Exports slow as raging inflation, uncertainty hit West

Export earnings, the largest source of foreign currencies for Bangladesh, slowed in May reflecting the fall in demand in western economies reeling from the crisis caused by higher inflation, the Russian–Ukraine war and supply chain bottlenecks.

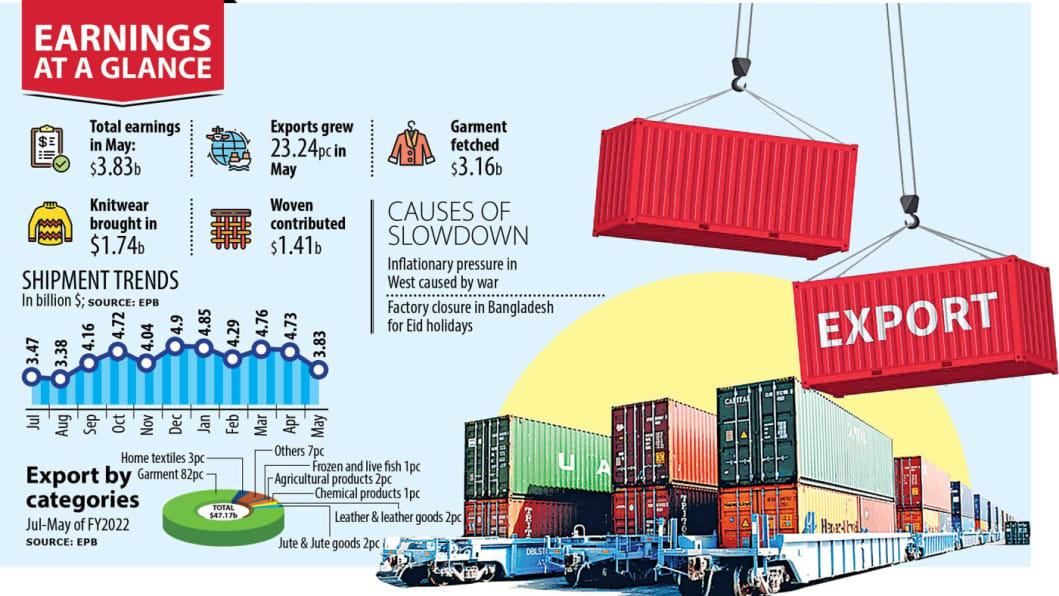

The country earned $3.83 billion in merchandise exports last month, up 23.24 per cent year-on-year but the lowest in nine months, according to data released yesterday by the Export Promotion Bureau (EPB).

It came a day after Bangladesh Bank data showed that remittance flows, the cheapest source of US dollars for the country, declined 13.15 per cent year-on-year in May.

The deceleration in exports and the decline in money transferred by migrant workers will intensify pressure on the country's foreign currency reserves as imports have escalated owing to higher commodity prices.

From September to April, exporters raked in more than $4.50 billion per month as demand surged in keeping with the receding pandemic.

The highest export earnings in Bangladesh's history were recorded in December when shipment brought home $4.90 billion.

The deceleration in earnings in May means the country received almost $1 billion less than the average registered between September and April.

Overall, entrepreneurs posted 34 per cent year-on-year growth in export earnings to $47.17 billion in the July-May period of the current fiscal year of 2021-22.

Garment shipment, which accounts for around 85 per cent of national international earnings, grew 34.87 per cent year-on-year to $38.52 billion during the 11-month period.

Knitwear shipment was up 36.61 per cent to $20.98 billion and woven garment export grew 32.85 per cent to $17.53 billion. Home textile exports surged 41.3 per cent to fetch $1.46 billion.

Kutubuddin Ahmed, chairman of Envoy Textile Ltd, said since the purchasing power of western consumers is declining due to accelerating inflation, the clothing items are not on their priority list.

"So, local suppliers may face work order cancellation and deferral payments again that they witnessed during the peak of Covid-19."

In April, inflation stood at 8.3 per cent in the US, 9 per cent in the UK and 7.4 per cent in Germany, the highest in 40 years in all of the countries. Inflation hit 6.8 per cent in Canada, the highest since January 1991.

The four are major export destinations for Bangladesh.

What is even more distressing, the odds of a recession in Europe, the US, and China are significant. If this translates into reality, demand in the western economies could fall further, hitting exporting nations like Bangladesh.

Ahmed, whose company mainly supplies denim products to European retailers and brands, said some international retailers and brands have already started demanding 2.5 per cent to 5 per cent discounts on consignments.

"Moreover, the import costs have started climbing up."

For instance, Ahmed opened letters of credit (LCs) for importing machinery from Italy and Germany, but the suppliers are deferring the delivery of machinery and asking for 20 per cent more price on the excuse of the war.

"Now, we are facing a crisis because of the war," he said.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association, said the export slowed a bit because of the Eid-ul-Fitr holidays when factories were closed for a week, on average.

He, however, warned that there might be a further slowdown in orders in the near future because of higher inflationary pressure.

"We are worried because of the deceleration in orders. We are trying to overcome the challenges by grabbing more market share in the new markets in Asia and other regions."

Hassan thinks giving incentives to the manufacturers who ship products made from man-made fibres may help lift exports to a higher level as the demand for non-cotton items is rising worldwide.

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association, says no work order for yarn and fabrics has been cancelled yet despite the slowdown in exports.

"However, the delivery of goods has slowed to a bit," he said.

The entrepreneur, however, hopes that orders may make a comeback in July.

Between July and May, the shipment of leather and leather goods increased by 31.85 per cent to $1.11 billion.

Frozen and live fish, plastic products, rubber goods, pharmaceuticals, cotton and cotton products, carpets, footwear, terry towels, ceramics, ships and bicycles performed strongly in May.

However, jute and jute goods export declined 3.19 per cent to $1.05 billion, EPB data showed.

The slowing economies, higher inflation and uncertainty in Europe might have prompted consumers to cut back on their spending, said Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue.

"The slowdown in exports also indicated that. If this continues, Bangladesh may not be able to maintain its higher export momentum in the coming months."

The economist says exporters are gaining from the weakening of the taka against the US dollar and they are supposed to convert their earnings into the local currency.

But the central bank should see whether any exporter is delaying the conversion of their export receipts into the local currency in the hope of further devaluation of the taka, he said.

The Bangladesh Bank, however, yesterday allowed the market forces to determine the exchange rate of the taka against the US dollar, for the first time in a decade. This means exporters will get the dollar rate as per the market price.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments