Driving towards Digital Bangladesh in reverse gear

There is no doubt that the country has come a long way in fulfilling its vision of becoming Digital Bangladesh. With less than a year remaining in the timeframe, Bangladesh looks set to make good on its promise thanks to the visionary policy support from the government.

The government's commitment towards digitalisation encouraged the private sector to be a part of this history. In particular, the telecom sector stood out as the most impactful partner of the government in implementing the national vision.

But when you look at the taxation regime created by the tax authorities you begin to question whether they are playing their due role by creating fiscal space for the telecom industry to enable it to contribute fully.

If I were to pick the most unjust part of the taxation regime for the investors, it would be the 2 per cent minimum turnover tax. Telecom companies pay 2 per cent of their revenue to the tax authorities whether they make any profit or not.

Let's suppose an operator's revenue in 2019 was Tk 100 crore. That means the operator will have to pay Tk 2 crore as the minimum turnover tax for the year.

The operator has to finance the tax from the profit it had made. If the operator were to report losses, it would still have to pay the minimum Tk 2 crore from its capital or through borrowing.

This is outrageous! It is certainly not part of the recipe for creating a conducive investment climate in the telecom sector. The 2 per cent turnover tax is literally sucking the oxygen out of the industry like the coronavirus, especially the smaller operators, who are struggling to make a profit.

Apart from the telecom sector, no other sector is made to pay 2 per cent minimum turnover tax. The only other sector that comes near the telecom sector is the tobacco sector, but it is required to pay only 1 per cent.

Besides, the telecom industry and the tobacco industry are subjected to the same corporate tax rate of 45 per cent.

Usually, the government tries to levy more tax on industries that are harmful or to discourage certain industries from policy perspective. If you apply that logic you have to conclude that the tax authorities consider the telecom sector more harmful or more non-conducive than the tobacco sector since we pay 2 per cent of our revenue as the minimum turnover tax while they pay only 1 per cent. Any sane person would term it an utter insanity.

Studies show a direct link between GDP growth and the growth of telecom and internet penetration.

A study conducted by the International Telecommunication Union (ITU) in 2019 shows a 10 per cent increase in mobile broadband penetration yielded a 1.8 per cent increase in GDP for middle-income countries.

Therefore, the tax authorities should make sure the telecom operators' revenue goes up so that they can invest more to deliver digital dividends to every citizen of the country.

That would mean the country will adopt the digital economy and we all know that is a far more efficient economy compared to the age-old analog economy. Hence, the ITU's finding is very much justified.

If anyone still has any doubt, they should imagine how we would have lived during this pandemic had we not had the digital infrastructure to deliver the services we are enjoying from home, rather than reaching out for it risking the prospect of contacting coronavirus in the process.

The sector creates one million job opportunities every year and contributes 7 per cent to the GDP right now. The telecom infrastructure put in place by the industry has become the key enabler for the blossoming mobile financial service (MFS) sector, e-commerce and the digital start-up community like Uber, Pathao and Shohoz. Literally, the digital economy is emerging on the back of the telecom infrastructure.

But looking at the minimum turnover tax, you may feel that the tax authority would rather want to have you take a large pull at the cigarette to ease your nerves than staying connected digitally during the pandemic.

The minimum turnover tax is certainly not the only tax that begs rethinking. But it surely is the most outrageous form of taxation that demands immediate correction. Just imagine, we are forcing the foreign investors of the sector who had brought the highest amount of foreign direct investment into the country over many years to park 2 per cent of their revenue as minimum tax payment. This flies in the face of all standard thinking around taxation and does not serve the country when it goes to the global market to look for potential foreign investors.

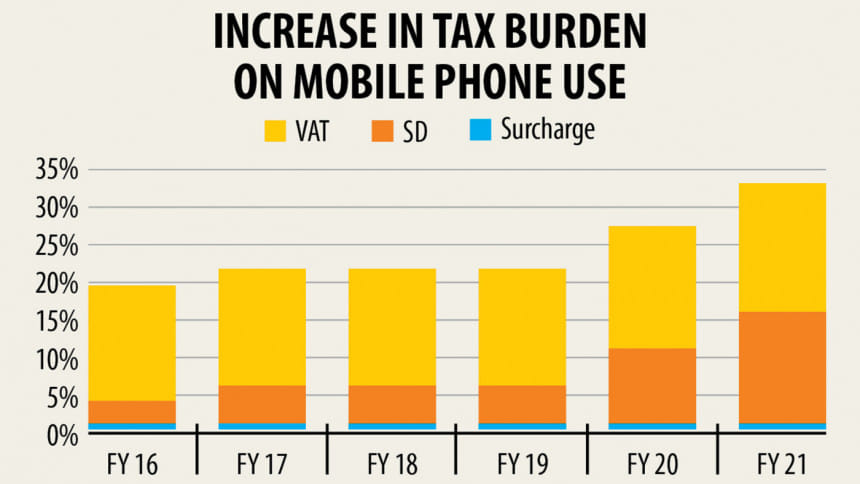

Bangladesh grabbed global attention when it outlined the vision for a Digital Bangladesh in 2009. The telecom sector responded to the clarion call from the government by reducing data prices by 99 per cent since then. On the contrary, the tax authority has raised the minimum tax rate by more than 150 per cent since 2012 and consumer tax (supplementary duty, VAT and surcharge) by more than 112 per cent since 2011. Something is seriously wrong here!

The minimum tax rate is reducing the breathing space for the sector, especially for the smaller operators that have no option other than passing the consumer tax entirely on the consumers.

Our unique mobile, internet and smartphone penetration stand at around 54 per cent, 30 per cent and around 40 per cent respectively whereas voice service is still contributing 60 per cent to the industry's revenue. So, there is a need for sustained investment to deliver the digital dividends to everyone in the society.

We hope that the tax authorities will acknowledge it by shifting the gear on the minimum tax rate, so that we can stop driving towards Digital Bangladesh in reverse gear.

The author is a telecommunications expert

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments