15 new factories to create 1 lakh jobs

When some industries are struggling with liquidity crisis and high lending rates, the ceramics sector has been getting five new factories on an average every year since 2017, industry players said.

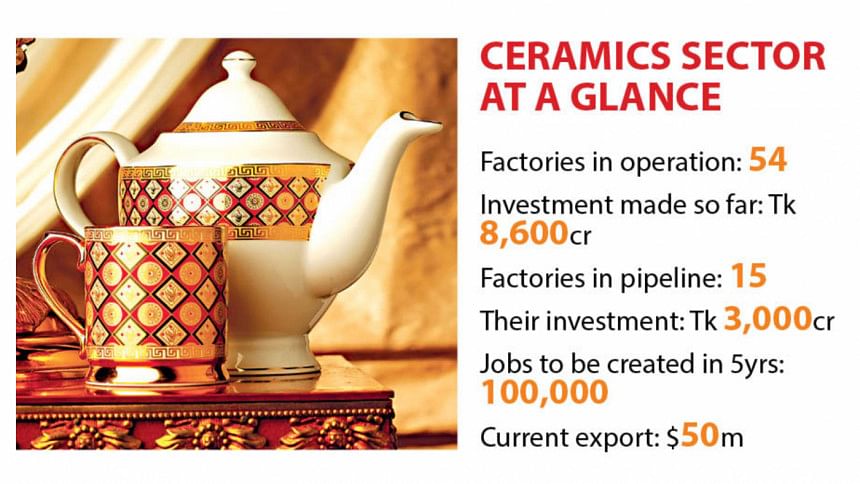

Riding on steady economic growth and rising purchases of consumers, another 15 factories are in the pipeline with an estimated investment worth around Tk 3,000 crore.

These plants are expected to begin commercial operations in the next four years and will create much-needed employment for nearly 100,000 people.

After entering the market with tiles and sanitary ware two years ago, Akij Ceramics is now investing a fresh Tk 500 crore to set up a tableware unit.

“We have already imported machines and installations are going on,” said Mohammod Khourshed Alam, director for sales and marketing.

The factory has set a target to produce 250 lakh pieces of tableware, which will elevate Akij to the ranks of Monno Ceramic Industries as the largest producer, according to data of the Bangladesh Ceramic Manufacturers and Exporters Association (BCMEA).

As tableware has huge prospect in overseas markets, Akij will export the items and sell it in the local market as well, Alam said.

Meghna Group of Industries, one of the country’s largest conglomerates, is investing Tk 400 crore to set up a tiles factory at its economic zone in Narayanganj.

“We hope to start commercial production by mid-next year,” said Mostafa Kamal, chairman and managing director of the group.

Ceramics is a capital-intensive business as setting up a factory takes Tk 150 crore to Tk 200 crore.

Presently, there are 54 ceramic factories that are manufacturing tiles, tableware and sanitary ware.

BCMEA data showed tiles and sanitary ware’s domestic demand to be higher than the existing production capacity.

Three tiles makers -- Excellent Ceramic Industries, Hi-Tech Ceramics and Top One Ceramics -- will hit the market in three months.

Another five factories of Akij Ceramics, JB Ceramics, Bangladesh Ceramic Industries, New Zhong Yuan Ceramics, and Sarmano Ceramics are expected to go into production next year. Four new companies, all tiles makers, are expected to commence production in 2021, according to the BCMEA.

“Local demand for ceramic products is increasing. Even factories that were set up with an export target are selling goods in the local market,” said Irfan Uddin, general secretary of the BCMEA and a director of FARR Ceramics.

He said an entrepreneur has to spend at least Tk 150 crore to establish a factory. Even then, new companies are coming in seeing business prospects both at home and abroad.

Shirajul Islam Mollah, president of the BCMEA, said ceramics is an emerging sector and has huge export potential.

“We had to depend on import for ceramics two decades ago. Now we are almost self-sufficient in tableware and sanitary ware,” said Mollah, also the managing director of China-Bangla Ceramic Industries.

When the companies in the pipeline start production, Bangladesh will be able to earn $1 billion from export of ceramics by 2025, he said.

He hailed the government for giving 10 percent cash incentive on exports since fiscal 2017-18, but believes 25 percent would boost exports significantly.

According to industry insiders, Bangladesh has duty-free access to European markets under the generalised system of preferences (GSP) that can increase export of ceramics there.

Availability of natural gas and cheap labour are two other competitive advantages Bangladesh enjoys over other countries. But a lack of skilled workforce is a problem for the sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments