Be wiser, be a winner

Not all owners of plastic cards are winners. But everyone can be a winner.

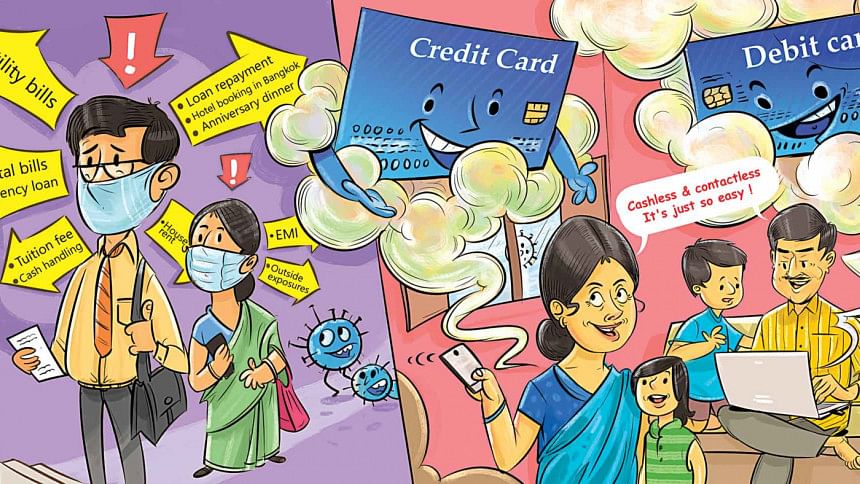

It all depends on how the debit or credit card is used. Take the two contrasting stories of Mizanur Rahman and Lutfar Rahman. Both brothers work as top executives in multinational companies, both get five-digit salaries, and make most of their expenditures through cards but have had completely opposite experiences.

As a chartered accountant, personal finance is easy math for Mizanur. All his expenses and repayment schedule are calculated. Before the start of the month, the plan for his family and himself is well-laid-out: dinner at a five-star hotel, retreat at Cox's Bazar, groceries at super shops, EMI (easy monthly instalment) for iPhone 12, tuition fees for children, etc. All the payment he makes is mostly cashless. And, at end of month, the credited amount is just debited from his accounts. Life is just so easy for him.

As a chief technology officer, Lutfar is quite adventurous. Unlike his brother, he runs his finances without much thought into repayment. He instantly buys gadgets, gears and stuff that he finds interesting. And he wakes up to the rude reality the next month, when he gets the credit card bills. Lutfar is always on the red, cursing the credit cards in his possession.

Card is a lifestyle, an experience. Owners of credit cards have the luxury of enjoying certain extra freedoms. And during a pandemic, it has become a necessity as many of us are now confined to our homes. From grocery, food delivery, shopping and dining, to travelling, studying, instant loans and transactions, one can do almost everything with a plastic card without bothering to visit banks.

But the winner is the owner who uses the card wisely. It is an important tool, but it can also be the cause behind your financial downfall. If the credit is misused or credit card debt accumulates, one can end up hurting oneself financially.

An owner must follow certain checklists and stick to basics in order to take the full advantages offered by banks. And, you can take the first step in the right direction by having the annual fee waived by using your cards as many times as required to score bonus points on offer.

Follow these four steps to be a winner:

1. Get the right credit cards: A lot of credit cards may be offered to you, but you do not need to go for all of those. It is very important that you choose the best credit card according to your lifestyle and expenses. When choosing a credit card, you should look for a card with a low interest rate, no monthly fees, and potentially even rewards or cashback. Be sure to compare the pros and cons of each card to find the best credit card for you.

2. Don't go over your limit: With credit cards in hand, you may get the occasional adrenaline rush to go on a purchase high. Get a grip over yourself, as you must have your priorities straight and a realistic spending habit. Make a monthly plan for your requirements in line with your financial ability. If you think that you will not be able to pay off the balance in full each month or that you will be tempted to run up the balance, it is better to steer clear of using a credit card. It's very important that you don't max out your credit card.

3. Pay your bills on time: Make it a habit to pay off your credit card balance in full and on time each month. If you don't completely clear your balance, you'll usually be charged interest on everything on your card – not just the bit you haven't repaid. So, don't get yourself into the trap of late payment or partial payment. It can eventually make you go broke as debts can spiral out of control. Because you pay interest when you don't clear your card each month, debts can accumulate and take a long time to pay off. Late payment will result in some serious consequences – additional fees and charges, increased interest rates and absurd pay-off propositions.

4. Get your interest rate reduced: Every now and then, contact the credit card provider and request that your interest rate be lowered. Generally, banks should be willing to work with you provided that you have always paid on time. If they say no to lowering your interest rate, don't give up. Give it a few months and try again.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments