RISKS GROWING for rising debt service-to-revenue ratio

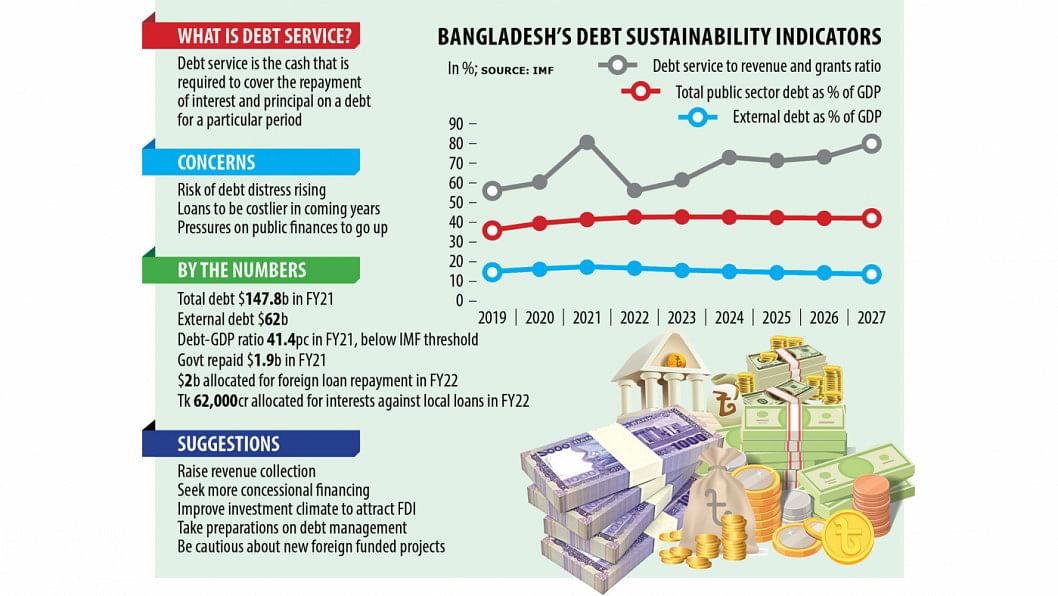

Bangladesh's debt service to revenue ratio rocketed to 81.2 per cent in the last fiscal year amid lower tax collection and higher borrowing, according to the International Monetary Fund.

This compared to 56.2 per cent registered in the pre-pandemic year of 2019.

The escalated level of the debt service to revenue ratio means if the government earns Tk 100 in taxes, it has to spend more than Tk 81 to pay off loans.

"Although the risk of debt distress remains low, the risk from a rising debt service-to-revenue ratio has increased," said the IMF Bangladesh in an analysis in March.

As a result, development and priority expenditures, including those aimed at supporting the economic recovery from the coronavirus pandemic, will continue to put pressure on public finances, it said.

Local economists have also described the situation as still okay but urged the government to be more cautious.

Total public debt in Bangladesh stood at $147.8 billion in FY21, which was around 41.4 per cent of GDP, way lower than the threshold of 70 per cent estimated by the IMF.

External debt accounted for $62 billion in the last fiscal year, or 17.5 per cent of GDP.

The issue of debt has become a topic of public debate after Sri Lanka descended into its worst financial crisis since independence for fast-depleting foreign currency reserves, caused by the dragging pandemic and the Russia-Ukraine war.

Last month, the IMF assessed Sri Lanka's debt to be unsustainable. And the Island nation yesterday said it would temporarily default on its foreign debts.

"The situation in Bangladesh is still okay. But if the country is not cautious going forward, unforeseen future shocks could create debt distress," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

Prime Minister Sheikh Hasina yesterday directed all concerned to take necessary measures so that Bangladesh could maintain its current position in future regarding the foreign debt, as the amount of foreign loan of Bangladesh is still far below the risk limit, according to news agency BSS.

Hussain says one debt will be repaid and then another debt will be taken.

"It will continue. If a loan is productively invested to yield a return higher than the interest rate, it creates no problem."

The IMF has projected the debt service to revenue ratio would come down to a great extent in the current fiscal year. It will increase gradually and again return to the current level by 2027.

When asked whether the increase in repayment is a matter of concern or not, Hussain said Sri Lanka can be an example in this regard.

Sri Lanka's debt repayment reached $7 billion, while it issued sovereign bonds and also took bilateral loans on tight conditions. On the other hand, its revenue plummeted due to populist measures.

"Bangladesh is facing low revenue and has taken some bilateral loans on tight conditions and the repayment of some of the loans has started," said Hussain.

In the future, the loan from the multilateral lenders will also be tighter as the country is on course to attaining the upper-middle-income status.

So, Hussain underscored the need for taking timely steps and preparations on debt management as well as increasing revenue mobilisation.

The IMF analysis says although all external debt indicators are below their corresponding thresholds under the most extreme shock scenario, the overall public debt is only slightly below its indicative threshold.

"This suggests that vulnerabilities have increased and also reflects the downgrade in debt carrying capacity from strong to medium."

According to the IMF, risks are tilted to the downside.

"This has further increased the urgency of mobilising revenues to support the much-needed spending to support pro-poor growth recovery."

Implementing the adaptive expenditure, as laid out in the 8th Five-Year Plan and the Delta Plan will be challenging unless it is financed through concessional or non-debt creating flows such as foreign direct investment (FDI).

"The authorities should continue to seek concessional financing to the extent possible, as well as improve the investment climate to attract FDI financing," said the IMF.

The document stated that the government remains cautious about contracting external debt and expressed concerns about the lowering of the debt carrying capacity.

"They are committed to the automation of the revenue administration and tax expenditure rationalisation to boost tax revenues."

The government set an annual revenue collection target of 12 per cent of GDP in FY16 and 13.5 per cent of GDP in FY20.

The actual revenue mobilisation remained limited at 10 per cent during this period, according to the Medium-Term Macroeconomic Policy Statement prepared by the finance division in June last year.

The actual revenue mobilisation came down to 9.4 per cent in FY21.

In South Asia, Sri Lanka's average revenue mobilisation was at 12.74 per cent, India's at 19.67 per cent, Pakistan's at 14.88 per cent, and Nepal's at 21.50 per cent in the year. It averaged 24.72 per cent for emerging and developing Asian countries.

According to the World Bank and the IMF, the foreign debt sustainability of Bangladesh is far below the maximum risk limit.

According to the Economic Relations Division (ERD), the foreign debt service to revenue ratio reached 10.2 per cent in FY20, but it was still far below the threshold of 23 per cent.

But the amount of foreign loan repayment is ever increasing.

The ERD repaid $1.9 billion, including principal amount and interest against foreign debts to the development partners in FY21, which was less than $1 billion a decade ago.

For FY22, the budget allocation for foreign loan repayment is over $2 billion.

The amount will go up further after five to six years when the repayments against the foreign loans taken for mega projects such as the Rooppur Nuclear Power Plant begin.

The expenses to pay back the domestic debts are also increasing.

The government allocated Tk 62,000 crore for the repayment of interests against the local loans for FY22, up 15 per cent from Tk 54,000 crore in FY20.

Revenue mobilisation has remained a major challenge for the country.

In Bangladesh, the revenue-to-GDP ratio is around 10 per cent whereas it is 32 per cent in the US.

The low tax-to-GDP ratio has been identified by global credit rating agency Moody's as the single most important concern for Bangladesh.

"Bangladesh's tax collection should be 18-20 per cent of GDP," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

He said measuring the level of the debt to GDP ratio is fine for the countries that have a higher revenue-GDP ratio as it reflects that they have a higher capacity to service debt.

"But we may not get the actual picture of our debt repayment capacity if we measure the debt as a percentage of the GDP as our revenue collection is low."

"The public debt level is still within tolerable levels, but we should note that debt service to revenue is increasing. There is quite a high risk," he said.

The rollover risk is increasing for the government as it is moving away from the cheap loan regime owing to the graduation from the grouping of the least-developed countries, and the public borrowing on commercial terms is going up, said Mansur, also a former economist of the IMF.

Muntaseer Kamal, a research fellow of the Centre for Policy Dialogue, says utmost caution should be exercised while taking up new and expensive foreign-funded projects.

"If such projects don't generate the envisaged economic return, the debt repayment will become a critical concern."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments