Bangladesh Bank lets taka float against US dollar

"The BB decision will give a respite to banks from the ongoing dollar crunch."

In an effort to stabilise the forex market, Bangladesh Bank has decided to allow the exchange rates of the taka to float against the US dollar for the first time in a decade.

Economists and bankers have welcomed the move as it will help boost remittance inflow and exports, and also put the brakes on the slide in foreign exchange reserves due to hefty import payments. It, however, could fuel inflation resulting from higher costs of import.

"The latest move will help contain the soaring import payments and subsequently shield the reserves from declining further."

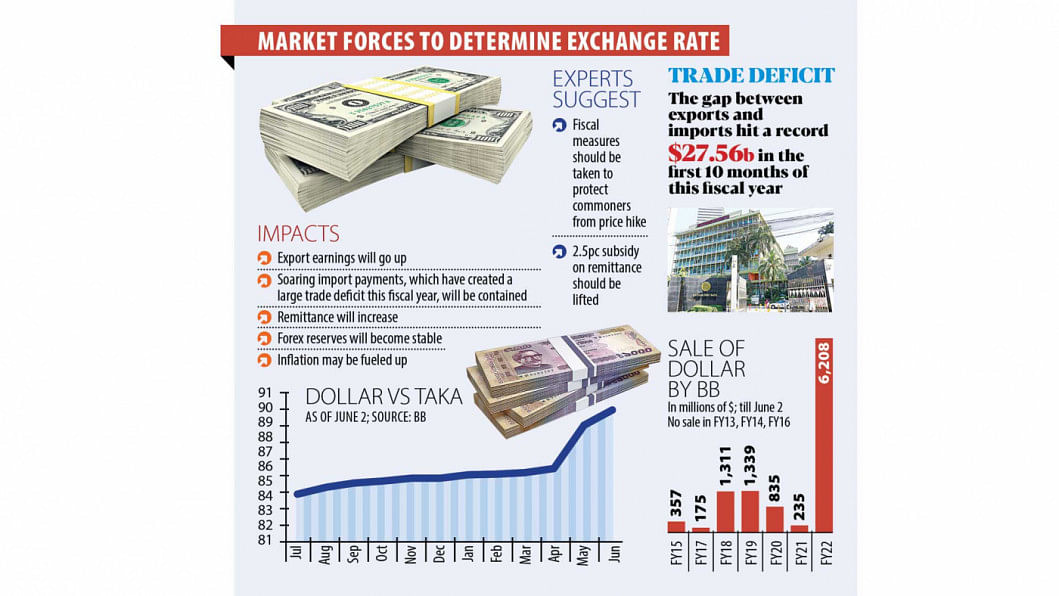

The local currency lost its value by 1 percent against the greenback to Tk 89.90 from Tk 89 per dollar soon after the BB decided to follow the floating exchange rates, which means the market forces, not the central bank, will determine the exchange rates.

The country's import payments have shot up since the end of the last year because of the rise in prices of commodities in the global market.

The local currency has recently come under immense pressure amid a US dollar crunch in the domestic market.

"The interbank market was becoming totally dysfunctional over the last few days because of the artificially fixed exchange rate at which no one wanted to trade. The central bank felt it as remitters lost interest in sending money through formal channels at the official buying rate."

Since the second week of last month, the BB took measures to stabilise the forex market but the majority of the banks ignored its instructions on the exchange rates.

On Sunday, it asked banks to set the selling rate of bills for collection at which lenders sell greenback to importers at Tk 89.15 per dollar. But most of the banks fixed the rate at Tk 94-95, resulting in indiscipline in the foreign exchange market.

The central bank also injected a record $6.20 billion into the forex market between July 1 and June 2 this fiscal year.

The dollar crunch has already compelled the BB to depreciate the local currency eight times this year to keep control on the forex market.

But the steps failed to ease the crisis, and the central bank yesterday decided to go for the demand-supply method followed by many developed nations for fixing the exchange rates of the local currency against the US dollar.

WHY SUCH A MOVE?

Bangladesh's forex market has been facing a shortage of the US dollar over the last couple of months mainly due to soaring import payments and lower than expected remittance inflow.

Between July and April this fiscal year, imports went up by 41 percent to $68.66 billion, while exports grew 35 percent to $41.10 billion.

This has resulted in a record trade deficit -- the gap between exports and imports -- of $27.56 billion, up 53 percent year-on-year.

Moreover, remittance inflow fell 15.95 percent year-on-year to $19.19 billion in the first 11 months of this fiscal year.

The foreign exchange reserves decreased to $42.11 billion on June 1 against $46.15 billion on December 31 last year.

Md Habibur Rahman, chief economist of the central bank, said the latest move will help contain the soaring import payments and subsequently shield the reserves from declining further.

FIRST MOVE IN A DECADE

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the BB had decided to follow floating exchange rates of taka against the US dollar in 2012.

It had made such a decision to contain the rising import payments stemming from an escalation in private sector credit growth. The move helped both the government and the BB manage macroeconomic stability in an efficient manner, he noted.

Though the BB allowed the exchange rate of the taka to float against the dollar, it had instructed banks, from time to time, to follow certainrates while settling import bills and purchasing dollars from exporters.

It also regularly injected or mopped up greenback from banks to influence the foreign exchange market. This is why the exchange rates were not settled based on supply and demand of the greenback.

BB data shows, the interbank exchange rate of the greenback stood at Tk 84.30 per dollar in February 2012 compared to Tk 76.20 in November 2011. The local currency, however, appreciated in June 2012 and stood at Tk 81 a dollar.

Ahsan said there is no need to panic even if the interbank exchange rate crosses Tk 100 a dollar as the taka may appreciate again after a few months like it did in 2012.

BANKERS WELCOME IT

Selim RF Hussain, chairman of the Association of Bankers, Bangladesh, a platform of managing directors of banks, said it would take seven to eight days to bring stability to the foreign exchange market.

The BB decision will give a respite to banks from the ongoing dollar crunch, he said.

It will allow banks to purchase remittances from exchange houses abroad based on the market rate, meaning that they can efficiently manage their required liquidity.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, gave the same opinion.

He said banks must follow the new method efficiently and also behave responsibly to help stabilise the forex market.

WHAT ECONOMISTS SAY

Ahsan said both the government and the BB will have to take additional monetary and fiscal measures to restore stability in the financial sector.

He said the BB should lift the lending cap of 9 percent immediately as it will help reduce the pressure of fluctuation in the exchange rate.

For instance, if the interest rate on post-import finance, which is now 9 percent, goes up, traders will feel discouraged to import goods, he said.

Also, remittance inflow will increase automatically due to the rise in exchange rates of the taka against the dollar.

The government should consider withdrawing 2.5 percent incentive given to the remitters, said Mansur, a former official of the International Monetary Fund.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said the BB made a very sensible move that recognises the market reality.

The interbank market was becoming totally dysfunctional over the last few days because of the artificially fixed exchange rate at which no one wanted to trade. The central bank felt it as remitters lost interest in sending money through formal channels at the official buying rate, he observed.

"Going forward, it will be important not to lose patience. The market has gone through a short period of instability. The transition back to a stable floating rate will not happen overnight. The market will find the equilibrium rate through trial and error over time ...

"There is no free lunch. By increasing the cost of imports, exchange rate depreciation will exacerbate inflationary pressure. This must be managed through judicious and coordinated use of monetary and fiscal policy," he noted.

Zahid further said the next budget can complement monetary policy efforts by containing deficit spending and expanding the provisions for social assistance. The latter is critical for low-income households for whom high inflation is a livelihood crisis.

Former BB governor Salehuddin Ahmed said the prices of imported commodities in the local market usually increase at a faster pace than that in the global market due to a lack of market governance.

The government should protect the consumers from the vested quarters, he said.

Besides, social safety nets for the lower-income groups should be widened in the next budget so they can get a respite from the price hike, added Salehuddin.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments