Floating exchange rate takes effect, finally

Bangladesh has finally embraced a floating exchange rate as the central bank adjusted its interbank foreign exchange rate yesterday in line with market realities.

As a result, the taka lost its value by 11.73 per cent, the sharpest depreciation faced by the currency in the country's history. It has fallen by 25 per cent in the past year against the dollar.

The USD traded at Tk 95 on the interbank forex market on Monday. But it rose to Tk 106.15 yesterday, data from the Bangladesh Bank showed.

The central bank embraced a floating exchange rate of the taka against the USD in 2012. But in reality, it used to instruct banks, from time to time, to follow certain rates while settling import bills and purchasing dollars from exporters.

It also regularly injected or mopped up the greenback to influence the foreign exchange market. This is why the exchange rates were not settled based on the supply and demand of the greenback.

The changes in the interbank rate for the greenback would have no new impact on inflation. This is because businesses are already importing goods by buying dollars at more than Tk 107 each.

So, economists have long demanded a floating exchange rate to save foreign currency reserves. The calls have grown louder after the outbreak of Covid-19 and the Russia-Ukraine war as the reserves have depleted fast amid escalated import costs.

The central bank had resisted such calls to protect the exchange rate of the taka at any cost, a stance that goes against the standard rule in an open market economy.

But such a position could not be continued as the reserves have kept falling amid persisting higher import bills for the commodities whose demand and prices have gone up sharply whereas the war shows no sign of coming to an end.

The switch to the floating exchange rate came a day after banks in Bangladesh introduced a uniform rate for dollars.

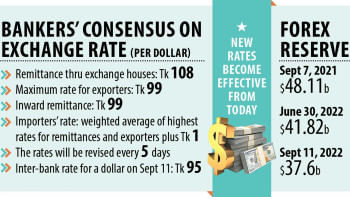

On Sunday, the Association of Bankers, Bangladesh (ABB), a platform for managing directors of banks, and the Bangladesh Foreign Exchange Dealers' Association (Bafeda), a platform of banks, set the uniform rate, which came into effect on Monday.

"It is a move in the right direction," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, while speaking about the BB's new interbank rate.

He argues that the changes in the interbank rate for the greenback would have no new effect on inflation.

"This is because importers are already importing by buying dollars at more than Tk 107 each. But public imports such as petroleum will be costly and additional cost has to be borne by the government from its coffer."

"If the government does not hike prices, the net impact on consumer prices will be zero, while the subsidy through the appreciated exchange rate (borne by the Bangladesh Bank) will be replaced by explicit fiscal subsidy."

Although a few banks sold each dollar in the range of Tk 109 to Tk 110 to importers yesterday for clearing bills, a majority of them reduced their weighted average rate for buying the greenback.

This means importers are now getting respite from paying a high price per dollar, which soared to Tk 112 a few weeks ago.

The weighted average rate is the average of the rates at which banks purchase dollars from exporters and remittances from foreign exchange houses.

Importers now pay the weighted average rate plus Tk 1 when buying the greenback from banks.

According to a Bafeda report, 25 banks cut their weighted average rate yesterday from what they paid on the previous day. Another 11 banks slightly raised their rate.

Two banks, however, kept the rate unchanged during the two days.

With the majority of lenders reducing their rates, the overall average rate for buying each dollar dropped to Tk 103.30 yesterday. In contrast, it was Tk 103.43 the day before.

"The weighted average rate will fall further in the days ahead," said Selim RF Hussain, chairman of the ABB.

The rates being quoted by some banks are still high as they are calculating it taking into account the average rate of the last five working days as per the decision taken by banks, he said.

"The current trend indicates that the instability will gradually fade away," said Hussain, also the managing director of Brac Bank.

The inter-bank platform for trading the dollar has been activated in the last two days, which is a positive development as it will help end the ongoing instability, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

A BB official said the central bank was now strictly monitoring the market to bring back stability.

A managing director of a private bank said the actual exchange rates were higher than the officially quoted interbank rates.

"Now, the actual rate is almost aligned with the official rate. It is a good step."

The CEO expects the BB to sell the greenback at the new rate instead of the previous rate.

Mansur, who formerly worked at the International Monetary Fund, said the spread in the interbank market is slowly narrowing and it needs to be narrowed further to one rate as there is still a wide difference between dollar buying and selling rates of banks.

"The rate of the dollar in the kerb market should also come down. Otherwise, we will not get a unified rate. The more the spread narrows, the more volatility will come down and we will move towards market stability."

The central bank injected another $40 million into the market yesterday, bringing the total supply this fiscal year to $2.86 billion.

Bangladesh's forex market has been facing a volatile situation since the Russia-Ukraine war began when import payments started to rocket.

The foreign exchange reserves slipped to less than $38 billion last week. In contrast, it was more than $46 billion a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments