Looking forward to better external sector management

A trade deficit may not be too bad even amidst the coronavirus challenges if you have a healthy foreign exchange reserve, strong remittance inflow, foreign direct investment, and aid flow. More importantly, when capital machinery or industrial raw materials import is the cause of this possible trade deficit.

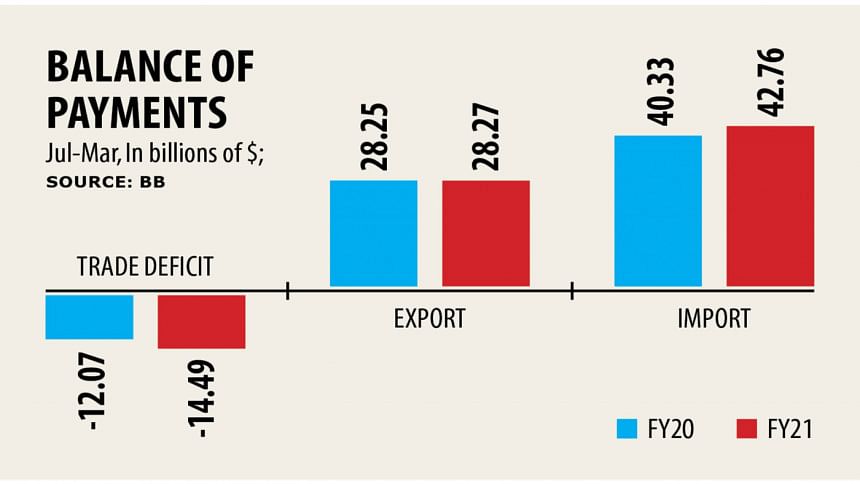

Bangladesh's trade deficit widened by 20.02 per cent in the first nine months of the current fiscal year as import payments rose. But export earnings stagnated, which is often being shown as the sluggish economy by the conventional school of thought in economics.

The deficit stood at $14.49 billion during the July-March period of the 2021 fiscal year, up by $12.07 billion from the same period a year ago.

Bangladesh Bank data showed imports rose by 6.04 per cent to $42.76 billion in the July-March period, from $40.33 billion in the same period last fiscal year.

On the other hand, exports rose by only 0.06 per cent to $28.27 billion in the nine-month period from $28.25 billion in the same period of the previous fiscal year.

The exports and imports have been declining noticeably since last year. However, the economy started to recover from the lacklustre situation created by the deadly virus since December, which possibly has been reflected in the import growth.

However, a lot of things depend on how deep the onslaught of the second wave on our external trade is. If we cannot control the infection rate of Covid-19, it is likely to be a big concern for the future of the country's trade and economy.

It has been mostly construed that the foreign investors would not be comfortable with investing if Bangladesh fails to manage the ongoing coronavirus situation.

The current account surplus stood at $125 million, which was a $2.65 billion deficit in the same period in the last fiscal year. The surplus number was $1.36 billion just a month ago.

Net foreign direct investment (FDI) dropped 7.96 per cent during the period.

Bangladesh received $948 million net FDI in the first nine months of the outgoing fiscal year, down from $1.03 billion a year earlier, central bank data showed.

Economists across the developing world have also been talking of healthy imports to generate higher exports in the future. With our number two position in the global apparel trade and strong inward remittance, I don't think we have much to worry about, provided our policy support to the national exports continues despite some noises here and there, and people are encouraged to go for further investments.

On the other hand, FDI and foreign aid disbursement depend on how Bangladesh positions itself among the global investment community and how many quality public interest or export facilitation projects we can put up on the table convincingly for the development partners.

While talking of export facilitation, economists were, therefore, focusing on import liberalisation too, in order to garner support for a better trade regime. While the Bangladesh Investment Development Authority (Bida) is quite focused on bringing in positive changes to our doing business index, we also need to go for further liberalisation of the international trade and foreign exchange policy regime.

The interesting part is Covid-19 has put most of the countries in the world in economic doldrums, forcing them to invest or divert more public money for the public interest and putting the reforms agenda in the backyard, at least temporarily. Hence, any focused work in this direction will ensure better results in the future.

The author is an economic analyst.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments