Mobile phone use to be even costlier

Mobile phone users are likely to face higher taxes next fiscal year as the government looks to chase a bigger revenue target riding on the essential services sector that generates more than Tk 30,000 crore in turnover a year.

The existing 10 per cent supplementary duty on phone calls, data use, texting and other services may rise to 15 per cent in fiscal 2020-21, said a senior official of the finance ministry, asking not to be named.

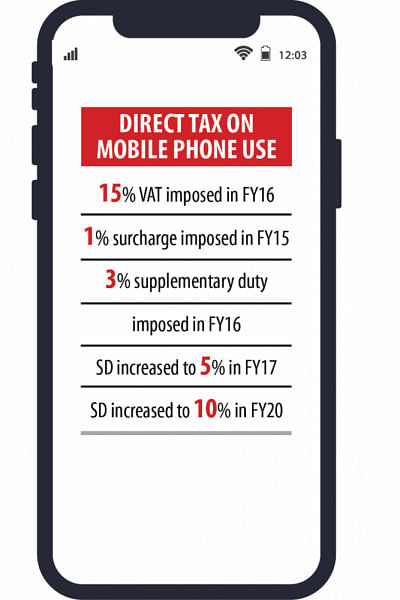

Apart from the 10 per cent SD, mobile phone users now have to pay 15 per cent VAT and 1 per cent surcharge on their bills.

If the SD goes up as planned, customers will foot a bill of Tk 133.0725 to get a service of Tk 100, or against each Tk 100 topped up, a user would get services not more than Tk 75.147, according to officials.

On the eve of the announcement of the national budget every year, the National Board of Revenue issues some statutory regulatory orders which empower them to collect some additional taxes even before the budget gets through the parliament.

The revenue authority considers raising the SD on the mobile phone services as it has been tasked with collecting Tk 128,800 crore in value-added tax and SD from domestic sources in the next fiscal year, which is 19 per cent higher than the revised target of the outgoing year.

The government had first slapped a 3 per cent SD on mobile phone use in fiscal 2015-16 and progressively brought it to 10 per cent this fiscal year.

Smartphone imports faced a huge tax hike last year as the government wanted to offer the local assembling industry an edge but the move eventually stymied smartphone penetration, industry insiders said.

Mobile phones and SIM cards were the third biggest sources of VAT and SD after cigarette and construction firms generating Tk 4,800 crore in fiscal 2017-18, up 12 per cent from the previous year, according to NBR data.

There should not be any such decision as it will further add to the burden on the customers, said Shahed Alam, chief corporate and regulatory officer of Robi.

"We need to remember that 53 out of every 100 taka spent by the customers reaches the government exchequer in different forms."

It is also worth noting that digital communication has become the only means of connectivity for a large portion of the population during the pandemic; if additional SD is levied it further add to the woes of the people under the current circumstances, Alam added.

Officials of other mobile operators said the additional taxes will slow down the government's digitalisation efforts and compel subscribers to cut down on their mobile phone use.

"This industry is already burdened with huge taxes," said an official of a mobile phone operator preferring anonymity.

More than half of their earnings go to the state coffer in different forms, while another 30 per cent is paid to other telecom service providers.

"And at the end, we don't have enough money to run our operations," he said, adding that any new taxes will deal them a blow.

The number of mobile internet users rose 9 per cent year-on-year to 9.5 crore in March this year, according to the Bangladesh Telecommunication Regulatory Commission (BTRC).

The number of active mobile phone subscribers went up to 16.53 crore in March from 15.97 crore in the same month a year earlier. But the number of subscribers dropped in March compared to that in the previous month, BTRC data shows.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments