Private sector in a sorry state

Bangladesh's private sector has long been in stagnation because of the coronavirus pandemic, and this was again on display during the auction for sukuk last week.

The government earlier said it would mobilise Tk 4,000 crore from the second and final round of the auction of the Shariah-based tool.

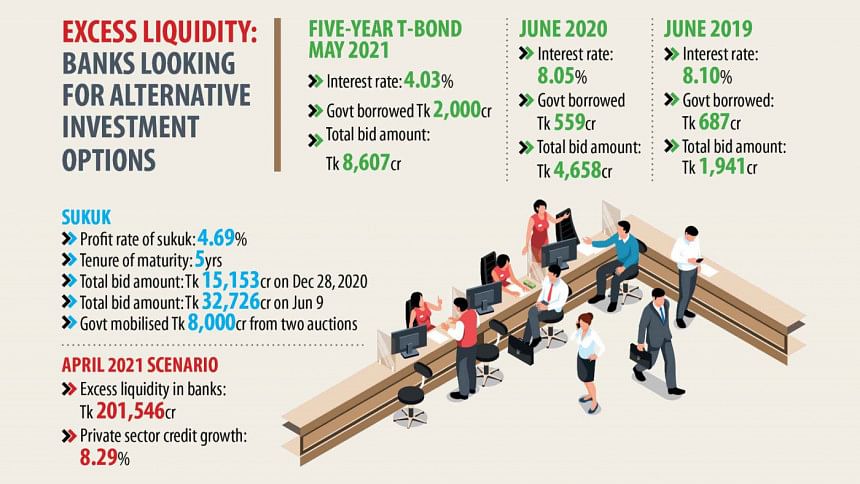

But investors placed bids for a record Tk 32,726-crore on June 9, in a sign of the weak credit demand in the private sector.

No auction of treasury bills and bonds have observed such massive bids. The final round has broken all previous records of auctions of government securities, said several officials of the Bangladesh Bank (BB), who have direct knowledge about the auction of government securities.

On December 28, the first sukuk auction in the country's history took place. Banks and individuals placed bids worth Tk 15,153 crore against the targeted amount of Tk 4,000 crore.

Through the two rounds, the government raised Tk 8,000 crore to implement a safe water supply project, which is expected to be implemented by June 30, 2025.

A sukuk is an Islamic financial certificate, similar to a treasury bond and structured to generate returns in compliance with Islamic finance principles.

As the economy is facing a protracted slowdown, banks are exploring various options to invest their idle funds to maximise profits amid the lower credit demand.

Banks flocked to T-bills and bonds since the second quarter of last year after the pandemic hit the country, bringing the economy to its knees.

In September last year, banks and other investors placed bids amounting to Tk 10,735 crore at an auction of a two-year T-bond. The government borrowed Tk 2,000 crore at the time.

The bid amount is the largest for government securities in the last four years, according to data from BB.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the higher bid for sukuk auction was not a good sign for the economy.

Excess liquidity in the banking sector has been on the increase since the second quarter of 2020 amid business slowdown, he said.

Businesses have adopted a slow-go policy when it comes to expanding their operations, bringing owes for the banks, Mansur said, adding that banks are cautious in lending in some cases.

Excess liquidity at banks stood at Tk 201,546 crore as of April, up 77 per cent year-on-year, data from the BB showed.

Private sector credit growth stood at 8.29 per cent in April against the central bank's target of 14.80 per cent for the outgoing fiscal year.

"The financial indicators have given a message that the economy is still facing hurdles," said Mansur, also a former official of the International Monetary Fund.

Heads of the treasury departments of two banks say that they have been facing difficulties in disbursing funds among the clients since April last year due to the lower credit demand.

The demand for loans had improved a bit in the first quarter of 2021, but the situation has started worsening since April when the second wave hit the country, they said.

Against this backdrop, banks are trying to invest their funds in various government tools, including T-bills, bonds and sukuk.

The profit rate on sukuk is 4.69 per cent, much higher than 4.03 per cent for the five-year T-bond.

"This is one of the main reasons behind the large bidding amounts for sukuk," said a treasury official of a bank.

The maturity period of sukuk is five years.

Investment in the Shariah-based tool is risk-free as the profit rate will not change in the secondary market.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said that banks were now feeling uncomfortable lending as loans might become sour due to the slowdown.

"So, it is quite normal that banks will try to invest their fund in the government tools, which is completely risk-free," he said.

Salehuddin Ahmed, a former governor of the central bank, said banks were now investing in government tools to reduce excess liquidity.

Sukuk is expected to help the government manage its deficit financing at a time when it is struggling to raise revenues from the domestic source.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments