Foreign assistance boosts infrastructure development

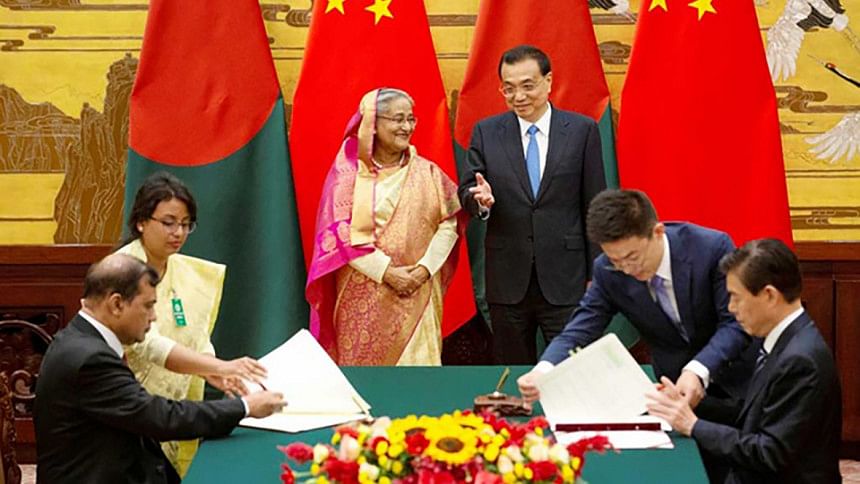

During the five-day state visit by PM Sheikh Hasina to China on July 2-6, Bangladesh and China inked some important deals—five agreements including three memorandums of understanding (MoUs) and other agreements that included investment in the power sector (USD 1.7 billion). The visit was important for Dhaka as it paved the way for Beijing to pay more attention to projects that are important to Bangladesh's development.

This comes in the backdrop of the USD 24 billion worth of loans and investments signed between the two countries over the past few years, ever since Bangladesh joined the BRI initiative in 2016. When we take into account the USD 13.6 billion invested in joint ventures earlier, it puts Bangladesh (after Pakistan) as the largest recipient of Chinese loans under BRI. Yes, Chinese investments have been growing at an exponential rate over recent years. As pointed out in a recent article in The Diplomat, "between 1977 and 2010, Beijing's investment in Bangladesh totaled just $250 million. This rose to roughly $200 million in 2011 alone. In the wake of the BRI, China has emerged as Bangladesh's largest investor."

When we look at the government's vision for the country, it is obvious that Dhaka wishes to make substantial improvements in its infrastructure. However, given the government's less-than-successful bid to secure funding from traditional sources, it has had to turn to China to fill the void. The unfortunate incident of the World Bank and subsequently the Asian Development Bank pulling out their combined funding (of USD 1.2 billion) for the Padma Multipurpose Bridge Project over alleged graft, left the ruling party with a bitter taste in the mouth. Then there was the Bank BNP Paribas and Norwegian government's sovereign wealth fund, both of which refused to finance the Rampal coal-fired power plant in Khulna on environmental grounds. These disappointments eventually paved the way for Bangladesh's move to join the BRI initiative, which also opened up the opportunity to take loans from China's AIIB, the newly emerging global lender, and of course, direct Chinese investments from the People's Republic of China (PRC).

China has been an active development partner for Bangladesh. A number of important projects have been awarded to Chinese companies in rail and road. Indeed, an industrial park is being built next to an upgraded Chattogram port that was done with Chinese assistance. Besides being a partner in the Padma bridge construction, China has built some eight friendship bridges in Bangladesh. Apart from these, Bangladesh is receiving a lot of support in the power sector, particularly in coal-fired power plants some of which are being built in Chattogram and Payra.

So, why are relations so warm between these two countries? As stated before, China is accommodative with Bangladesh's demands for financing/investing in projects that are important to Bangladesh. As for the question put forward by pundits in Washington and Delhi about Chinese loans fuelling a possible debt-trap, Dhaka has been cautious about the projects it undertakes. For instance, Bangladesh opted to go with Japan's proposal to build a deep sea port at Matarbari and effectively shelved the Chinese proposal for one in Sonadia because there is no need for two deep sea ports. Now that shows the country's financial planners are well aware of what will work and what won't when it comes to taking out multi-billion-dollar loans. Just because the money is on offer and on the table doesn't mean we will take it. China for its part has shown remarkable restraint in not pushing the deep sea port too much.

When we take into account the fact that Bangladesh's economy has actually pushed beyond the 6 percent annual growth rate and ventured into the 7-plus percent benchmark, the continued growth in inward remittance from expatriate workers and robust export of readymade apparels, and coupling all those indicators with soft loans available from countries other than China, particularly India and Japan, it gives us hope that no, we are not headed in the same direction as, say, Sri Lanka, or Pakistan for that matter, and setting ourselves up for an eventual debt-trap. India, which has been a time-tested friend of Bangladesh, has extended soft loans worth around USD 7 billion and the Japanese are helping develop multi-billion-dollar projects, including the Matarbari complex, multiple power plants and a deep sea port. Hence, our externally-assisted development portfolio is not entirely China-centric.

Of course, not everything is as rosy. True, MoUs have been signed worth billions and billions of dollars. The Achilles heel has been slow disbursement. Going by media reports, we are informed that China has actually disbursed less than a billion dollars on agreements signed back in 2016. The reasons for such a snail's pace in disbursements vary but what has been shared unofficially by the Chinese is that red tape is largely to blame. There have also been cost overruns on many of the projects that have been financed by China and one of the biggest allegations levelled against Chinese firms is that they always bid a sum that is lowest to clinch the project—and once the project is awarded, they go for time extensions, which inevitably lead to revising project costs that do not benefit the country.

The last visit by PM Sheikh Hasina has paved the way for a joint working committee that will identify and eliminate issues that are holding up disbursement and this, it is hoped, will help keep project completion times in check. At the end of the day, the BRI is happening. As is Bangladesh's road map for infrastructure development. The country will move ahead with all its development partners playing a role in infrastructure development including India, Japan and yes, China.

Syed Mansur Hashim is Assistant Editor, The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments