How IT innovations are transforming lives

The year 2020 marks the beginning of a new decade that is pregnant with a plethora of transformative possibilities with anything from artificial intelligence, bio-engineering, distributed ledger or blockchain and genetics to predictive healthcare, quantum computing, re-usable rockets and virtual reality; the world as we knew in the last couple of decades is destined to transform right before our eyes in leaps and bounds. As an IT industry practitioner for the last three and a half decades, I have had the fortune to experience how IT innovations have touched the lives of everyone from a poor old woman in a remote village receiving senior-citizen allowance through mobile financial service, to an autistic child in a middle-class family getting free access to augmented teaching aids—quality of life in Bangladesh has certainly improved a great deal in pace with the rise in per capita income that has quadrupled over the last two decades.

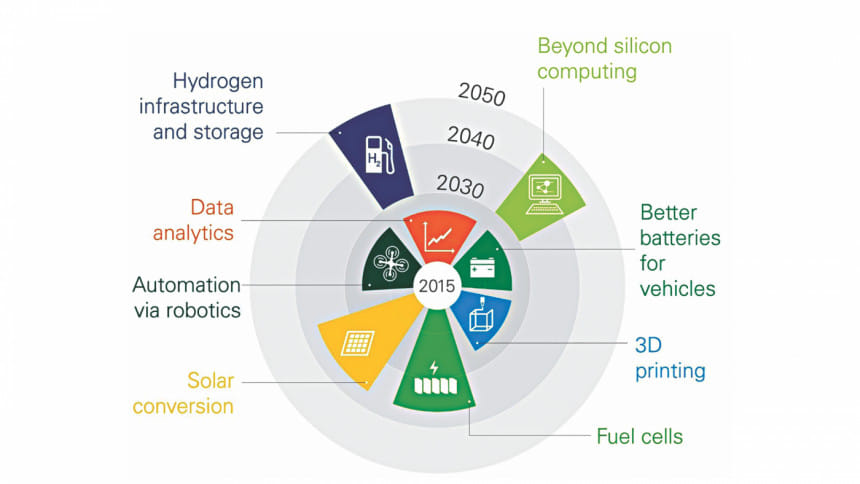

Global trends in some emerging technologies

The Digital Bangladesh thrust of the government of Bangladesh since 2009 has catapulted the nation from a rank of 130 out of 134 by 18 places to 112 in 2016 in the World Economic Forum's network readiness index. The fibre optic backbone has crisscrossed the country to reach almost all Unions—the smallest administrative units and thereby has given internet access to more than 75 percent of the population. At the central government level, many citizen services are already available online such as construction permits by Rajuk, import permits by CCI&E, investment registrations by BIDA, land title mutation by AC Land Offices and many others most of which are localised in Bangla for easy navigation by all. These facts have not escaped the notice of "Ease of Doing Business Index" by the World Bank where Bangladesh has moved up eight notches in the latest ranking.

One important aspect to note is that online services that are successfully operating are all developed and maintained by Bangladeshi software solution builders. This goes to show that the IT industry has matured over the last three decades to a point where it not only serves as the back-office for global IT outsourcing services but has moved up market to design, develop and market own software products and solutions in its own backyard that was long dominated by overseas players. This certainly speaks volumes for the visionary ICT Policy adopted by the government, the most recent revision of which in 2019 has mandated "Made in Bangladesh Software"—a top priority to advance the onward march of Digital Bangladesh.

Another indication of Bangladesh IT industry's maturity is the increasing number of global investors taking stakes in IT and ITES companies here giving the market a decidedly globalised look. 20-years ago, at the turn of the century, the nation's software market size including exports was less than Tk 1 billion—a tiny blip compared to the size of the economy. Now this has grown to a substantive Tk 150 billion, more than half of which comes from exports. One of the great transformations sweeping the country is an army of IT freelancers—the second largest in the world—that has empowered enterprising young people even in remote nooks and crannies of the country to be self-employed and make healthy earnings for themselves and their families.

In the olden days, Bangladesh had always been a follower when it came to adopting the latest information technologies for developing new products and services. The vast majority of BASIS members build and market database applications. However, a sizable number these days are making forays into the emerging technologies such as Blockchain or distributed ledger technology, data analytics, internet-of-things (IOT), machine learning tools, three-D printing, robotic process automation and virtual and augmented reality applications.

Investing in emerging technologies is inherently much riskier as trends in technologies and platforms which developers must learn and build applications on are continuously shifting. The enterprises have to be nimble and resourceful enough to pivot to new tools and platforms on the fly that takes some serious management bandwidth as well as investment of scarce resources. Managing the risks of working with emerging technologies is crucial to building a solid foundation for Digital Bangladesh. It is heartening to see that the government is taking bold and visionary measures to support such risky endeavours by providing human resource skilling support to mid-size and large enterprises and venture funding support to new startups.

This coming decade will ultimately determine whether Bangladesh as a country remains only the destination of mundane low-cost back-office operations of the world or breaks out as a pioneer in some of the top emerging technologies. To do justice to the dreams and aspirations of the seventh largest nation on earth, we must seize the opportunity and make our mark with emerging technologies. It will be a tough and uphill battle—a battle that the academia, the government and the industry must fight together—for the rewards at the top of the hill are unbounded and breathtaking as a rising sun over the sea.

With the rising sun comes a new day and we must take to the world in a new light. Just as ancient Greek philosopher Heraclitus stipulated that, "The only thing that is constant is change", the world of business has been going through rapid transformations throughout the world in the last three decades and this has touched trade and commerce in Bangladesh in significant ways as well. When I started business in 1986, telex machines were still the rage in large trading houses and fax machines were just trickling in as each one of these new-fangled telecommunication devices required written permission from the president's office! It took me three years to get the permission for our first fax machine in 1989. Today, except for some arcane government offices, no one uses fax machines and to see a telex machine one needs to go to a science museum. Fax machines replaced telex machines and desktop-computer based emails replaced fax machines. In the last five years, mobile messaging apps such as IMO, Viber, and WhatsApp have gradually encroached the communication realms dominated by emails before. It's not too far-fetched to imagine a world moving away from emails to messaging apps in the not-too-distant a future. Just 10 years ago, sending money from one place to another required visits to a bank branch or post office, filling out numerous forms and then it could take days and even weeks for the money to be seen by the receiving party. Today mobile financial services dominate this segment bringing instant money transfers between any two places within reach of all no matter how remote the location or what time of the day it is. A child born in a rural area 10 years ago may not know the name any bank but certainly knows the names of the most popular mobile financial service (MFS) brands. From MFS people are gradually moving to payment apps or digital wallets which have been around for some time but the adoption has been slow due to inherent sophistication of such apps that deter people with limited digital literacy from using such apps. This may soon change as more user-friendly digital wallets come to the market making its widespread adoption a reality as has been the case in USA, Europe and even China. In Singapore the Monetary Authority (MAS) is already issuing licenses for Digital Banks which require no brick-and-mortar operation. Combining distributed ledger technology, i.e., Blockchain and digital wallet technology the digital banks of the future may make traditional banks obsolete just as emails have made Fax machines obsolete.

Conventional trade settlement instruments such as Letters of Credit (LC) are already on the way out in many countries and trade finance automation tools based on blockchain will soon step in to fill the void. The digital onslaught is reaching tsunami proportions and is washing away old business practices like broken twigs. However, digitalisation of business and services by default requires appropriate mechanisms for digital identities, provenance and verification. These on the other hand raise issues of security, privacy and immutability. Together these six factors stand in way of digital nirvana.

Digital identity has been a hot topic in legislatures around the world for at least a decade. While Bangladesh has been in the forefront of introducing digital national identity cards and e-passports, these seemingly innocuous digital implements that make governance easier and presumably cheaper, happen to raise spectres of digital identity thefts and intrusion of privacy that have prevented adoption of these technologies in many technologically and economically advanced countries such as France, Germany, USA and others. Canada and Hong Kong, for example, are in the process of bidding out digital identity solutions that address these six vectors of digital incarnation for humans and objects. It may be several years before any definitive digital identity system is adopted by them. Centralised digital identities such as Aadhar in India have been found to marginalise the poor further bringing up one the most perplexing digital paradoxes of our times.

The security and immutability of digital identities and assets are similarly an intractable problem that has defied digital advances of the past half century until the advent of distributed ledger or blockchain technology in the past decade. However, building applications using this intrinsically complex technology is facing challenges due to tremendous scarcity of skilled resources. A digital identity can theoretically be hacked, copied or deleted. As long as the issuing authority is centrally managed, a rogue officer with proper access authorisations or a hacker having found a loophole in the security setup, could enter the identification database and copy data for fraudulent use as well as change or delete data for pure mischief—in both cases causing the affected persons tremendous grief and even a run in with the law. This is why no matter how honest and fool-proof a central digital identity system is, there is always a risk of such breach. While blockchain technology has the chutzpah to prevent such breach of security and provide immutability of data, its adoption will only pick up speed if the troika of academia, government and industry find a way to work together. In South Korea and Taiwan, such tripartite collaboration has given rise to a new breed of startups—some as fully owned subsidiaries of large corporations—that are bringing new paradigms of digital solutions not conceivable under conventional approaches. South Korea is now a global leader in published research done in collaboration with industry. It is a widely known fact that industry-academia collaboration with a helping hand from the government gave rise to the most famous technology wonderland called "Silicon Valley".

Privacy of digital data is another major concern that has many privacy advocates around the world crying hoarse for decades on the loss of privacy entailed with digitalisation as a lifestyle. While in many countries it is unlawful to record the movements of the citizens, that has not prevented governments from digitally tagging the movements of people—citizens and non-citizens alike—which raises the phantasm of an authoritarian government tampering with such evidence to frame a person just as depicted in the sci-fi movie "Minority Report". In some parts of China, the local government has introduced loyalty points for good citizen behaviour based on where they go, what they do with their free time and what they eat, drink or smoke. Such total devolution of privacy is unthinkable in any country with a modicum of respect for privacy. In this country we need to be careful with what we do with all the data collected by various agencies of the government. It is technologically very easy to collate all that data through Big Data Analytics and get an exact picture of a person's activities and movements which is a total breach of one's privacy. There needs to be careful safeguards for and firewalls around various repositories of citizens' private data.

Of course, just as you can take out a prick with another prick the privacy nightmare of digital identity can also be tackled by sophisticated digital techniques called self-sovereign digital identities and zero-knowledge proofs. However, the overall digital upskilling and capacity development needed to embark on such implements have been found to be a daunting challenge even for countries with ample resources. For a newly graduated middle-income country such as Bangladesh the challenges are much more acute.

On the one hand we must be bold enough to tread into emerging technologies in a pioneering road-warrior, and at the same time, we must be alert at all times on the pitfalls of technology, specially the widening digital divide, to make sure that "no one is left behind", borrowing from the singular mission of the UN sustainable development goals to be attained by the end of this decade. Despite the misgivings of a digital future portrayed in George Orwell's "1984", our future is inevitably digital. Let us rewrite that digital future to make everyone well-endowed to pursue "life, liberty and happiness" without sacrificing the human spirit to an automaton.

Habibullah N Karim is Founder & CEO, Technohaven Company Ltd and former President, BASIS.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments