Business and banking in the changing landscape of IT

The uses of different kinds of emerging information technology (IT) and automation are transforming the business world rapidly. Like money, rapid advancements of technology tend to make the world go “round”. Emerging technology helps companies of all sizes and types drive innovation, strategy and growth and gain competitive advantages. All deemed exciting for the business world, but there is a dark side too. In particular, the impacts of automation on businesses and society are uncertain. As Robert F Kennedy stated more than half-a-century ago, “Automation provides us with wondrous increases of production and information, but does it tell us what to do with the men the machines displace?” Advancements of technology and information are cheered by those who benefit from improving product quality, living standards and creation of new jobs requiring specialisation. But another group of people jeer it, who are deeply concerned for massive job displacements, dislocations and permanent job losses in the process of the so-called Schumpeterian “creative destruction”. But in light of the above, as technology keeps evolving, none in the business world can escape its timely adaptation.

The planet had experienced several revolutions relating to agriculture, commerce, industry and computing and is now facing digital revolution. In an increasingly digital world, manufacturing and service sectors have already started rapid transformations. Sectors like readymade garments, textile, leather and footwear, furniture, agro-foods, tourism, hospitality and banking are playing pivotal roles in Bangladesh’s economy. Garments and textiles are vulnerable to automation. It is known that Software Automation, a US company based in Atlanta, has built an entire assembly line manned by robots that can pick a piece of garment, arrange it properly and then sew it. This technology is called Sewbot. The landscape of RMG and textile industry of Bangladesh is being threatened by this type of modern technology. Several agro-processing companies, namely Pran, Akij, Square, Ahmed, ACI, BD Foods and Bombay Sweets, in Bangladesh are selling products locally and internationally. Robotic automation is already deployed in some. The furniture sector employs about two million workers in Bangladesh. Automation and computerisation through the introduction of robots, advanced software and artificial intelligence are substitutes for the routine and rule-based tasks in the furniture sector of Western countries. Because of product innovation and business model transformation, this sector may see a large number of unskilled and semi-skilled workers lose their jobs unless necessary steps are taken to upgrade their IT knowledge. The tourism and hospitality sector is being drastically changed. The ICT tools are providing new means for analysing the information. As a result, converting this valuable information to be incorporated into the knowledge system is a challenge for this industry. The growth of footwear industry is very much profound in Bangladesh. Already 51 foreign companies have shown interest in establishing footwear units in Bangladesh. Without rapid adoption of automation, the local footwear companies will face a bumpy transition ahead.

The banking and financial institutions need to control the credit and lending management and the entire credit process. These financial institutions need to focus on policy and compliance related issues, detect fraud and offer high quality services to customers. Invention of artificial and computational intelligence has given the opportunity to evaluate complex problems and provide solutions in no time. Use of these inventions is completely transforming the banking industry and giving birth to branchless banking. The perceived benefits of computational intelligence can be observed in many directions like cost savings, creation of efficient processes and enhancement of customer experiences. Very particularly, artificial intelligence (AI) based models will ensure that only worthy applications with low credit risk get through. Evolution of AI has now reached a level where machine learning can effectively identify fraudulent transactions. Financial firms are assisting governments trace laundered money, terrorism financing and other suspicious global transactions with the help of AI techniques. Questions automatically arise for countries like Bangladesh, Sri Lanka and India on whether banks are ready to adopt AI, how banks will collect data and will collection of these data invade privacy of clients. At present, the economic benefit of using chatbots for the financial services industry is enormous. As per Gartner research, chatbots will be dealing with more than 85 percent of all customer service interactions by the end of 2020. Further, Juniper’s report suggests that chatbot adoption will lead to the potential savings of $8 billion annually by 2022. Bangladesh is also in a leading position in using chatbots and exporting this AI software.

This is obvious that workplace in the near future will look nothing like the job market of 2019. It is true that although many jobs will disappear while other jobs take new shape. Jobs at high risk are those that are routine, repetitive and predictable and require high skill. But what might come as a shock for countries like Bangladesh is that job losses will be significantly worse as many organisations are labour-intensive and the working people are not apparently well-versed on technology.

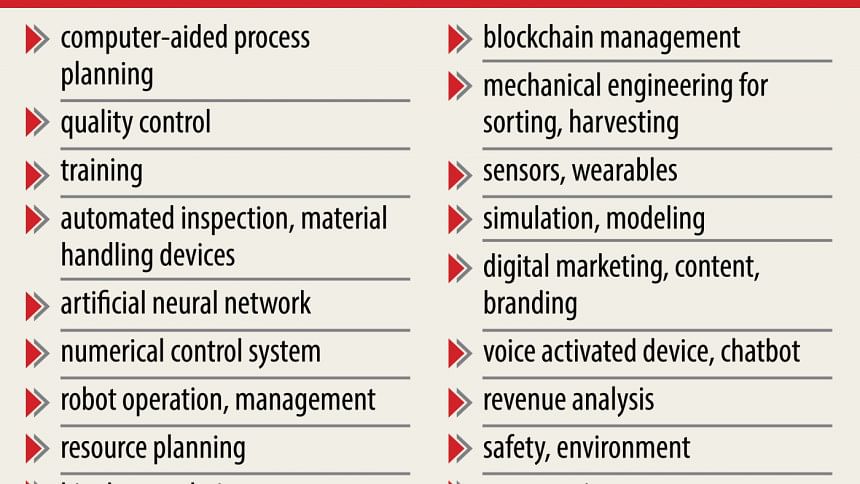

Of course, the future will be brighter for the workers equipped with new skills, technical professionals and those who are tech savvy. The major new occupations that may emerge are computer-aided process planning professionals, quality control professionals and training professionals. To this effect, expertise in automated inspection, automated material handling devices; artificial neural network; numerical control system; robot operation and management; resource planning, big data analytics; blockchain management, mechanical engineering acumen of servicing sorting and harvesting machines among others will be in high demand. Other jobs include professionals having expertise on sensors and wearables; simulation and modeling experts; digital marketing executives, digital content developers and brand managers; professionals for operating voice activated devices, chatbots and travel bots; revenue analysts; safety and environment experts; computation experts, etc. To remain competitive from the micro and macro perspectives in the 21st century, businesses, governments, policymakers, academicians, professionals and jobseekers should keep consideration of the above. Accordingly, they should be work-ready with government policy support, training and innovative mindset.

The digital revolution will unleash a new wave of advanced machines and will automate complex tasks. In the increasingly digital business landscape, data, devices, algorithms, sensors and humans are the main players. These technologies are forcing workplaces to change dramatically at alarming speeds. To spur innovation, productivity and growth, we therefore need to ensure that everyone has the right skills for an increasingly digitised and globalised world. In this perspective, enterprises need to welcome digital revolution to remain globally competitive by ensuring that manpower will keep up with the accelerating pace of changes. They need to invest overwhelmingly in introducing new technology and utilising big data through the mining of information. ICT generic skills are required to be learned by all members of the society so that all can use digital technology. Those currently in employment need to be re-skilled. The ICT foundation and high-level skills are becoming increasingly important when it comes to benefitting from technological innovation in terms of better employment opportunities and higher salaries. Apart from these, the complementary ICT “soft skills” such as leadership, communication and teamwork are required to avail evolving opportunities in the digital era. The government and policymakers need to play a very effective role. Both need to make sure that everyone can participate in and learn new skills through extending regulatory and policy support. Sector-wise comprehensive policies are needed to allow workers to upgrade their skills and help them move between jobs avoiding skills mismatch. Public-private partnership may also play a greater role. Investment in R&D is imperative for inventions and innovations. The days of prototypes are over. Innovations in process, product and commercialisation can ensure success at a time when a new business paradigm is emerging.

The writer is a professor of the Bangladesh Institute of Bank Management and can be reached at [email protected].

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments