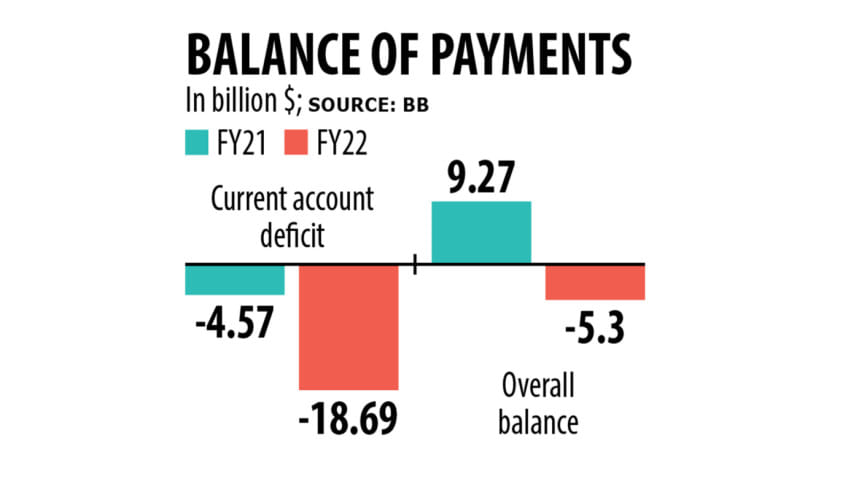

FY22 closed with record $18.7b current account deficit

Bangladesh closed its financial year 2021-22 with an $18.7 billion current account deficit, the highest on record, as export earnings failed to narrow the gap with skyrocketing imports, Bangladesh Bank data released yesterday showed.

The nation paid $82.49 billion for imports while it earned $49.2 billion by shipping goods abroad, causing the trade gap to rise to $33.2 billion last fiscal year, which, along with a downturn in remittances, has created intense pressure on the forex market and resulted in a steep rise in cost of the US dollar.

"It is unprecedented," said Selim Raihan, a professor of economics at the University of Dhaka.

The widening gap has fanned worries regarding the overall stability of the economy, which has done better than its Asian peers even during the worst days of the coronavirus pandemic, prompting the government to go for austerity measures, allow depreciation of the taka, and tighten rules to curb the import of luxury and non-essential goods.

Prof Raihan said the widening current account deficit was a short term yet strong shock for the economy.

"The good thing is that the steps taken by the policymakers were timely and the impact of the measures has started to become visible."

Imports, which surged more than 40 per cent in the initial months of FY22 amid rising commodity prices, supply chain disruptions and the war in Ukraine, went up 36 per cent at the end of the fiscal year, thanks to the tightening of the rules since May and the currency deprecation that has made imported goods costlier.

The depreciation of the taka might give a boost to export and remittance.

Opening of the letters of credit for imports dropped below $5.5 billion in July from more than $7.9 billion in June, said Md Serajul Islam, a spokesperson of the central bank.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said the demand for dollars may decrease if remittance and exports grow and import falls.

This may reduce the gap between the actual rate of the greenback in the foreign exchange market and the inter-bank rate, he said.

"Uncertainty will remain," he said, citing slowing orders for exports.

Atiur Rahman, a former governor of the BB, said overall imports might decline during the current quarter of 2022-23.

"Volatility in the foreign exchange market will ease too."

However, import tightening measures alone will not be enough, he said, adding that the government also needs to cut its development expenditure.

"Besides, some relaxation is necessary regarding the interest rate," he said, referring to the cap on loans and deposits maintained by the central bank since April 2020.

Raihan, also the executive director of the South Asian Network on Economic Modeling, said the short-term shock stemming from the widening of the current account deficit may not affect the macroeconomic stability in the long term.

"But it has created stress."

And for the longer term, he said, the government should try to attract more foreign direct investment and go for reforms in the financial sector, taxation and subsidies with a view to strengthening the country's structural resilience to absorb short-term strains.

"We are frequently facing short-term shocks and these are unpredictable. We have to take steps to increase the resilience of the economy. It is high time to go for the structural reform."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments