Internet banking transactions double as users find ease

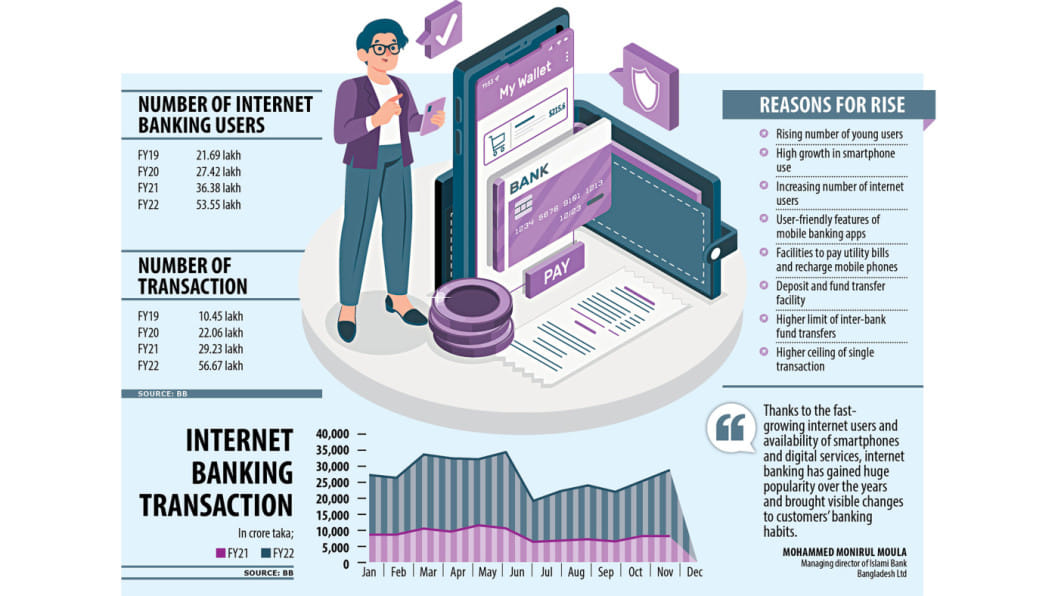

Transactions through internet banking in Bangladesh more than doubled in the last fiscal year as a huge number of people, especially the young generation, are using the platform to carry out financial activities.

In 2021-22, transactions shot up 122.60 per cent year-on-year to Tk 224,958 crore, according to data from the Bangladesh Bank.

Banks started taking up a wide range of initiatives in 2010 as part of their efforts to encourage customers to adopt the digital window.

But it was the outbreak of Covid-19 in early 2020 that turbocharged internet banking as the virus forced people to turn to technologies to communicate, work, study and find entertainment.

Thanks to the growing use of internet banking, people can deposit and transfer funds any time, from anywhere, eliminating the necessity to visit a physical branch of banks. Besides, they can comfortably recharge their mobile phones, and pay utility bills and rents.

Thanks to the growing use of internet banking, people can deposit and transfer funds any time, from anywhere, eliminating the necessity to visit a physical branch of banks. Besides, they can comfortably recharge their mobile phones, and pay utility bills and rents

Abu Masum, an official of a garment factory in Gazipur, performs most of his financial transactions through internet banking owing to his hectic schedule.

"Internet banking has simplified the life of the people, particularly for those who are very busy. I would never have done it all after doing my job without this new form of banking."

Banks have rolled out various products to increase their presence in the digital space. For instance, almost all banks have introduced mobile applications.

The availability of smartphones at affordable prices has contributed to the expansion of internet banking in recent times.

Mohammed Monirul Moula, managing director of Islami Bank Bangladesh Ltd, says thanks to the fast-growing internet users and availability of smartphones and digital services, internet banking has gained huge popularity over the years and brought visible changes to customers' banking habits.

IBBL has been providing internet banking services to its customers through its iBanking platform since 2007.

Currently, it has around seven lakh internet banking users and 17,000 transactions are made every day using this service.

Launched in 2020, Cellfin is another internet banking app of IBBL.

People can avail banking facilities such as account opening, remittance transfer and ticket purchase through the app, said Moula.

Brac Bank introduced Astha mobile app in April 2021 and it has gained immense popularity among clients within a short time, said M Sabbir Hossain, a deputy managing director of the private commercial bank.

In June 2019, the number of internet banking active users of the bank was 20,000 and it has now risen to 1.5 lakh. About Tk 2,800 crore was transacted through the platform in July this year.

"We conduct promotional campaigns to increase the number of clients and make the service popular. We levy no annual charge on internet banking transactions though we could have realised the fee in some cases," Hossain said.

Brac Bank plans to invest more to expand its digital banking operation as it has set a target to double the number of clients within the next two years.

In Bangladesh, the number of customers using internet banking stood at 5.35 crore in June, an increase of 47 per cent from a year earlier, BB data showed.

The central bank has provided support to banks at the height of the pandemic so that they could expand their internet banking operations.

For example, the central bank, in September 2020, raised the limit of inter-bank fund transfers to Tk 5 lakh per day from Tk 2 lakh.

It also doubled the ceiling of a single transaction to Tk 1 lakh from Tk 50,000 and permitted customers to settle as many as 10 transactions per day from five in the past.

A central banker says branch-led banking is already on the wane in keeping with the spread of internet banking, which cut the operational costs of financial institutions at the end of the day.

"This also benefits clients as they can opt out of going to branches to settle transactions. This has helped them utilise their valuable time on other productive purposes."

The central bank's platforms – Bangladesh Real Time Gross Settlement (BD-RTGS) and the Bangladesh Electronic Funds Transfer Network (BEFTN) -- have popularised internet banking as well.

Customers can settle transactions of large volumes instantly through the RTGS while the BEFTN helps them carry out retail transactions within a day.

"Various types of payments, ranging from paying utility bills and tuition fees to booking tickets can be now made from any place, which was unimaginable six to seven years ago," said HM Mostafizur Rahman, head of the retail business division of Dhaka Bank.

Dhaka Bank introduced mobile banking app "Dhaka Bank Go" in 2016.

"The coronavirus pandemic has been a turning point for internet banking. It has globally gained huge traction," said Rahman.

"Some 10 per cent of transactions are carried out through internet banking and this will increase by several folds within the next few years."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments