Bangladesh sees encouraging rise of green finance

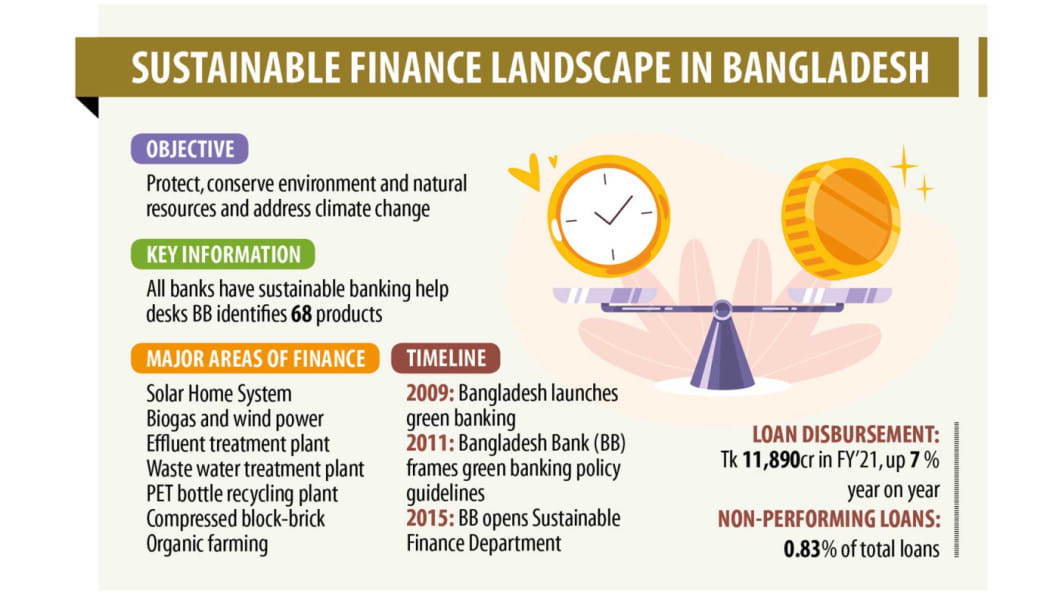

Sustainable financing has gained popularity in recent years as both banks and enterprises in Bangladesh have become increasingly keen to embrace the business model that protects the environment from pollution.

In addition, Bangladesh Bank has taken several initiatives in order to expand the use of sustainable financing.

Last year, banks and non-bank financial institutions (NBFIs) in the country gave out Tk 11,893 crore in green loans, up from 7.11 per cent a year ago, according to data from the central bank.

The amount of green loans disbursed in 2020 would have been much higher if the business slowdown caused by the ongoing coronavirus pandemic had not hit the economy, a Bangladesh Bank official said.

He went on to express hopes that the disbursement of green loans would go up this year as the economy is recovering from the Covid-induced economic downturn in line with the falling rate of infections.

Green or sustainable banking is a genre of banking practices which considers all social, environmental and ecological factors with an aim to protect the environment and preserve natural resources.

It is also known as ethical banking.

Bangladesh Bank began its efforts to popularise sustainable financing in a broad manner in 2011 by drawing up green banking guidelines for banks in the country.

"The model helps create a healthy society and environment to boost our economy," said Khondkar Morshed Millat, general manager of the Sustainable Finance Department, a dedicated wing of Bangladesh Bank for green banking.

The central bank set up the department in July 2015, extinguishing the previous Green Banking and CSR Department in order to widen the use of sustainable finance.

Bangladesh Bank selected 68 products under 13 categories so that lenders can efficiently disburse loans under the sustainable financing programme.

The major products include solar home systems, biogas and wind power plants, biological effluent treatment plants (ETPs), wastewater treatment plants, PET bottle recycling plants, compressed block-bricks, palm oil production, organic farming and so on.

Non-performing loans under the sustainable financing programme currently stands at about 0.83 per cent of the total loans disbursed.

This ratio is much lower compared to the overall default loan ratio of 8.18 per cent in the banking sector as of June this year.

This indicates that clients who have taken green loans are highly compliant.

The central bank had taken a decision last year to prepare a sustainability rating for banks and NBFIs to step up green loan disbursements, said Chowdhury Liakat Ali, a deputy general manager of Bangladesh Bank.

"The move encourages lenders to give out more loans to entrepreneurs who are keen to convert their industries into green ones," he said.

The central bank selected 10 banks and 5 NBFIs that showed the best performance to disburse green loans.

The rating will be prepared every year, which will certainly motivate all lenders to disburse more green loans.

Besides, the central bank has so far rolled out four refinance schemes from its own fund for clients so that they can get loans at a low interest rate, Ali added.

For instance, Bangladesh Bank established a revolving refinance scheme amounting to Tk 200 crore from its own fund for solar energy, biogas and ETP projects in 2009.

The size of the fund was later increased to Tk 400 crore to fulfil the growing demand from borrowers. The interest rate of the fund hovers between 6 and 7 per cent.

Since inception, a total of Tk 511 crore had been disbursed until December last year.

Ali went on to say that a number of sectors, including garments and textiles, had already shown magnificent performances to set up environmentally-friendly industries.

Some 338 washing, dyeing, spinning, weaving, and garment factories now save 28.7 billion litres of water a year by adopting solutions provided by the Partnership for Cleaner Textile (PaCT), a flagship programme of the private sector lending arm of World Bank Group.

Similarly, the factories are saving 2.9 million megawatt-hours of electricity annually and avoiding 558,391 tonnes of carbon emission, according to data from the PaCT.

The PaCT has given technological solutions to industries to set up equipment that allows them to go green.

Bakhtiar Uddin Ahmed, chief operating officer of Fakir Apparels Ltd, said his company did not take any bank loan to set up the green industry.

"However, we will apply to the central bank to manage a soft loan to set up more green equipment, such as solar panels," he said.

The central bank initiative is excellent beyond a doubt as it has opened a new window for businesses to set up green production units, Ahmed added.

Md Arfan Ali, managing director of Bank Asia, said more foreign investors would come to the country if sustainable financing gains pace.

"Foreign businesses take the existing industrial infrastructure of any country into account before making investments there," Ali said, adding that they will take more initiatives to bolster green financing programmes in the days to come.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said that it was a bit challenging to step up sustainable financing programmes given the poverty level in Bangladesh.

"But we have to speed up the programme as the industrial sector is largely responsible for pollution. On top of that, climate change has already started to take a heavy toll on the environment," he said.

Rahman suggested that the central bank could expand its refinance schemes so that businesses show more interest in taking the soft loans.

The government could also think about giving tax rebates to entrepreneurs who operate green industries, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments