National Budget FY2019-20: first impressions

The annual national budget is the most important government statement of its socio-economic policy for the coming year. The FY2019-20 budget is the last budget for the implementation of the 7th Five-Year Plan (FYP). It is also the first budget for the new government elected in 2018 and provides an indication of the government’s thinking on policy and programme priorities and the reform agenda.

There are several strengths of the new budget. First, it admits the dismal state of affairs with tax revenue mobilisation, which at around 9 percent of GDP, is among the lowest in the world, and intends to address this policy failure in the new budget. Second, it anchors the budget to the macroeconomic framework of the 7th FYP and the forthcoming Perspective Plan 2041 (PP2041), thereby acknowledging the fiscal challenges moving forward. Third, it formally announces the intention to adopt the National Social Security Strategy (NSSS) approved in 2015 and initiates the implementation of the Bangladesh Delta Plan 2100. Fourth, it specifically targets several of the key growth drivers (public and private investments, exports and human capital) and seeks to take policy actions to stimulate these drivers. Finally, it reasserts the intention to preserve fiscal discipline and debt sustainability by keeping control over the fiscal deficit.

As against these strengths, there are major issues that reduce the quality of the budget as a strategic document. First and foremost, the revenue and expenditure projections are highly optimistic. Second, even though the budget is anchored on the 7th FYP and the PP2041, the underlying policy framework is either undefined or inadequate. Third, the prevailing challenges in the banking sector that can easily threaten financial stability are basically overlooked with no indication how they will be addressed. Fourth, the budget is completely silent on the need for reforms of public enterprises that are a huge drag on the Treasury. Finally, there is no mention of fiscal decentralisation that is key to improving public service delivery and urbanisation.

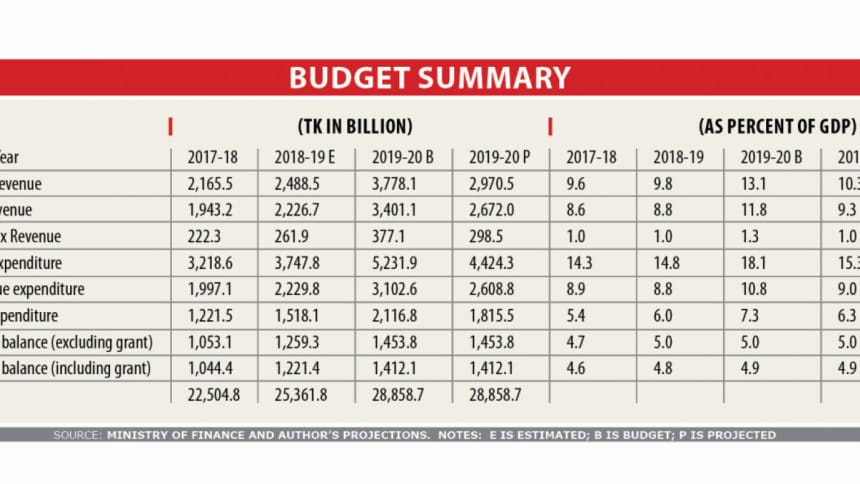

Budget Realism: Cumulative shortfalls in past budget implementations have enhanced the degree of optimism to an extent that the budget numbers are no longer in the realm of realism. With the fiscal deficit basically capped at around 5 percent of GDP, the size of the annual budget is essentially determined by the tax revenue mobilisation effort. Absence of tax reforms over past several years has caused the tax-to-GDP ratio to stagnate at around 9 percent of GDP and actual annual public spending has stabilised at around 14 percent of GDP. Yet every year the budget targets to increase public spending and the tax-to-GDP ratio by 1-2 percent of GDP that is not achieved.

As an example, total tax collection was targeted at Tk 3,059 billion in the FY2019 budget. Based on actual revenue collections for the first nine months, the estimated revenue collection is Tk 2,227 billion, yielding a revenue shortfall of Tk 832 billion. Combined with an estimated non-tax revenue shortfall of Tk 72 billion, the total revenue shortfall in FY2019 is estimated at Tk 904 billion. With fiscal deficit fixed at 5 percent of GDP, this massive revenue shortfall will be met through expenditure cutbacks, mostly in development spending but also reductions in transfers to local governments, state-owned enterprises, subsidies and social security spending.

The main reason for the revenue shortfall is the inadequacy of policy reforms to mobilise the targeted revenues. The ex-post expenditure cutbacks make the interpretation of the budget allocations, especially for development spending and transfer programmes, very unreliable because these are only intentions. Even the revised budget numbers are optimistic and not very helpful to understand what actually happened. This reduction in the meaningfulness of the budget numbers is a serious problem that needs to be addressed swiftly with the publication of actual budget outcomes for all revenue and expenditure items.

The revenue numbers and total spending for the FY2020 budget are similarly optimistic. Although the budget announces several tax measures, especially the implementation of the new VAT law and the intention to increase reliance on personal income tax, these reforms have major limitations that are not likely to yield the targeted and unprecedented 3 percent of GDP increase in tax revenues. The revenue effectiveness of the VAT is diluted by the introduction of several lower rates (5 percent, 7.5 percent and 10 percent) that are essentially excise duties and not VAT. Also, there are many exemptions in the VAT. Regarding income taxes, reliance only on increasing the number of tax collection centres and tax collectors will not likely increase the tax yield much. There are serious inefficiencies and corrupt practices in income tax collection that must be addressed comprehensively with a major overhaul of the income tax administration.

The projected revenue shortfall for FY2020 budget is Tk 800 billion (1.5 percent of GDP), suggesting that the likely growth in tax-to-GDP ratio would be 0.5 percent, which will be a positive development but far short of the targeted 3 percent. Total expenditure will similarly be below the budget by Tk 800 billion or so (1.5 percent of GDP). How this projected shortfall will be reflected in actual budget spending is unclear. However, given that a large part of the budget spending are fixed commitments (salaries, defence and security spending, interest costs, materials and supplies) the cutbacks will likely concentrate on the development spending, local government transfers, and safety net schemes. Because of this uncertainty, it is near impossible to analyse the true spending priorities.

Impact of the budget on GDP Growth: The budget targets a GDP growth of 8.2 percent for FY2020. It focuses on improving several growth drivers, including public and private investments, exports and human capital. The BBS shows progressive increases in public investment as a share of GDP (8.2 percent of GDP for FY2019 and 8.6 percent of GDP for FY2020). These investment rates are highly optimistic and not consistent with the ADP estimates of 6 percent of GDP for FY2019 and 6.3 percent of GDP for FY2020. The BBS says the difference is public investment by local governments and state enterprises. The problem is both institutions are financially bankrupt and their investment spending is financed directly through the budget. The mystery about the true level of public investment must be resolved credibly. Nevertheless, modest increases in the ADP have supported higher spending on infrastructure that has helped GDP growth.

An open question though is if indeed public investment is 6 percent of GDP as reflected in the ADP and private investment is 23 percent (BBS estimate), whether this 29 percent investment rate is adequate to sustain an 8 percent plus GDP growth rate. With growing capital intensity of production due to technology and skill intensity, this level of investment will appear inadequate. The budget proposes to expand the private investment rate by 1 percent of GDP in FY2020 through lowering the cost of doing business but provides no details how this will be done. For exports, the main policy is to provide fiscal incentives to textiles and RMG. Here the budget misses the boat by miles. The only sustainable way of expanding exports is through sharp reduction in trade protection and correcting the appreciation of the real exchange rate. The budget is silent on both counts. Regarding human capital the budget’s focus on education and training spending is appropriate but the allocated education spending of 2 percent of GDP is highly inadequate relative to needs. The proposed increase in the taxation of ICT sector, which is already over-taxed, will likely reduce the growth impact of this important growth driver and is also inconsistent with the Prime Minister’s Digital Bangladesh Initiative.

Impact on Employment and Poverty: Much will depend upon the ability to sustain an 8 percent plus GDP growth, which is uncertain. Given technology changes and growing capital intensity of production, employment prospects will depend upon growth of relatively labour-intensive export-oriented manufacturing and upgradation of skills. The budget does not have a broad-based export promotion strategy. This is a major policy gap. The budget’s emphasis on skills and employment for youth is good but policies are not well-defined. The 2 percent of GDP spending on education is business as usual. This spending has to go up to 3-4 percent of GDP to make a real dent in education quality and skill accumulation. Other necessary policies that are missing include decentralisation of education and partnership with private sector on training.

While GDP growth is a major determinant of poverty, public spending on health, education and social security are very important. The budget does well to focus on these areas, including the NSSS and the Delta Plan. The main problem is that the uncertainty surrounding the highly optimistic revenue targets will adversely impact on the budget’s ability to finance social sector spending, especially social security programmes. Depending upon the magnitude of the expenditure cutbacks, the poverty impact will be commensurately reduced.

The writer is vice chairman of the Policy Research Institute of Bangladesh. He can be reached at [email protected].

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments