Govt pledges transparency, addressing banking sector ills to IMF

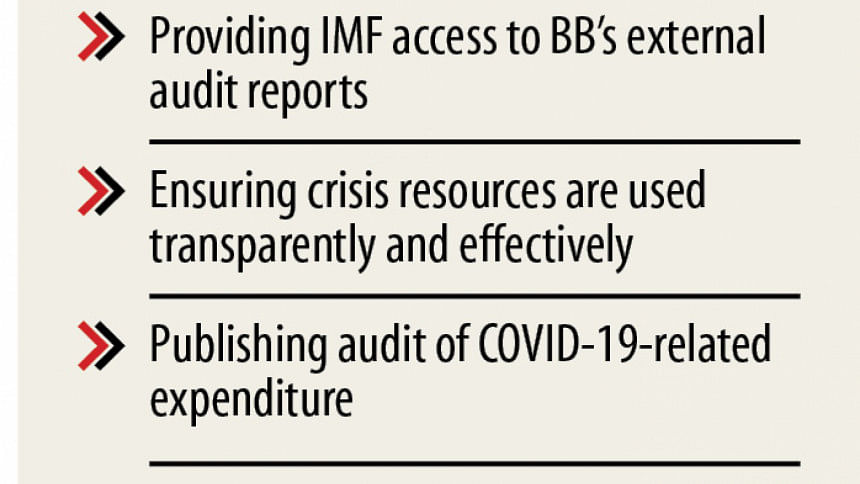

Bangladesh has pledged to use the emergency assistance from the International Monetary Fund transparently and effectively, ensure fiscal discipline and prioritising addressing banking sector problems as it secured $732 million from the crisis lender to tackle the coronavirus pandemic.

The finance ministry and the BB are finalising a letter of intent on their respective roles and responsibilities for servicing financial obligations to the IMF, they said.

"We are committed to ensuring that crisis resources are used transparently and effectively," said Finance Minister AHM Mustafa Kamal and Bangladesh Bank Governor Fazle Kabir in a joint letter to the Washington-based multilateral lender.

Toward that end, the government would ensure that applicants for coronavirus-related contracts provide their beneficial ownership information to the government and that this information is appropriately recorded and made available to audit authorities.

The government will publish online an audit of COVID-19-related expenditure and other government subsidised programmes by the Office of the Comptroller and Auditor General within 12 months and crisis-related public procurement contracts and related documents.

"We will seek to adopt reforms to allow publication of beneficial ownership information of companies awarded public procurement contracts as soon as feasible," said the letter dated May 20.

On May 29, the executive board of the IMF approved a disbursement of $244 million under the Rapid Credit Facility and a purchase of $488 million under the Rapid Financing Instrument.

This will help finance the health, social protection and macroeconomic stabilisation measures, meet the urgent balance of payments and fiscal needs arising from the coronavirus outbreak and catalyse additional support from the international community, the lender said.

The IMF has not attached any conditions for the loan like it did while extending assistance in the past and has not called for belt-tightening because spending is needed to stop people dying or from falling into a permanent trap of unemployment.

Besides, countries all over the world, including Bangladesh, are facing a shortage of foreign exchange, not because they have indulged in any irresponsible spending sprees, but because of a virus beyond their control.

But the Washington-based fund urged governments to keep close track of what they were spending and to make sure that multitrillion-dollar spending commitments did not cause permanent damage.

"Spend what you can but keep the receipts," Kristalina Georgieva, the fund's managing director, said in a clear warning to countries that there was a risk that a chunk of the $8 trillion already committed would vanish as a result of corruption.

"We don't want accountability and transparency to take a back seat," she said.

To mitigate the impact on the economy and the population, a series of fiscal, monetary and regulatory measures have been put in place in Bangladesh, the finance minister and the BB governor said in the letter.

"Following the emergency response to the crisis and stabilisation of the economy, we intend to re-focus on addressing banking sector problems, including non-performing loans and poor performance of state-owned commercial banks."

Before the outbreak of the rogue virus, the government started amending several laws to enforce more banking sector discipline.

"Looking ahead, we are committed to addressing the issues as a matter of priority by ensuring effective banking sector supervision, strengthening corporate governance of commercial banks and improving the financial performance of state-owned commercial banks."

The government has committed to bringing the fiscal deficit gradually back to 5 per cent of gross domestic product (GDP) following the temporary widening as a result of the pandemic while ensuring smooth recovery of the economy.

"We recognise that restoring fiscal discipline and debt sustainability while allowing the government to provide the necessary public services and investment, will require an improvement in revenue performance."

With the ongoing technical assistance from the IMF, the government is determined to strengthening tax administration and compliance, reducing tax exemptions and broadening the tax base, the letter said.

The IMF assistance will help meet the urgent foreign exchange needs stemming from the disruptions to remittance and garment exports and mitigate the near-term pressure on the balance of payments and the budget.

Bangladesh has announced a series of stimulus packages, including subsidised loans by banks, aggregating about Tk 103,000 crore, which is 3.7 per cent of GDP.

It issued a revised budget for fiscal 2019-20 at the end of March that includes additional resources to fund the COVID-19 Preparedness and Response Plan and to augment existing transfer programmes that benefit the poor.

Retail cash transfers to households will be channelled through bank accounts and mobile payments to ensure effective targeting and plug in leakages, said Surjit Bhalla, executive director for Bangladesh at the IMF and Bhupal Singh, an adviser to the executive director, in a statement to the IMF.

The economy is expected to record a sharp V-shaped recovery with supply chains resuming.

Given the moderate level of the pre-pandemic fiscal deficit, general government debt, current account deficit and well-anchored inflation, the economy is placed favourably to gain traction once external risks subside, the statement said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments