claim as loan recovery by state-run banks in 2018 was only Tk 4,054 crore, down 21 percent year-on-year. On the other hand, private banks recovered over Tk 9,185 crore, up 28 percent from a year earlier.

The state-run banks have weaknesses including poor governance, bad selection of borrowers, inadequate monitoring of loans, insufficient collateral against loans and lacklustre recovery efforts, he added.

"Cash recovery by private banks was not good enough considering the volume of their default loans," said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks' chief executive officers.

The authority concerned should offer judiciary support to banks to recover NPLs as wilful defaulters often file writ petitions with the High Court and get to lift their default status, said Rahman, also the managing director of Dhaka Bank.

Foreign banks recovered Tk 152 crore last year, down 60 percent year-on-year.

Some bankers wishing not to be named said if lenders had followed the rules and regulations properly while rescheduling default loans, recovery would have been much higher. Lenders must take down payment of 10 percent to 50 percent of the outstanding loan amount for rescheduling of NPLs, according to the central bank's instruction.

But banks do not follow it, they said.

In 2018, lenders rescheduled a record amount of default loans worth Tk 23,210, up 22 percent from a year earlier. "Continuous follow-up is essential to speeding up the cash recovery from default loans. Lenders should select proper borrowers to ensure the recovery of default loans," Rahman said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments