Big scammers top defaulters’ list

The number of loan defaulters stands at 8,238 who owed Tk 96,986.38 crore to various public and private banks till November last year.

Finance Minister AHM Mustafa Kamal disclosed this at a question-answer session in parliament yesterday.

He further said Tk 25,836 crore was recovered from different defaulters as of November.

Apart from individuals, both public and private organisations are on the list.

Many of the business organisations, which swindled huge sums from different banks in recent years, dominate the list. Bangladesh Bank unearthed their financial scams by carrying out inspections.

These firms are largely responsible for the rise in defaulted loans in the banking sector.

Rimex Footwear Ltd, Crescent Leather Products Ltd and Rupali Composite Leatherwear Ltd -- all sister concerns of the Crescent Group -- are the top three loan defaulters, shows the list unveiled by Kamal.

The three firms, which took major portions of the loans from the Janata Bank, didn’t pay back any money to the state-run bank.

According to Bangladesh Bank, the Crescent Group’s total loan from Janata stands around Tk 4,000 crore.The state-run bank disbursed the loans, sidestepping the banking rules and regulations.

Three companies of AnonTex -- Galaxy Sweater and Yarn Dyeing, Simran Composite and AnonTex Knit Tex -- are also on the list of loan defualters.

The group swindled more than Tk 5,500 crore from Janata between 2007 and 2014.

The list includes Benetex Industries, a concern of Buildtrade Group; Bismillah Towels, a concern of Bismillah Group; and Hallmark Design Wear, a company of Hallmark Group.

Buildtrade Group siphoned off more than Tk 3,000 crore from both public and private banks, according to BB data.

Three non-bank financial institutions (NBFIs) have also become defaulters as they failed to pay back bank loans taken for running business.

They are Bangladesh Industrial Finance Company, International Leasing and Financial Service, and Peoples Leasing and Finance Services.

The BB has already started the process of liquidating one of the three NBFIs -- Peoples Leasing and Finance Services -- for its failure to repay the depositors’ money.

The central bank had earlier unearthed a number of financial scams at the NBFIs.

Among the government entities, the food ministry’s defaulted loan is Tk 26.46 crore.

Bangladesh Bank statistics show that the defaulted loans totalled Tk 1,16,288 crore in September last year.

According to Kamal’s statement in the House, the amount fell by Tk 19,302 crore in the following two months.

Bank officials said the defaulted loans dropped due to relaxed loan rescheduling facilities offered by the government in September last year.

BANK DIRECTORS’ LOANS

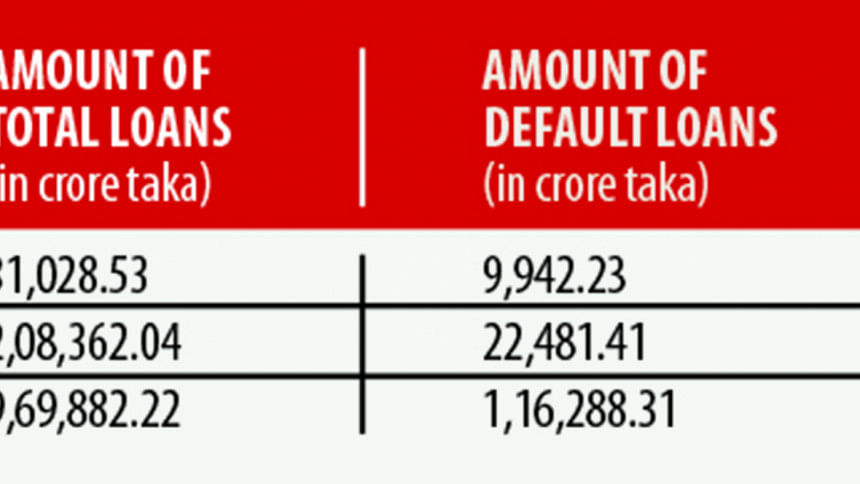

As of September last year, directors of various banks took loans amounting to Tk 173,230.89 crore from their own as well as other banks, said the finance minister.

The amount is around 12 percent of the total outstanding loans, according to him.

Directors of 25 banks have taken loans of Tk 1,614.77 crore from their banks -- around 0.166 percent of the outstanding loans of the banks.

Bank directors also took Tk 171,616 crore from 55 other banks. The amount is 11.21 percent of their total loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments