Macroeconomic challenges: Towards middle income status

A country's macroeconomic management challenges have to be evaluated with reference to the objectives it seeks to accomplish. Every country generally pursues multiple development objectives. Bangladesh is no exception. Within the limited scope of a single paper it is not possible to deal with all of them. This article focuses on one overriding objective identified in the Sixth-Five Year Plan (SFYP). That is acceleration of growth.

SFYP relates to the period fiscal year 2011(FY11) to fiscal year 2015 (FY15). The Plan has been formulated in the backdrop of vision 2021 announced earlier by the Government. The vision envisages that Bangladesh would achieve middle income country status by 2021. Consistent with this objective, SFYP seeks to accelerate growth of real gross domestic product (GDP).

Growth Targets

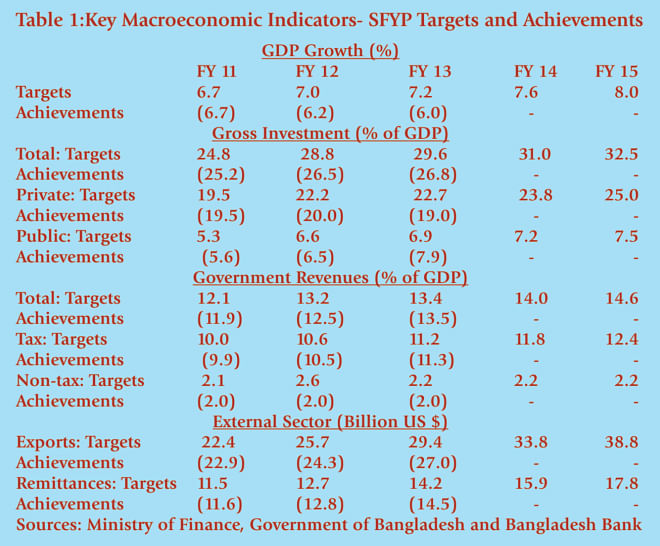

The Year-wise targets of GDP growth envisioned in SFYP are given in table1. The achievements in this regard during the first three years of the Plan fall considerably short of targets. The estimates of likely growth rate for FY 14 by various organizations fall in the range of 5.5%-5.8%. In a separate paper (forth coming) I made an estimate of my own. That estimate turns out to be 5.6% based on somewhat optimistic assumptions. The country is thus consistently falling short of GDP growth targets of SFYP. Another worrying feature of growth performance is that it is on a downward trend.

A recent World Bank study shows that Bangladesh would need to grow by 7-8 percent annually to reach the minimum middle income country threshold by 2021.The required growth rate has become higher by now in view of the shortfall likely to be recorded in the current fiscal year, in addition to the shortfalls already experienced. The first challenge to macroeconomic management, therefore, is to reverse the downward trend in growth and accelerate it substantially.

The determinants of growth

(a) Investment:

Arguably the most important determinant of growth is investment. In an earlier paper (D S. dated 29 December 2012) I reviewed the long-term growth and investment experiences of 12 Asian countries. The review showed a strongly positive relationship between investment and growth.

The World Bank study referred to above notes that to achieve economic growth of 7 to 8 percent Bangladesh would have to raise investment/GDP ratio to at least 33 percent. Now that GDP growth requirement for achieving middle income status by 2021 has become higher, investment/GDP ratio has to be considerably greater than 33 percent.

(i) Private Investment

Private investment which typically accounts for about 75 percent of total investment has been stagnating. As proportion of GDP it has been in the range of 19 to 20 percent since FY 06. A number of structural characteristics of Bangladesh offer immense possibilities for acceleration of investment by both local and foreign investors to serve domestic as well as export markets. The country has a large domestic market owing to large population and reasonably increasing per capita income. Per capita GDP grew on average by 1% during the 1980s, 2.7% during the 1990s and 4.4% during 2000s. The proportion of total population who are young and easily trainable is high. The country has two giant economies (China and India) as its neighbors. It enjoys preferential duty free market access to many developed countries and, more recently, to some developing countries as well.

But the constraints to private investment are aplenty. A basic precondition for both domestic and foreign investment is political stability. Every election cycle in Bangladesh generates considerable political volatility which often degenerates into violence. Another important binding constraint to investment is the inadequacy and unreliability of infrastructure. Power plants based on natural gas as primary energy often do not get adequate supply of gas. The gap between the demand for and supply of electricity remains large despite some recent improvements. If investment were to pick up, the gap would keep growing. Transportation is also an important constraint. The World Bank notes that Bangladesh is at a competitive disadvantage in terms of poor port infrastructure, paved road, airport density and quality of air transport and railways. According to the World Bank's Logistic Performance Index, Bangladesh's rank was 79 in 2010 compared with 27, 44, 47 and 53 for china, Phillipines, India and Vietnam respectively.

Another set of constraints to investment relates to poor governance. Table 2 tells the story. As of 2012, Bangladesh was in the lowest one-third to one-fifth percentile rank in world-wide governance indicators compiled by the World Bank.

As indicated above, the country has a large young population which should be a reservoir of productive work force. Nevertheless, the country suffers from skill gap in most production activities, including garments industry. Existing education and training systems are not adequately geared to the needs of the market place. Improvement in the quality of human resources through relevant education and training to meet the emerging skill needs deserves attention.

(ii) Government Investment

There is also an urgent need for increasing government investment in Bangladesh. Though the private sector will continue to play the leading role, government has to create facilitating conditions. This would require enhancement of investment by the government in infrastructure, health,

education and provision of other merit goods and public goods. In this context, it may be mentioned that as of 2012, Bangladesh had one of the lowest central government expenditure ratios at 17.6 percent of GDP among 30 Asian countries.

The key to enhancement of government investment lies in increasing revenue collection. Domestic revenues account for nearly three-fourths of total government expenditure. But, as of 2012 Bangladesh had the dubious distinction of occupying the second lowest position in mobilizing central government revenues among Asian countries. As proportion of GDP, it was 12.5 percent. This proportion was lower than even that of Nepal (18.3 percent) with a per capita GNP of $540 as against $780 for Bangladesh in 2011. Efforts to raise tax revenues need to be supplemented by improving the efficiency of state-owned enterprises which could be potentially an important source of non tax revenues.

(b) Exports:

Numerous empirical studies substantiate positive impact of exports on economic growth. An important driver of growth in Bangladesh also has been exports which have so far performed reasonably well. As proportion of GDP, exports increased from 12.6 percent in FY02 to 20.7 percent in FY 12. However there has been considerably volatility in the growth of exports. Over the last five years growth of exports ranged from a minimum of 4.3 percent in FY10 to 41.5 percent in FY 11. The rates of growth were 10.3 percent in FY09, 6.0 percent in FY 12 and 11.2 percent in FY 13.

There are two important problems which stand in the way of improved export performance in a stable manner. These are a narrow basket of export goods with garments accounting for about 80 percent and concentration of export destinations with only four countries (USA, UK, Germany, France) absorbing well over 50 percent. Therefore, diversification of products and markets and also upgradation of existing products to higher quality levels have to receive urgent attention.

It may be noted that exports are of particular significance for Bangladesh. The country is heavily dependent on imports for the supply of raw materials, intermediate goods and capital goods.

Growth acceleration would require higher levels of imports. If exports fail to keep up with rising demand for imports, imbalances in external payments would exert negative impact on future growth.

(c) Remittance

Another important driver of economic growth in Bangladesh has been the remittances sent by our nationals employed abroad. Remittances foster economic growth through several channels. Remittances support household consumption and thereby higher effective demand and growth of GDP; meet the foreign exchange gap arising from imbalance between import demand and export earning; and to a limited extent, also supplement investment from domestic savings.

Bangladesh has achieved notable success in increasing remittances. The amount increased from $1.9 billion in FY 01 and $14.5 billion in FY 13, exceeding SFYP targets. But in the first six months of current fiscal year, there has been a negative growth of over 8 percent. Here again, there are two important problems. First, the host countries from which remittances are received are only a few. In FY 12, Saudia Arabia, UAE, UK USA and Kuwait accounted for 76 percent of total remittances. Second, most of the migrants belong to unskilled and semi-skilled category. Diversification of destination countries and raising the skill level of migrant workers could be important conduits for increasing remittance flows.

Concluding Observations

The key macroeconomic challenge facing Bangladesh is to accelerate growth of GDP substantially in order to realize the country's dream of achieving middle income status by 2021. To do so would require enhancing both private and government investment. The constraints to private investment starkly visible in the areas of political instability, infrastructural deficiency, poor governance and skill deficiency need to be addressed. Raising revenue/GDP ratio including through improvement in the efficiency of state-owned enterprises remains a major concern for increasing government investment. The basket of export goods as well as markets for exports need to be diversified. The number of countries from which remittances are received needs to be widened and the skill levels of workers who find employment abroad require upgradation.

Economic growth is a complex process. It involves interaction of a wide range of policies and institutions, private sector responses and external environment. Nevertheless, it can be asserted that if the issues identified in this paper are effectively addressed, Bangladesh should be on the way to achieving middle income states in the foreseeable future, but most unlikely by 2021.

The author is a former Adviser to the Caretaker Government, Ministries of Finance and Planning and presently a Visiting Professor in BRAC University.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments