Alesha Mart pays Tk 52 lakh VAT after evasion allegation

Alesha Mart has paid Value Added Tax (VAT) of Tk 52 lakh after the intelligence found evidence of VAT evasion against the e-commerce platform.

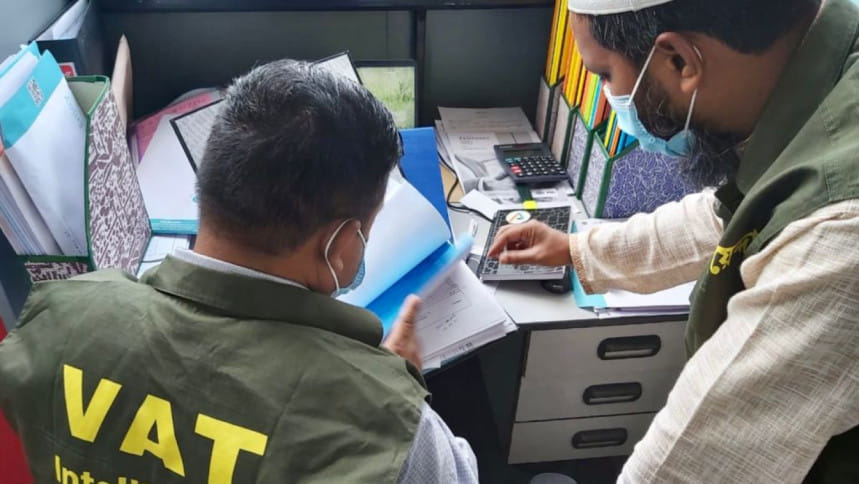

Earlier, a team of VAT intelligence department conducted a drive at the office of Alesha Mart in Banani area of Dhaka on June 8.

During the drive, the intelligence team found that the platform sold products by taking orders online, but it did not pay the VAT imposed on the commission it received by selling the products.

As per the documents seized during the drive, the company sold different products at Tk 181.76 crore after buying those at Tk 175.30 crore in five months since January 1, according to a press release of VAT Intelligence Department.

In this case, the company got TK 6.48 lakh as commission and at a 5 per cent rate, the amount of VAT stands about Tk 32 lakh. But it did not pay the VAT, it said.

In further investigation, the intelligence found that the company had paid Tk 4.41 crore at source VAT on various purchases during the period. But the amount of VAT payable by the company was Tk 4.61 crore. In this case, the online platform evaded VAT of around Tk 20 lakh.

As an online service provider, the company has not complied with the obligation to deposit the VAT of about Tk 52 in the government treasury.

Meanwhile, Alesha Mart today informed the VAT intelligence department that by accepting the allegations of VAT evasion, it has submitted the VAT to the government treasury voluntarily in the middle of August, said Moinul Khan, director general of VAT Audit, Intelligence and Investigation Directorate.

"Although they deposited money, the case was not settled yet. As per the VAT Act, the fine can be doubled of the amount of VAT evasion," he told The Daily Star.

A case has been filed over the VAT evasion and the report of the case has been sent to the VAT Commissionerate (Dhaka North) for taking legal action against Alesha Mart for being involved in VAT evasion, Khan said.

At the same time, it has been requested to further monitor the overall activities of the organization and check whether there are any other financial irregularities, he added.

Tanjilur Rahman, head of Public Relations of Alesha Holdings, said, "We respect the law of the government of Bangladesh. We did not go into any kind of argument. We paid the VAT as soon as we came to know about the matter."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments