Two major economic woes Bangladesh needs to address right now

Bangladesh saw a sharp rise in inflation in August 2022 – 9.5 percent – which dropped slightly – 9.1 percent – in September, according to the Bangladesh Bureau of Statistics (BBS). Earlier in July 2022, the inflation rate was 7.48 percent, compared to 5.36 percent in July 2021. This increase is driven by food inflation in the domestic market, since food makes up about 60 percent of the Consumer Price Index in the country.

Low- and fixed-income households are particularly feeling the bite of the inflationary pressure. For a country like Bangladesh, inflationary pressure is quite significant since we are not a rich country. Even if our per capita income is USD 2,824 (projected) in FY2022, lower-middle-income and fixed-income groups earn much less, because salaries are not increased in accordance with inflation. According to the Trading Corporation Bangladesh (TCB), prices of essential commodities have increased by as much as 50 percent compared to last year.

High inflation is now a global phenomenon. But if we look at the prices of essential commodities in other countries, we will find there are several commodities that are more expensive in Bangladesh than even in advanced countries – be it domestically produced or imported. Much of it is due to market distortion and mismanagement, where only a few players dominate the market. We frequently claim that if imports become more expensive, domestic prices will follow suit. However, certain commodities are produced locally. Of course, the cost of transportation has gone up and it is added to the price at the consumer end, but by how much? In the case of imported goods, imports are made in bulk, and it is not like they are imported every other day.

Monetary policy plays an important role in taming inflationary pressure. Within the monetary policy mechanism, the interest rate is used as an effective tool in such circumstances. Many countries are applying this tool where the rate of interest on bank loans is increased to control money supply in their economies. In Bangladesh, the interest rate regime is controlled by the central bank despite the fact that our economy is largely driven by market economy philosophy. The logic which is often used by policymakers of developing economies is that a high interest rate on credit would discourage private investment. But credit growth in our private sector has been upwards in the current fiscal year. Some of this loan is for importing capital machinery for investment, but not all. Besides, if one looks at the trend of private investment in the country, it has been hovering around 24 percent of GDP. It is unlikely that, during a crisis period, this trend will be broken. So, the logic of private investment being deterred, manufacturing process being disrupted and thus employment generation being reduced due to a high interest rate on loans is not well-grounded.

What we need now is an increase in supply of essential commodities, both through imports and local production, for which bigger finance is needed. To create such a fiscal space, unnecessary costs and wastage of resources have to be stopped. There should also be targeted support for small and medium enterprises (SMEs). They should be given loans at a lower rate than the large enterprises for their survival and employment generation.

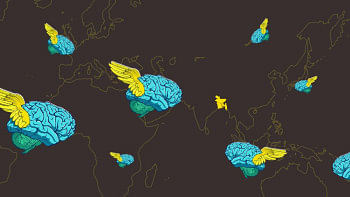

Apart from inflation, there has also been a decline in export earnings and remittance inflow in recent months. This is concerning because exports and remittances are important sources of our foreign exchange reserves, which are used for our imports since we are import-dependent for many commodities. Bangladesh mostly exports ready-made garment (RMG) products. Since the whole world is facing economic slowdown and inflationary pressure, people in the middle-income and lower-income categories will prioritise their spending on food, education, healthcare, housing and other necessities, and cut their expenses on clothes. The lower growth and apprehension of many economies slipping into recession are alarming signs for our export sector.

As for low remittances, there is a lack of interest among the remitters to send money through the banking channel, despite the 2.5 percent incentive offered by the government. Though the number of workers going abroad is increasing, the remittance flow is declining because of their preference to send money through informal channels that provide much better exchange rates. Also, because of the managed currency exchange rate regime for a long time, there was a significant difference between the official exchange rate and the kerb market and the informal hundi transactions. The central bank's recent move to operationalise the floating exchange rate has not seen any material impact yet, since the taka has been depreciating continuously. Of course, devaluation of the taka against the US dollar was overdue since the real effective exchange rate (REER) in Bangladesh has been higher than other competing economies. The REER indicates whether the currency of a country is overvalued, undervalued, or rightly valued. Though it helped to keep import costs lower, it hurt exports and remittances.

As opposed to lower export earnings, import costs are increasing, leading to a large trade deficit. The negative trade balance exceeded (-) USD 30 billion in FY2022, driven by rising imports and relatively lower rise in exports. Moreover, due to the negative growth of remittances, the negative current account balance rose sharply from (-) USD 4.6 billion in FY2021 to (-) USD 18.7 billion in FY2022, which is unprecedented in recent history.

The challenge in the external sector is also reflected through lower foreign exchange reserves. High import costs are depleting our forex reserves fast. In June 2021, our forex reserves were enough to cover 10 months of imports. Due to recent decline, the reserves can cover about five months of import bills. Though it should not concern us in normal circumstances, the rate of depletion and a smaller scope for replenishing the reserves in the current circumstances are worrying.

The ongoing challenges are expected to continue for many more months, and the scenario is uncertain. This is reflected through the changes in projections of various international organisations frequently. Therefore, policy responses of the relevant authorities will have to be prompt and pragmatic. This is not the time to be obsessed with GDP growth. Rather, our policymakers should focus on strengthening the macro-fundamentals so that our economy is strong enough to navigate through these uncertain and difficult times.

Dr Fahmida Khatun is executive director at the Centre for Policy Dialogue (CPD). Views expressed in this article are the author's own.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments