Is duty-free facility enough to boost export to China?

On June 16, 2020 China declared duty-free export facilities for the least-developed countries (LDCs), including Bangladesh on 97 per cent of their tariff line. The media reports that followed mentioned that China was going to provide duty-free export benefits to an additional 5,161 products from Bangladesh, taking the total number of products to 8,256, including the items admissible under the agreement of the Asia Pacific Trade Agreement (APTA).

The media reports gave a clear sense of prediction that with such a duty-free facility, exports from Bangladesh to China are going to be boosted in the near future at a significant level. People expect to grow our exports to the Chinese market, the most populous and the second-biggest economy in the world.

However, that expectation needs to be evaluated based on ground reality. We need to think first on whether the extension of the duty-free facility will help grow our exports. Then based on the proper evaluation, we should fine-tune the strategy and the government policy to enhance Bangladesh's exports to the Chinese market.

When China first declared the LDCs package of the duty-free facility in 2010, it covered about 61 per cent of their tariff line. Bangladesh availed such facility. Since the scheme was implemented, Bangladesh has been enjoying duty-free export facility on 5,054 products in China.

China extended the facility covering about 97 per cent of the tariff line in 2013. However, it attached a condition of signing a 'Letter of Exchange' by the beneficiary LDCs to avail the facility. Signing such a letter of exchange practically meant that any other benefits availed under any regional trading arrangements had to be sacrificed.

China and Bangladesh are the members of the APTA and both countries are availing duty benefits for each other's products. So, Bangladesh needed to sacrifice APTA benefits if it wished to avail the Chinese-extended package for the LDCs. The fourth round of trade negotiation under the APTA, which started in 2006, completed in 2017 where all the member countries offered greater concessions than before to the other members.

The APTA is a preferential trading arrangement where the members do allow duty concessions ranging from 5 per cent to 100 per cent on a certain percentage of the tariff line for the products to be exported from the other members.

China, following the fourth round of the APTA negotiation, allowed duty benefits to 2,191 products under 'General Concessions' applicable for all other members and for 181 products under 'Special Concessions' applicable for the LDC members (Bangladesh and Laos) and it was implemented on July 1, 2018.

In the Chinese offer under the APTA, duty concessions for most of the products given under the 'General Concessions' were 35 per cent while the same was 100 per cent for most of the products under the 'Special Concessions'. Moreover, many of the products under the 'Special Concessions' were from the textile and leather sectors, which are considered more sensitive.

Bangladesh, as an LDC, is entitled to duty concessions for the products under both concessions.

Major export items from Bangladesh to China include jute and jute products, plastic products, rawhide and skins, frozen fish like crabs and live eel fish, sesame seeds and cotton waste products.

Bangladeshi exporters are entitled to export most of the products to China duty-free since 2010. Additionally, duty benefits are enjoyed since long for many products from Bangladesh to China under the third round of the APTA negotiation. Because of the fourth round of negotiation, Bangladesh enjoys duty benefits at different rates for 2,372 products.

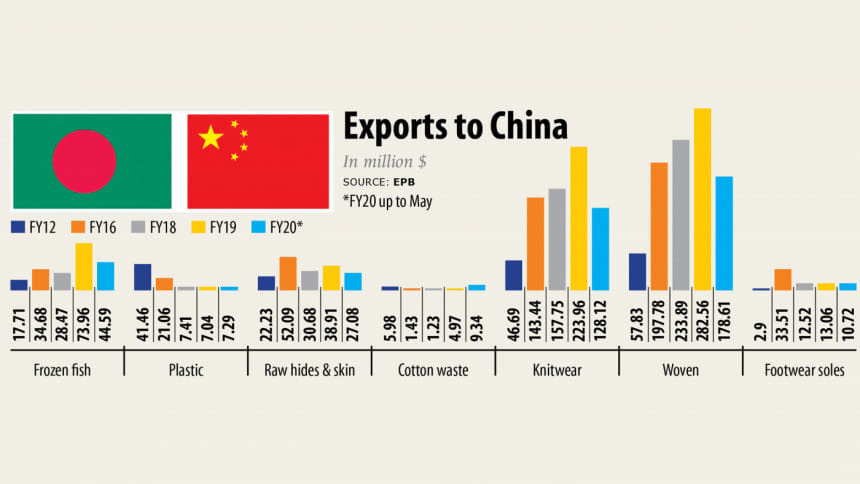

Despite all the duty benefits, exports to China are not growing much. According to the Export Promotion Bureau (EPB), total export to China was worth $791 million in fiscal year 2014-15, $808 million in FY16, $949 million in FY17, $695 million in FY18, $831 million in FY19 and $557 million in July to May period of FY20.

Exports declined in the FY20 because of the Covid-19 pandemic. But the reasons for very little export growth or even decline in the remaining years are not understood. While Bangladesh's exports to the other countries, including the US and Europe showed very impressive growth over those years, the same to the Chinese market looked pathetic. That reality proves that duty-free export benefits, though helpful is not the major factor for boosting exports. Rather, other factors, including price competitiveness play a vital role.

An analysis of the export trend to China reveals that most of the export items from Bangladesh do vary a lot. The export amount for most of the products is very fluctuating. It is true for all the time even if one excludes the very abnormal fiscal year of 2019-20. There was good growth for some items in a year or two before they slid in the following year. The only exception is ready-made garments, which showed consistent positive growth over the years, whatever little it be.

Before July 1, 2020, all the potential export items from Bangladesh were not entitled to duty-free entry into China. It happened as the extended offer from China covering 97 per cent products from the LDCs came in 2013 subject to signing a 'Letter of Exchange' and Bangladesh was not in a position to ink it sacrificing the duty benefits available under the APTA negotiations.

Facing such a situation, Bangladesh requested China to bilaterally consider granting duty-free status on 17 products. The products included underpants and briefs for men and women, swimwear and tracksuits, sacks and bags made of polythene and polypropylene for packing articles, duster cloths, footwear soles made of rubber, textile and plastic, lead-acid accumulator, clothing accessories made of leather, plastics as packing materials, tobacco stripe and maize cereal.

China responded that out of the items requested, one (maize cereal) is not included in the package offered duty-free for the LDCs and the remaining 16 products could be allowed once Bangladesh signed the 'Letter of Exchange'.

Now with the recent declaration from China on allowing duty-free to 97 per cent products without sacrificing any duty benefits available under the regional trade agreements such as the APTA, the 16 products can be exported to China without any duty. Any other products under the package are entitled to the duty-free facility from now on to the Chinese market.

An analysis of the export status of the 17 products reveals that there were no exports of at least five products -- clothing accessories made of leather, plastic as packing materials, tobacco, maize cereal and accumulator -- in the last three years. Moreover, the remaining products had very little amount of export to China.

Products having either no actual export or very insignificant amount of export at present are most likely not to have substantial exports even after its duty-free status. Thus, it can be very logically assumed that the recent declaration of China on allowing duty-free export facility for Bangladeshi products is not enhancing Bangladesh's exports there. If it grows, it will be for other reasons.

China is called the 'Factory for the World.' In terms of quality consideration, their products are so cheap that anyone can hardly dare to challenge them. Many of the products made in Bangladesh are also made there.

China is the top exporter in the world for so many products, including footwear and ready-made garments. Still, they produce a lot of products which Bangladesh does produce and export. So, it will be very challenging for Bangladesh, along with other developing countries, to capture a substantial share of Chinese domestic markets as long as China keeps its price competitiveness and produces those products.

The good news is that with its impressive economic growths over the years, China is moving forward to the higher value chain of economic activities. Chinese producers are gradually facing the higher cost of doing business and many of them are relocating to the other countries with cheap labour and reasonably good infrastructure.

In consideration of that reality, Bangladesh needs to emphasise framing policy positions accordingly to lure Chinese investors. More and more foreign direct investment from China should be the focus of our export development strategy.

With the establishment of factories in Bangladesh, the Chinese investors, on the one hand, can have available and cheap labour as required and on the other hand, the manufactured products could be exported to China with duty-free facilities. That will also benefit Bangladesh with greater employment generation as well as export growth. Thus, the utmost efforts should be given on the proper development of infrastructure, both physical and non-physical to attract foreign investors, especially from China.

Moreover, approval and facilitation should be provided to Chinese investors interested to establish the ready-made garments factories outside the export processing zones and special economic zones. If those are done properly, Bangladesh's export to China will grow at the expected level with the utilisation of the recently declared duty-free facilities.

The author is a former additional secretary

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments