July trade deficit far below FY22’s monthly average

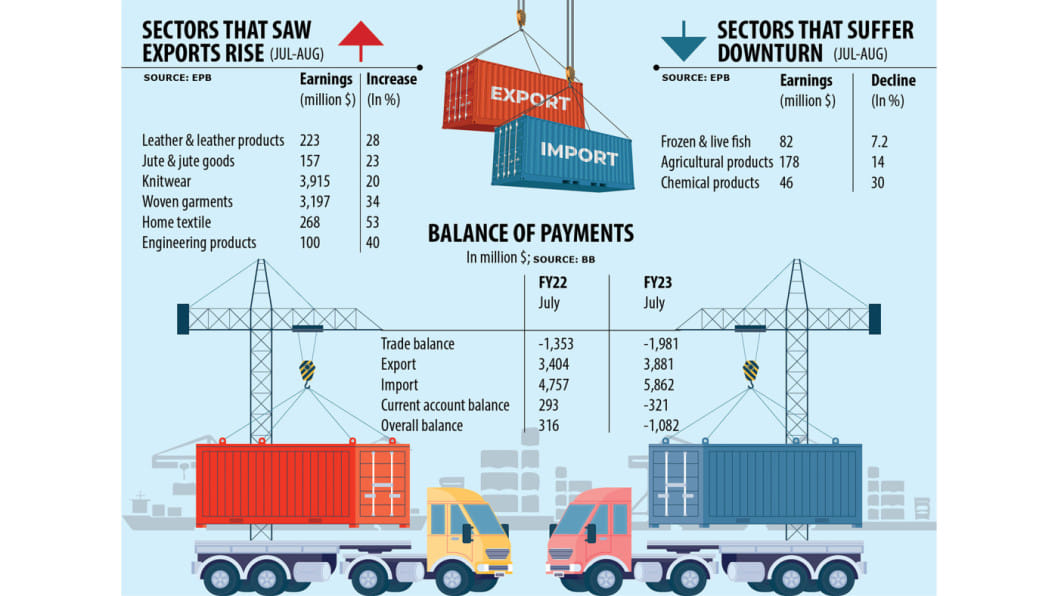

Bangladesh's trade deficit widened by 46.4 per cent year-on-year to $1.98 billion in July, but it was far below than the monthly average recorded in the last fiscal year, an encouraging sign for the economy.

If the current trend continues in the coming months, the ongoing instability in the foreign exchange market may peter out and the taka's slide against the US dollar may come to a halt.

The trade deficit, which happens when import bills exceed export receipts, hit a historic high of $33.24 billion in the last fiscal year that ended in June, data from the Bangladesh Bank showed, meaning a monthly average deficit of nearly $3 billion.

The escalation of import bills, driven by higher costs of commodities amid pent-up demand, supply shocks and global energy crisis caused by the dragging pandemic and the Russia-Ukraine war, has created volatility in the external sector of Bangladesh.

Imports surged to $5.86 billion in July, up 23.2 per cent from a year prior. Exports grew 14 per cent to $3.9 billion and remittance flow rose 11.76 per cent to $2.09 billion.

A number of economists say it is tough to make a precise comment on the trend on the basis of a single month's data.

"The trend of the trade deficit, however, signals that it has started to narrow in contrast to the monthly trend seen in the last fiscal year," said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

Both the Bangladesh Bank and the government have recently taken a number of measures to curb import payments, which hit a record high of $82.49 billion in FY22.

The BB has asked banks to impose a 100 per cent margin on the opening of letters of credit for non-essential items, meaning that importers have to make a full import payment in advance. The measure has already had a positive impact on import payments.

AB Mirza Azizul Islam, a former finance adviser to a caretaker government, terms the falling trend of the trade deficit as a welcoming development.

He, however, expressed concerns about the declining foreign exchange reserves.

The reserves stood at $39.08 billion on September 1 in contrast to $48 billion a year ago, BB data showed.

"The taka will weaken further against the greenback if the reserves keep depleting. Under such a situation, inflation will worsen," Islam said.

In July, inflation, a measure of changes in prices of a basket of commodities, fell to 7.48 per cent from a nine-year high of 7.56 per cent in June.

The forex reserves have been facing pressure for more than a year as the economy rebounds from the business slowdown caused by Covid-19, sending imports to an unprecedented level. The Ukraine war has intensified pressure on the reserves.

In July, the reserves stood at $39.60 billion, enough to settle import bills for 5.3 months. It was $45.82 billion in the same month a year ago that could help the country pay import bills for 6.7 months.

Monzur Hossain, a research director of the Bangladesh Institute of Development Studies, thinks stabilisation of the exchange rate is important to keep the financial sector stable.

Amid dollar shortages, the local currency has lost more than 11 per cent of its value against the US dollar on the inter-bank platform, where banks buy and sell American greenback among themselves.

Although the dollar trades at Tk 95 on the platform, importers have to count up to Tk 110 per USD to settle import bills, meaning the taka has fallen by at least 25 per cent against the dollar in a span of a year.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, says Bangladesh faced an abnormal trade deficit last fiscal year. "Imports have swelled since the final quarter of the last fiscal year."

He thinks that the country may benefit from the BB's initiative after one or two months.

"The squeeze in the trade deficit in July has given a positive signal," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments