Card Payment: Foreign currency transactions hit all-time high

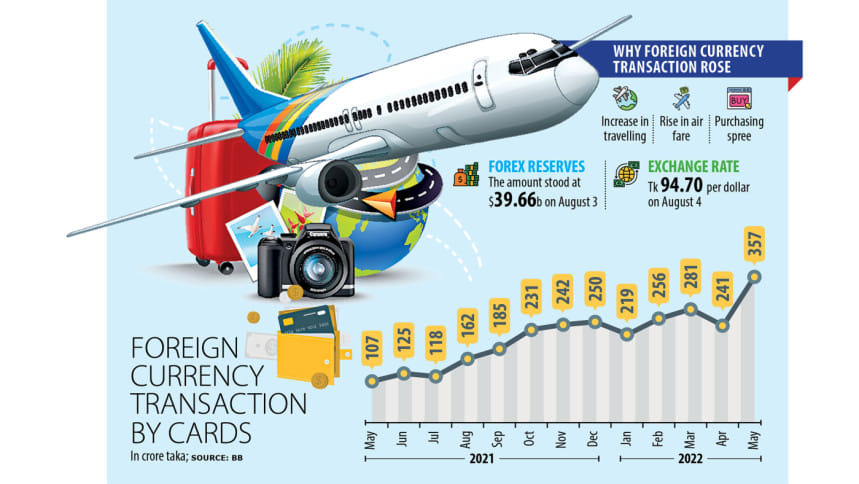

Foreign currency transactions through cards hit an all-time high of Tk 356 crore in May due to a rise in the number of travellers going abroad.

This is a massive 233 per cent rise year-on-year.

In April of 2022, the transactions amounted to Tk 241 crore, showed data from Bangladesh Bank.

Bankers say transactions of a high amount of money through cards had aggravated the ongoing pressure on the country's foreign exchange reserve.

Md Mahiul Islam, head of retail banking at Brac Bank, said a hefty number of people had travelled abroad in May during the vacation of Eid-ul-Fitr, pushing the foreign currency transactions up significantly.

Fares of flights also increased substantially during this period, he said. The travellers had also purchased a good number of products while travelling, as a result of which the spending of the greenback increased, he said.

People had been compelled to opt out of travelling abroad at the height of the coronavirus pandemic, which is why there was a surge in travellers in May, he said.

Although the taka has depreciated significantly with respect to its exchange rate against the dollar in recent times, spending through cards is yet to decline, he said.

He, however, said transactions through cards might decrease in the days to come.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, echoed him.

Many people went abroad to seek medical treatment in May, which also increased the foreign currency transactions through cards, he said.

HM Mostafizur Rahman, head of retail banking at Dhaka Bank, said the number of people travelling abroad had recently started to decrease due to the efforts taken by both the government and Bangladesh Bank.

The government and central bank have recently imposed restrictions on their employees travelling abroad so as to cut the spending of the dollar.

A BB official said the country's foreign exchange reserves were now under pressure due to surging import payments and a decline in the inflow of remittance.

The rise in the expenditure through cards also played a role in exacerbating the pressure, he said.

Import payments amounted to $82.49 billion in FY22, up 36 per cent year-on-year, while the amount of remittance coming in fell 15 per cent to $21.03 billion.

Against this backdrop, the reserves stood at $39.66 billion as of August 3 compared to $46.15 billion on December 30 last year.

Besides, the exchange rate of the taka in the interbank platform increased to Tk 94.70 for each dollar on August 4 in contrast to Tk 84.80 a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments