Loan Defaulters: BB extends fresh rescheduling facility

In a baffling move, the central bank yesterday extended a set of new facilities to loan defaulters to give them a fresh lifeline, stoking fears of further deterioration in the banking sector’s financial health.

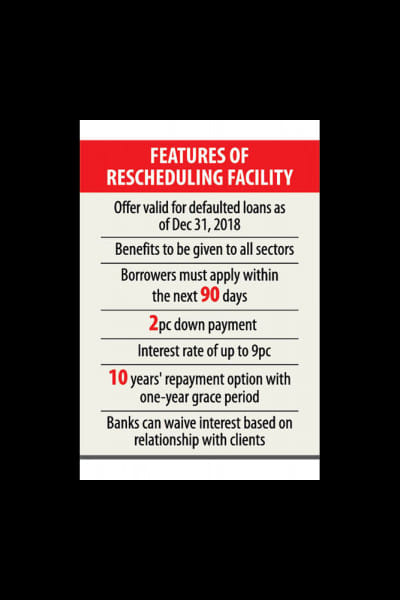

As per the new policy, the defaulters will be allowed to reschedule their classified loans by making a down payment of only 2 percent instead of the existing 10-50 percent.

A maximum 9 percent interest will be charged on the rescheduled loans while the existing interest rate is 12-16 percent.

Besides, the tenure for repayment is 10 years with a grace period of one year.

Based on the bank’s relationship with the client, the accrued interest on the defaulted loan can be waived, leaving the defaulter to pay only the principal amount with the new interest rate of 9 percent.

“This will be devastating for the banking sector,” said Khondkar Ibrahim Khaled, a former deputy governor of Bangladesh Bank.

The policy will encourage wilful defaulters to continue with their shady activities without repaying the depositors’ money. “It will weaken the foundation of banks,” he added.

Earlier, the central bank had extended such facilities back in January 2015 but the move did not yield any success.

At that time, 11 large business groups got their loans of nearly Tk 15,000 crore restructured on relaxed terms.

But the amount swelled to Tk 17,103 crore as repayments were not made, according to a recent BB document.

The latest move will bring down defaulted loans for the time being, but the amount will go up again once the grace period ends, Khaled said.

The BB instructed banks to withdraw the facilities if the clients do not pay their instalments regularly after the grace period is over.

In case of monthly instalments, if the client fails to pay up for six months straight, the facilities will be taken back. In case of quarterly instalments, two back-to-back non-payments will result in cancellation of the facilities.

To avail the benefits, the defaulters will have to apply within the next 90 days.

Businesspeople from wheat, food stuff and edible oil manufacturing sectors, and shipbuilding, ship-breaking, steel and aluminium industries will get the facilities straightaway. Defaulters from the other sectors will have to face special audit.

If a defaulter wants to clear his or her debts to the bank in one year, the interest rate would be just the lender’s cost of fund.

At present, the banks’ cost of fund ranges from 7 to 9 percent.

The banks will have to calculate the cost of fund based on the financial indicators of December 31 last year, according to the BB notice.

The lenders’ cases against the defaulters will also be put on hold while the rescheduling process goes on. If the defaulters fail to repay their loans, the cases will be revived.

At the end of last year, the total defaulted loans in the banking sector stood at Tk 93,370 crore, up by 25.66 percent year-on-year.

Ahsan H Mansur, executive director of the Policy Research Institute, said, “The policy is a dictation to lenders -- this is not acceptable at all.”

Banks should follow the BB instructions very carefully or else it can have a negative impact, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of the chief executives of private banks.

“Fraudsters and habitual defaulters should be dealt with diligently,” said Mahbubur, also the managing director of Dhaka Bank.

GOOD BORROWERS TO GET REWARD

The BB notice also offered reward for good borrowers in the form of interest rebates, along with other incentives.

Those having unclassified loan accounts for consecutive four quarters before September every year will be considered as good borrowers.

A good borrower will get a minimum 10 percent rebate on interest incurred in the previous year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments