3 more submarine cables: Private companies to invest Tk 2,000cr

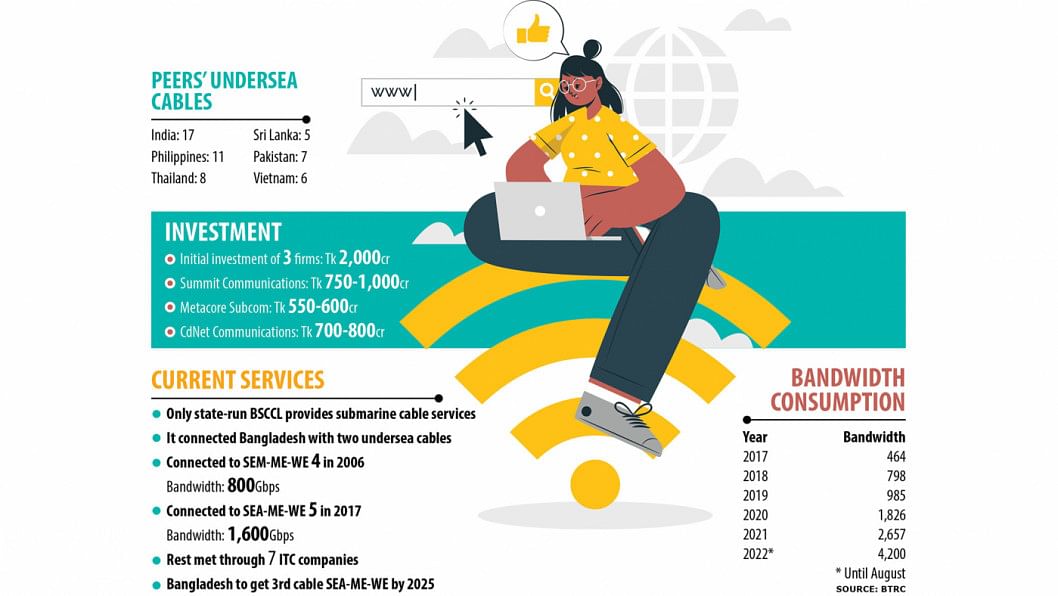

Three private firms will invest around Tk 2,000 crore collectively to connect Bangladesh with at least three more submarine communication cables, in a development that would ensure smooth supply of bandwidth amid surging internet use.

The move will also ensure that internet connections are available at more competitive prices and reduce or end bandwidth imports. India currently caters to around 40 per cent of the country's demand for bandwidth through land cables.

Three local companies -- Summit Communications, CdNet Communications and Metacore Subcom Ltd -- have obtained the licence to establish, maintain and operate submarine cables.

Having deposited a licence awarding fee of Tk 10 crore each, excluding 15 per cent VAT, the firms will also have to pay Tk 3 crore as an annual licence fee.

In addition, they will have to rollout communication cables within 48 months of obtaining the licence, according to Bangladesh Telecommunication Regulatory Commission (BTRC) guidelines in this regard.

However, the companies are planning to connect the country with new submarine cables by 2024, which is one year ahead of the deadline considering the date they were awarded licenscs.

"We are planning to launch our service by 2024," said Aminul Hakim, a director of Metacore Subcom.

"There is a possibility of a bandwidth crunch that year so if we can connect Bangladesh with a cable by then, it will be a good move for our business," he told The Daily Star.

The company will initially invest around Tk 600 crore to this end with the fund coming from local sources.

Submarine cable systems generally use optical fibre cables laid undersea to carry international data traffic, creating telecommunication links between countries across the world.

As such, cable systems cost several hundred million dollars to construct, it is funded by consortiums of telecom operators, private cable operators and private-public partnerships in some cases.

All three local companies said they are initially looking to join any of three initiatives, namely Reliance Jio Infocomm of India, NTT Ltd of Japan or Campana of Singapore.

The Bangladesh Submarine Cable Company Ltd (BSCCL) is a member of the South East Asia-Middle East-Western Europe 4 (SEA-ME-WE 4) consortium, the first undersea cable with which the country was connected in 2006. It supplies about 800 Gbps bandwidth.

The state-run entity also supplies 1,600 Gbps bandwidth through the SEA-ME-WE 5, the connection with which was established in 2017.

Meanwhile, the BSCCL is set to receive 13,200 Gbps from its third undersea cable connection, SEA-ME-WE 6, by 2025.

Besides, the company is going to spend $3.2 million to raise the capacity of its first undersea cable connection by more than four times to 4,600 Gbps.

However, the entry of private firms is set to break the state monopoly as the BSCCL was previously the lone entity permitted to connect the country with the rest of the world through undersea cables.

Asked if the investment is viable considering how the BSCCL's capacity will rise in the future, Hakim said telecom companies devise strategies taking long-term business goals into account as none can break even on the first day of a new initiative.

"Business growth projections suggest there will be good business here. Besides, the government is taking some projects that will spur data use even further," he added.

The director of Metacore went on to say that the rollout of 5G services has been delayed by the ongoing global economic slowdown.

"But I think 5G usage will start in metropolitan areas by next year, propelling bandwidth use further," he said.

Bandwidth consumption witnessed a remarkable rise during the coronavirus pandemic as people turned to the internet for work, education and entertainment from home.

As such, bandwidth usage surged to 4,200 Gbps at present from 1,000 Gbps in the pre-pandemic era, BTRC data shows.

CdNet Communications, which is a new company in telecommunication sector, is initially planning to invest $70 million to $80 million, according to its CEO Mashiur Rahman.

"We want to land the first cable connection by 2024 and a second by 2026," he said.

Like the other two firms, CdNet will connect Bangladesh with submarine cables routed from Singapore.

"About 95 per cent of the country's data traffic is already linked with Singapore, which is Southeast Asia's biggest data hub," said Rahman, a former managing director of the BSCCL.

Google recently established its third data centre in Singapore in order to support the reliable access of Google services by 2.5 billion people in the region.

CdNet plans to connect with a westward cable for European data and Hong Kong for Chinese data.

Md Arif Al Islam, managing director of Summit Communications, said their initial investment would be between Tk 750 crore and Tk 1,000 crore.

"Our company has the capacity to manage the funds locally but still, we are open for foreign investment," he added.

With this backdrop, Bangladesh will be connected to a total of six submarine cables.

Asked if it is necessary for the country to have six connections, Islam said the number of submarine cable links is higher in other countries in the region.

There are seven submarine cable connection systems in Pakistan, 11 in the Philippines, 17 in India, 6 in Vietnam, 5 in Sri Lanka and 8 in Thailand, he added.

However, an official of a telecom operator said if they could lay their own fibre optic cables in the country, then the rolling out of new submarine cables would be more fruitful for end users.

In 2008, the BTRC barred local telecom operators from laying fibre optic cables and introduced a Nationwide Telecommunication Transmission Network (NTTN) licence that only other private entities can avail in order to break the telecom industry's monopoly in this regard.

So, the BSCCL could face stiff competition once private companies launch their services.

"If bandwidth use increases, then it will not affect our business. But if bandwidth use doesn't increase to expected levels, we will face competition," said Md Azam Ali, managing director of the BSCCL.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments