External debt repayment rises 16pc

Bangladesh's external debt repayment has increased gradually in recent times aided by an inflow of a huge amount of foreign loans from multilateral and bilateral partners in the forms of project aid and budget support.

The servicing of foreign debt including interest and principal amount saw an increase of around 16 per cent in the first six months of the current fiscal year.

Bangladesh repaid $1.04 billion to external lenders between July and December, data from the Economic Relations Division (ERD) showed. The amount was $900 million in the same period a year ago.

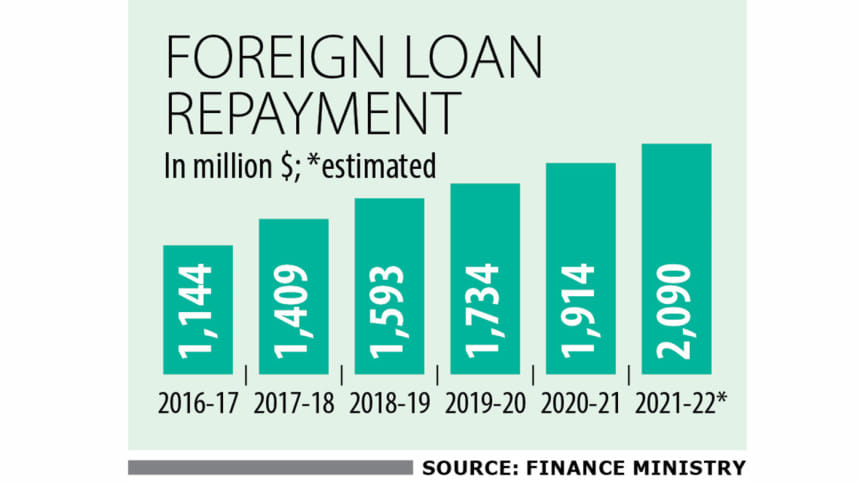

The government has set aside $2.09 billion to service external debts for the current fiscal year of 2021-22.

It paid back $1.91 billion in FY21. The principal amount was $1.42 billion and the interest was $496.18 million.

The loan repayment has accelerated in recent period thanks to a huge inflow of foreign loans in the past decade.

Development partners committed $61.99 billion in the five years to 2020-21 or $12.39 billion per fiscal year on average. Disbursement totalled $31.56 billion during the period, averaging $6.31 billion a year.

The amounts of commitment and disbursement of foreign assistance in FY21 were $9.35 billion and $7.21 billion, respectively.

For Bangladesh, most of the foreign loans are medium- and long-term, are usually concessional in nature, and have a minimum repayment period of 20 years.

The loans against which principals are currently being paid were secured 20 to 30 years ago. The repayment of the interest rate begins immediately after a disbursement is made.

Of the foreign loan repaid in the first six months of FY22, the principal amount was $781.05 million and interests amounted to $259.33 million.

Of the $900.22 million repaid in FY21, the principal amount stood at $661.89 million and the interests $238.33 million.

A mission from the International Monetary Fund (IMF) during its recent visit to Dhaka commented that despite the downgrading of its debt carrying capacity and consequent lowering of thresholds, Bangladesh remains at low risk of external debt distress.

However, the ratio of total public debt service to revenue is high and rising. This is projected to exceed 100 per cent by 2022, pointing to the need for more pronounced revenue mobilisation to support increased social and developmental spending while limiting fiscal risks.

Since independence, Bangladesh has never defaulted on loan repayments and has never sought for re-scheduling of instalments, said an ERD official.

The country's debt-to-GDP ratio is below than international standards.

Development partners pledged $4.4 billion in grants and loans in the first six months of the current fiscal year, up 83 per cent from $2.4 billion committed in the same period in FY21. The disbursement stood at $4.2 billion, up from $3 billion a year back.

ERD's borrowing plan for the current fiscal year, which ends in June, is $12.89 billion. Of the sum, $10.38 billion is project aid.

Bangladesh is sitting on a huge amount of foreign loans as lower spending capacity holds it back from raising the use of cheap funds to a much higher level.

Foreign assistance in the pipeline stood at $50.67 billion in December.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments