Bangladesh Bank policies have begun to work

Bangladesh, which has been going through financial difficulties for several months now, can finally see a little light at the end of the tunnel, because a couple of good policies have started to kick in. Making the value of the US dollar float based on the market demand and supply is the best among the policies enforced since early this year, when macro instability began to surface. The floating exchange rate policy was introduced in 2003, but in the early 2010s, a few old-fashioned advisers at the Bangladesh Bank (BB) were gradually successful in reverting to a Pakistan-era policy, when the domestic currency value was artificially fixed and often overvalued. This is a populist stance, but harmful for trade balance and foreign exchange reserves. The central bank should not make the same mistake by walking backwards once the dollar crisis tapers off.

Customers and particularly politicians dislike the idea of letting the dollar's value float in the market, since the value skyrocketed to reach above Tk 115. Economists think the dollar's value should not be higher than Tk 110. While these stakeholders all have a point, BB's decision can be explained by German economist Rudi Dornbusch's theory of exchange rate overshooting. With the onset of multiple oil shocks, the inflation-tormented US economy faced the highest volatility in prices in the 1970s. That was more so for its exchange rate, sprouting confusions in policymaking. Dornbusch rightly pronounced the theory of exchange rate overshooting in 1976, which says the exchange rate will overshoot following its float, but it will eventually come back to the market-determined equilibrium. If you hold a football deep under the water, the ball will jump above the water level once it is released before it gets settled at a normal float. Since the dollar was artificially depressed below the market-desired level in Bangladesh, the world's strongest currency just overshot once the central bank was eventually compelled to unleash it.

The overshooting in Bangladesh was worse than what he predicted simply because Dornbusch did not know about the currency devils in the country who make abnormal profits through arbitrage and illicit hoarding. Nor did he know about the money launderers who siphoned off more dollars than usual, aggravating the crisis. The Bangladesh Bank's policing and catching on currency manipulators has been quite effective and praiseworthy.

The concern is that the forex reserves are depleting and are still under pressure. Trade deficits are widening without encouraging notes. And that is quite normal after the rate adjustment, which the economists term as the J-curve effect, suggesting worsening of the trade balance even in the wake of the exchange rate devaluation or the weakening of taka, and then the recovery after a period.

In 1962, American sociologist James Davies coined the term "J-curve" to show how social and political stability follows a down-and-up path in the wake of a good corrective policy. In 1973, American economist Stephen Magee used the concept of a J-curve in American trade balance, which followed a downhill in 1972 despite the US currency devaluation in 1971. But it displayed an uphill growth in 1973. The path looks like the English letter "J" – hence the name. The time to reach the recovery varies across economies. Bangladesh is likely to see an improvement in trade balance and dollar availability in a year or less.

However, the central bank's efforts and innovations must continue to control imports, expedite exports, and rationalise the channels of remittance. While most countries have moved to electronic remittance for speed and certainty, Bangladeshi exchange houses in overseas are still making remitters follow the mediaeval procedures of filling out forms, writing cheques, labelling addresses in the envelopes, mailing them, and waiting for days, if not weeks, until the money really reaches the Bangladeshi destinations. The Bangladesh Bank should remove the bureaucracy and advise other banks and exchange houses to adopt the fastest and simplest avenue to send remittance. Doing so will dampen the spirits of hundi culture, diverting more funds through official channels and may add another extra five billion dollars to the annual accounts or remittance. The central bank must discover the best practices in this regard. Although remittance is almost half of export income, its modernisation and swiftness will add more peace and safety to the country by raising its volume.

The measures of austerity by the government, restriction on luxury good imports, and the central bank's steps to tighten imports have started to slow the pace of import. Big loans must be controlled while encouraging the loans for small and medium enterprises – which will generate ample employment opportunities. Big loans never care for the interest rate because they will default by plan; the current economic slowdown will be another good excuse for them to default on loans again in the future. The central bank should push the politically pampered, habitual defaulters towards the capital market, while taking good care of the small entrepreneurs for the sake of employment and safe banking.

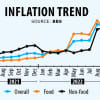

Despite some successes, the central bank's failure to free the lending rate from the government-imposed nine-percent ceiling will dampen much of its policy effectiveness achieved so far. Inflation will not be tamed without putting a brake on big loans. The government's untimely fuel price adjustment has added salt to the wound caused by inflation. This proves that Bangladesh's policymaking is always behind the curve, and its fiscal authority, or the finance ministry, pays no attention to the central bank's goals or the sufferings of the people from the flames of high prices.

It is valid to ask why fuel prices were not adjusted downward in 2014-2020, when oils in the international market were dirt cheap. That could have contributed to further growth acceleration and consumer benefits. Bangladesh will continue to face problems in the energy sector so long as the energy policy is not transparent and short-sighted. The country must dismantle the incompetent, corruption-prone Bangladesh Petroleum Corporation (BPC), and allow free import by private agencies so the prices are determined by the market demand and supply. Otherwise, the central bank will not be able to do its prime job of maintaining a moderate level of inflation that is conducive to higher growth and better development.

Dr Birupaksha Paul is a professor of economics at the State University of New York at Cortland in the US, and former chief economist of Bangladesh Bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments