Bangladesh can stay ahead of global inflation, if it acts now

"Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman"—these were the words of Ronald Reagan during his campaign for the US presidency at the beginning of 1980s. Inflation was a major development challenge at that point in time, and the trade-off between inflation and unemployment was at the centre of policy debates. Later on, inflation was tamed around most of the world (except for extreme cases such as Zimbabwe), and jobless growth dominated the policy arena of a number of countries. In fact, inflation was in hibernation for almost three decades.

But after decades lurking in the shadows, inflation is back globally, and price spirals remain a real fear for people, both in the developed and the developing worlds. Some stylised facts: in the US, the inflation rate reached 7.5 percent in January 2022, a level not seen since the 1980s; in Britain, it was 6.2 percent last month, the highest since 1997; in the eurozone—the 19 countries using the euro—consumer price index hit 5.1 percent in January, the highest levels since records began in 1997. Among developing countries, the inflation rate in Brazil reached 5.03 percent last month—well above the target of 3.0 percent. South Africa experienced an inflation rate of 5.7 percent last month, and the corresponding figure for India was 6.1 percent. And for Bangladesh, it is estimated to be 5.7 percent. The extreme case, however, is Pakistan, as inflation in that country soared to 13 percent two months ago, just as the rupee, the national currency, is devaluing.

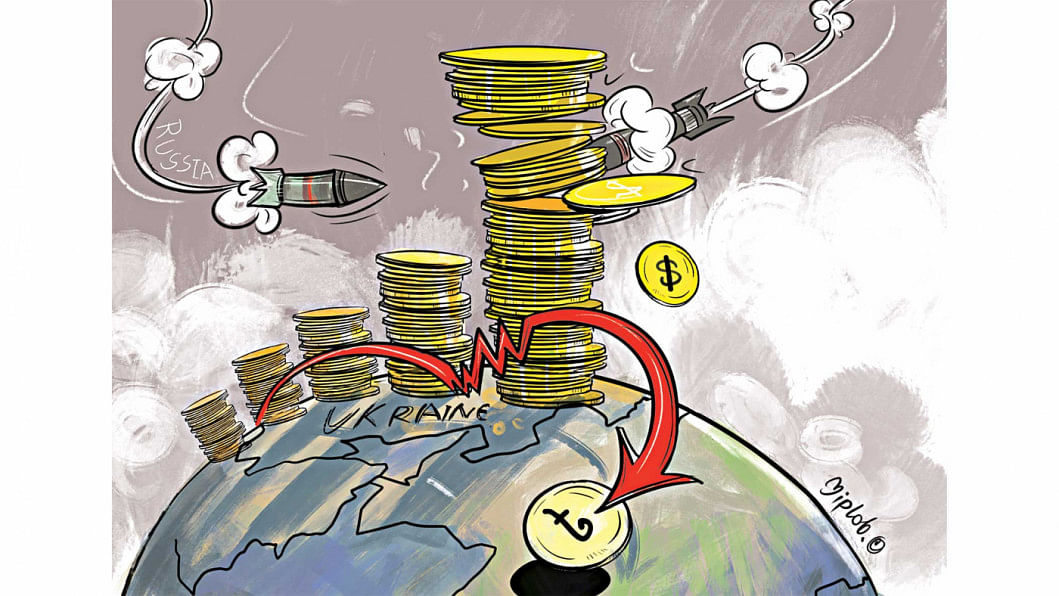

The re-emergence of inflation is often blamed on the Ukraine crisis, but it is only partly true. Inflation in many countries has been brewing for quite some time because of production disruptions and supply chain issues related to the Covid-19 pandemic. There is also increased demand globally. Because of Covid, productions and outputs have been lost, putting pressure on the prices of essentials. Covid, by negatively impacting the transport sector and the intra- and inter-country movement of commodities, has disrupted the supply chains, thus contributing to global inflation. Because of increased demand, global oil prices were up by 77 percent in January 2022 compared to its price in December 2021. In emerging markets and developing economies, because of the lower flow of foreign capital, inflation rose for imported goods.

But there is no denying the fact that the ongoing conflict in Ukraine has contributed to the surge of inflation. Disruptions in global oil markets such as sanctions on Russia, a major oil- and natural gas-producing county, and Saudi Arabia's refusal to increase its production have resulted in price hikes in the global market. The war is also affecting food prices. Ukraine contributes to about 12 percent of the world's total food production, while Russia's share is 16 percent. Ukraine also supplies 17 percent of the world's corn export. With disruptions in production and global supply chains of wheat and corn due to this war, prices of bread and corn may go up sharply in the coming months.

In this broader global context, the critical question is: How would these developments impact Bangladesh's economy?

First, global inflation has adversely impacted mostly food and energy prices, and Bangladesh is not immune to that. The Bangladesh Bureau of Statistics (BBS) has estimated the food inflation to be 4.9 percent in the urban areas of the country and 6.0 percent in its rural areas. Experts, however, opine that the actual inflation rates are much higher. Since the average food consumption constitutes more than 60 percent of the total consumption expenditure of marginal households, increased food inflation in Bangladesh would affect the poor and vulnerable households more. As Bangladesh is a petroleum-importing country, the increased prices of petrol in the global market have already been reflected in domestic prices. Diesel and kerosene prices were raised from Tk 65 to Tk 80 per litre last year. As a result, sectors like transport and agriculture have been adversely affected, and it is the common people who have to bear the brunt of it.

Second, as poor and marginalised groups would be disproportionately affected by inflation, inequalities and disparities between the rich and the poor will increase, not only in terms of outcomes (for example, incomes and nutrition), but also in terms of opportunities. Because of inflation, the real income and wage of poor people would erode more sharply compared to the rich, and the income inequality between the rich and the poor will diverge. Furthermore, because of the rising prices of food, energy, and other essentials, poorer and vulnerable households will have to spend even more on food and energy, which would, in many cases, impede their ability to afford their children's education or healthcare services.

Third, if domestic inflation rises to a certain level, Bangladesh's competitiveness in the world may suffer. Our exportable commodities may become costlier in international markets, reducing export volumes. This will reduce our export earnings, shrinking our foreign exchange.

Fourth, because of Covid, a number of small businesses have already suffered losses in terms of jobs and income. Inflation would be an added injury as small businesses would experience increases in input prices, higher costs of loans (with interest rates going up), and even decreased demand. The viability of such businesses, particularly informal sector activities, may be at stake.

Finally, inflation will adversely affect women. With a tight budget, they may face more difficulties in managing household expenditures, especially in choosing consumption commodities while ensuring proper nutrition for their children. Difficulties in making the ends meet may cause frictions and tensions within the family, giving rise to domestic violence.

Given the overall situation, early policy interventions are a must-do now; pre-emptive actions and strengthening the central bank's independence are some such actions. Furthermore, a dual target of inflation reduction and employment expansion should be the central bank's priority. Monetary instruments must be used to reduce inflation, to manage the value of taka in order to ensure export competitiveness of the economy. Fiscal policies may help ensure employment, continue economic activities and protect the vulnerable. A combined set of relevant monetary and fiscal policies would help combat the inflation as well as ensure non-shrinkage of the economy. Pursuing a pro-poor growth policy would also help—the social protection programmes and structures must be strengthened. But the time to act is now.

Selim Jahan is a former director of the Human Development Report Office and Poverty Division at the UNDP.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments