Stocks tumble despite corporate tax cuts

The domestic stock market took a dive yesterday, the first trading session since Finance Minister AHM Mustafa Kamal proposed the national budget for the fiscal year of 2022-23 in parliament on Thursday.

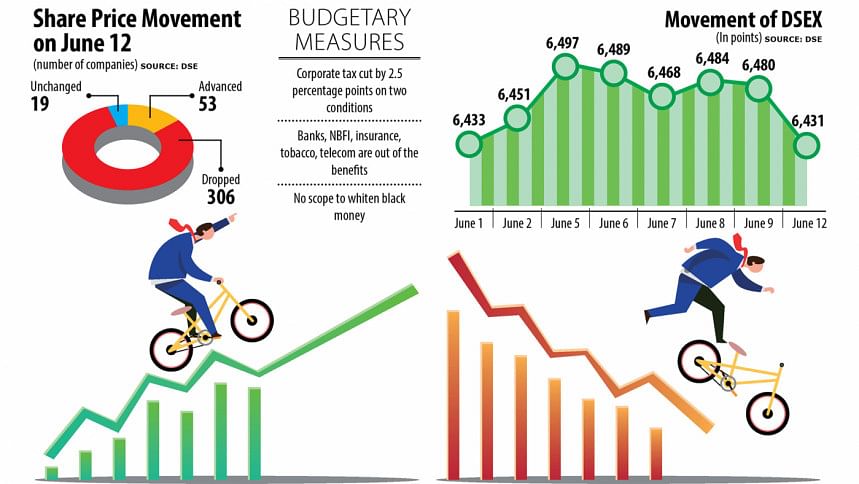

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), decreased by 48 points, or 0.72 per cent, to close the day at 6,431.

Similarly, turnover of the Dhaka bourse dropped 16 per cent to Tk 636 crore from the Tk 758 crore registered on Thursday.

"Investors are not happy with the budgetary measures given for the stock market and so, they are reacting negatively," a merchant banker said.

A corporate tax cut of 2.5 percentage points was included in the proposed national plan but it was for both listed and non-listed companies.

Moreover, two conditions were given that companies will have to offload more than 10 per cent of shares and maintain all income transactions through banking channels in order to enjoy the benefit.

Besides, banks, NBFIs, insurance, tobacco and telecom companies were excluded from the benefit even though there are 113 of these companies that make up one-third of all listed firms.

What is more, the government abolished the opportunity to whiten black money through the stock market.

"So, investors think the market did not get any exclusive measures in the budget," the merchant banker said.

A stockbroker said investors hoped that the government would increase the tax-free dividend income limit up to Tk 50,000 for the next fiscal year.

In addition, the tax gap between listed and non-listed companies should be increased so that more companies are encouraged to go public.

"However, no direct measures for the stock market were given," he added. The DS-30, the blue-chip index, and the DSES, the Shariah-based index, fell by 17 points and 10 points, respectively.

"The DSE slumped into negative territory as investors took the proposal to withdraw the scope of investing undisclosed income in stocks as an unfriendly measure towards the market," International Leasing Securities said in its daily review.

The change alone prevented investors from injecting new funds into the market. As such, the index began a steep slide from the beginning of the trading session.

However, upward price movements of a few stocks later in the day helped buck the declining trend to some extent, it added. Almost all major sectors posted losses, with paper and printing dropping 2.6 per cent while ceramics fell 0.7 per cent.

Investors were mainly focused on the textile (11.8 per cent), pharmaceuticals (10.7 per cent), miscellaneous (10.5 per cent) and engineering (9.6 per cent) sectors.

At the DSE, 53 stocks rose, 306 fell and 19 remained unchanged.

Meghna Insurance topped the gainers' list, rising 9.91 per cent, while Dulamia Cotton Spinning Mills, Monno Fabrics, Shinepukur Ceramics, and Shurwid Industries were placed in the top five.

Summit Alliance Port eroded the most, dropping 2 per cent. Renwick Jasneswar & Company, Green Delta Insurance, Nitol Insurance Company, and Janata Insurance were among other companies in the loser tally.

Shinepukur Ceramics became the most traded stock with its shares worth Tk 39 crore changing hands, followed by Beximco Ltd, BDCOM Online, IPDC Finance, and Bangladesh Shipping Corporation.

The Chittagong Stock Exchange (CSE) also fell yesterday as the CASPI, the prime index of the port city bourse, edged down 134 points, or 0.70 per cent, to 18,891.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments