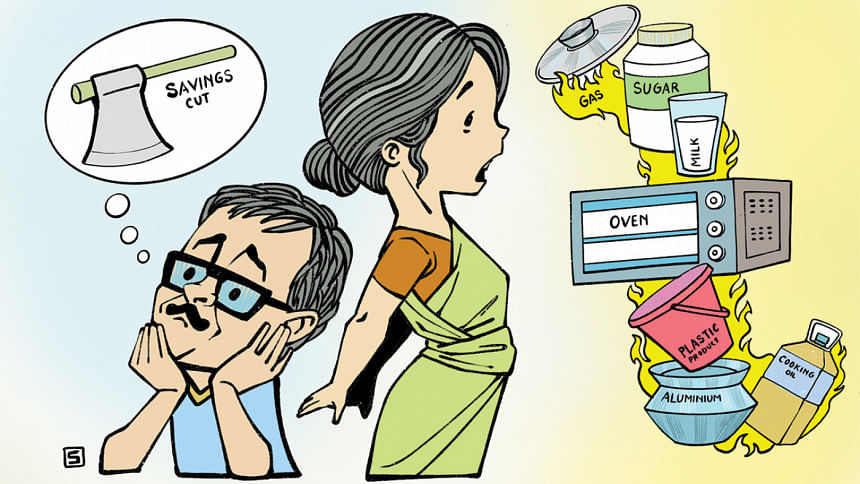

Needle for middle class

Afsana Rahman's maternity leave is about to end, and so baby formula milk will soon have to substitute breast milk for her second child. As she and her husband are both job holders with fixed income, she now has to adjust her monthly expenditures to make ends meet, since the government plans to increase customs duty on imports of powdered milk from 5 percent to 10 percent. Adding to that comes an increase in prices of sugar, soybean oil, mustard oil, spices, mobile phone services and a rising expenditure for the ownership of a private car.

At a first glance, it may seem to be a good initiative in the proposed budget to impose import duties on foreign products to protect local dairy and sugar industries. But when the local products are not enough to meet market demand, people would have to buy these everyday items even if they get costlier.

Import duty of unrefined sugar, as per the new budget, will be increased from 2,000 per tonne to Tk 3,000, while for refined sugar the duty will be increased from Tk 4,500 to Tk 6,000.

On top of that, regulatory duty will be increased to 30 percent from 20 percent for both refined and raw sugar imports.

Afsana says maybe she and her husband will stop having sugar, convincing themselves it's not good for health, but for their two children they will have to buy milk and sugar.

While it is still not too hard to cut down on milk and sugar, rationing oil and spices -- that are at the heart of Bangalee cuisine -- would be a much bigger challenge. While social safety net coverage for the poor and the underprivileged are increasing, as are different kinds of incentives for rich businesspeople, it is the middle class who will have to suffer in silence.

And now from the costs within the households to those after leaving home: everyday commute by ridesharing services or by a private car or motorbike will become more expensive, because the use of such vehicles is thought to be luxury rather than necessity.

Private service-holder Rina Das has been availing app-based motorbike rides for a couple of years to get to work on time.

"The services brought me relief from making daily excuses at work for being late," she says.

Rina fears that the potential added expenditure may compel her to live without occasional breaks from Dhaka's mundane yet stressful life, like going to the movies or eating out. Her shrinking space for solace does not end there. Rina will have to use a damaged cell phone for longer than she would have liked, because up-grading to a new smartphone is going to be costlier too.

Besides, she will have to shell out more cash to use mobile phone services, or even to scroll her Facebook News Feed or watch videos on Youtube. In Dhaka -- infamous for its chaotic public transportation system, a private car is also not al-ways an item of luxury.

Banker Gofur Hossain recently bought a car on loan to ensure safety of his wife and children on roads. The car is used only for his children -- a 10-year-old son who suffers from autism, and a four-year-old. His wife struggled every day to board public vehicles with two children to school, and then on the way back home.

Gofur says he didn't consider that car ownership cost would go up so soon. A 10 percent supplementary duty has been imposed on issuance or renewal of vehicle registration, route permit, fitness certificate and ownership certificate for private vehicles.

However, many who cannot afford a car of their own, must pay income tax. Russel is one who falls under the category of those at the bottom of the tax slab for an individual taxpayer. He has to pay 10 percent tax.

Over a few years, the government has kept the lowest tax-exempted income unchanged at Tk 2.5 lakh, but inflation has caused people's purchasing power to shrink with income not rising at the same rate. Centre for Policy Dialogue proposed reducing tax for the lowest tax slab, said its senior research fellow Towfiqul Islam Khan.

The budget has also brought bad news for retirees and those who supplement income deficits through returns from savings certificates. Tax at source on interests of the certificates will go up by 5 percent to 10 percent. If the government remains firm in its position, the middle class has to be flexible about compromising its moderate lifestyle, and keep waiting to reap benefits of economic development.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments