Integration with Airtel a year away: Robi chief

Robi yesterday said it would take a year to complete the merger with Airtel Bangladesh as the mobile phone operators will have to get approvals from the authorities and hold key meetings in favour of the merger.

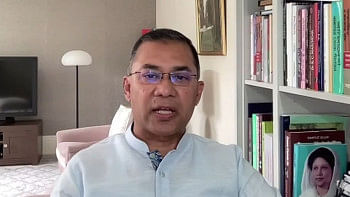

Supun Weerasinghe, chief executive officer of Robi, the third largest mobile phone operator, said they expect to receive official approvals in three months.

“Twelve months will be required for completing the whole process,” he told reporters at a briefing at his office in Dhaka.

Weerasinghe said a shareholder meeting would take place in December this year, which will be followed by a technical meeting to speed up the merger.

He said the merger would bring convenience to the customers as well as benefit the shareholders in terms of profitability.

On September 9, the parent companies of Robi and Airtel disclosed that a negotiation is underway for a possible merger in Bangladesh.

Both the companies have already applied to the telecom regulator for the merger and applied to the court for clearance.

The press conference was organised to declare the performance of the operator in the third quarter of 2015.

In July to September, Robi's net profit fell 13 percent year-on-year to Tk 113.1 crore.

The company said it made the highest amount of investment in the country for developing the telecom service in the last two years.

In 2014 and 2015, Robi invested $500 million while market leader Grameenphone put in $380 million and the second-placed Banglalink $270 million. Weerasinghe said data will be the future driver of growth, and Robi has invested in the segment to give more comfort to the subscribers in using data.

He said additional investments would be needed in the area. “Joint investment might be helpful.”

Malaysia's Axiata Group, the majority owner of Robi, and India's Bharti Airtel, owner of Airtel Bangladesh, signed a non-discloser agreement on the discussion on the potential merger.

If it goes ahead, the merger will make Robi the second largest operator in Bangladesh in terms of subscriber base.

Robi and Japanese mobile phone operator NTT Docomo will have a 75 percent stake in Robi while the rest will go to Airtel, according to a joint letter signed by Weerasinghe, and PD Sarma, managing director of Airtel Bangladesh.

At present, Axiata and NTT Docomo own 91.59 percent and 8.41 percent share in Robi respectively.

Describing different aspects of the proposed merger, the Robi boss said as Bangladesh is a low return market, it would be helpful for the shareholders to invest jointly that will give them a good return.

“The proposed merger will create significant benefits for all stakeholders and create the platform for a Digital Bangladesh,” Weerasinghe added.

India and Malaysia have already introduced 4G, and Bangladesh would launch the service within a short time. “Besides, 5G is also coming. In order to provide quality services, we need more and more investments,” he said.

The merger was crucial to ensure broadband penetration in rural areas and make the business sustainable, according to Weerasinghe. “The merger will also help improve the quality of services.”

Robi added 3.1 million new subscribers in the first nine months of the year to take the subscriber base to 28.4 million, giving it a 21.6-percent market share.

In the nine months to September, the company clocked a revenue growth of 6.7 percent compared with the same period a year ago, while data revenues growing by over 100 percent.

The growth in data revenue was propelled by the continuous investment in 3.5G network expansion coupled with innovative data offerings to drive data usage, said Robi.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments