Banks finally fix uniform rates for dollar

Banks yesterday fixed the buying and selling rates of the US dollar in order to contain the volatility in the foreign exchange market resulting from higher imports than export and remittances earnings.

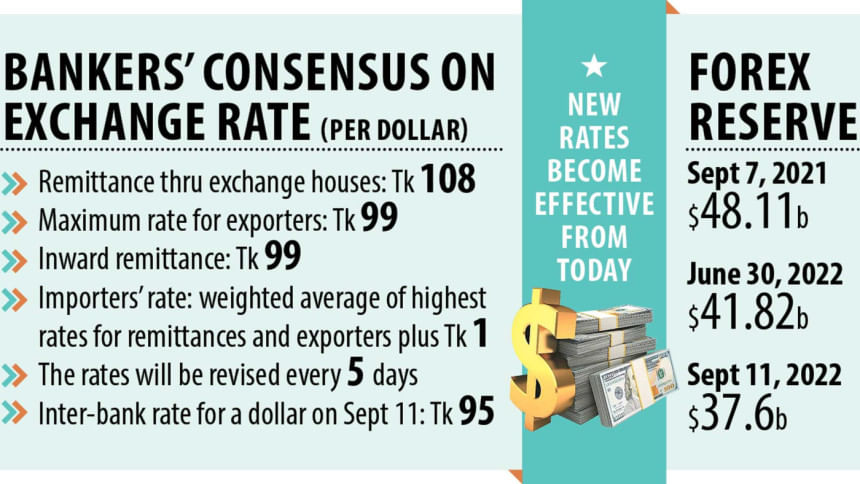

From today, banks will offer a maximum of Tk 108 for a US dollar for the remittances coming through exchange houses, including the funds that are channelled by banks' own exchange houses, with the objective of attracting increased forex currencies from Bangladeshis living abroad.

Exporters and remitters who will send money directly to banks will get Tk 99 for each dollar, according to the decision of the Bangladesh Foreign Exchange Dealers' Association (Bafeda) and the Association of Bankers' Bangladesh (ABB) yesterday.

The gap in the planned purchased rates of the greenback was described as discriminatory by an economist, although bankers said migrant workers mainly send money through exchange houses.

The uniform rates came after the central bank said on Thursday that it would allow the market to fix the exchange rate of the dollar against the local currency.

Until yesterday, banks followed the interbank foreign exchange rate that was prescribed by the Bangladesh Bank. But the rates have come under pressure in recent months amid dollar shortages caused by the higher imports.

The shortage saw the USD trading at as high as Tk 110 although the interbank exchange rate hovered around Tk 95.

Yesterday, both platforms of the bankers agreed about the new uniform exchange rates considering the overall market situation and in order to bring stability to the foreign exchange market to better serve the customers.

As per the decision, importers will have to buy the greenback to clear payments based on the weighted average of the maximum rates plus Tk 1. It means that importers will have to pay Tk 104-Tk 105 for a dollar.

The weighted average cost will be calculated based on the actual costs on a rolling basis over a five-day period.

Bankers hailed the decision, saying the rates are very close to the market realities and are a step toward determining the rates on the basis of demand and supply.

"We think these rates are fair under the current circumstances and these are the just market rates for the US dollar. This is a big milestone for the banking sector. This is a journey toward a more market-determined exchange rate," said Selim RF Hussain, chairman of the ABB.

"The interbank market will be able to operate smoothly and our clients will get the best possible exchange rates."

The rates would be revised from time to time.

According to Hussain, there would be monitoring, enforcement and intervention in the market.

"It will also guide us from time to time."

Hussain, also the managing director of Brac Bank, expects the exchange rate to come down in the next couple of months.

ABB Vice Chairman Mashrur Arefin said the rates fixed by banks will work this time.

"This is because these rates are aligned with the market and fair for all parties involved in the buying and selling of the USD."

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said: "Our governor is saying that he wants the market to determine the rates for dollars. This is the first step towards that end."

"The rates that we agreed in the joint meeting will have to be adhered to by all banks. This is a national issue, so we expect all will follow the rates. And we hope we will see stability in the dollar-taka rate very soon."

Ahsan H Mansur, executive director of the Policy Research Institute (PRI) of Bangladesh, however, questioned the rationale behind the widely different exchange rates for remittances coming through exchanges houses and inward remittances sent by non-resident Bangladeshis as well as exporters.

"Why should we pay much higher rates to intermediaries? Why do we offer them Tk 10 margin per dollar? Why can't I offer a higher rate to small remitters who are sending money directly? Why should exporters get Tk 99?"

"The exchange houses that are manipulating the market by using their financial power are being incentivised through this decision. There is no justification for this," he said.

The noted economist called the policy irrational and wrong because it discriminates against small remitters and it will not work.

"This policy also leads to the emergence of multiple currency practice. We must go back to one interbank rate like it used to be, not multiple rates."

The new dollar rates come as the foreign currency reserves slipped to $37.6 billion on Thursday following the settlement of import payments worth $1.73 billion through the Asian Clearing Union, an arrangement for clearing trade bills among the participating central banks of Bangladesh, Bhutan, India, Iran, the Maldives, Myanmar, Nepal, Pakistan, and Sri Lanka.

The USD traded at Tk 95 on the interbank forex platform yesterday, data from the central bank showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments