Standard Chartered, BRAC University to develop curriculum on financial crime

Standard Chartered Bangladesh has recently teamed up with BRAC University to develop a curriculum on financial crime and compliance (FCC) for both undergraduate and graduate students enrolled at the institution.

The joint team is working to develop a nation of professionals, who are trained to prevent financial crime while following both local and international standards of compliance, Standard Chartered Bangladesh said in a press release today.

"This initiative builds on a major need for FCC-oriented knowledge in Bangladesh. As such, launching this programme at the university level ensures Bangladesh's youths and future human resources receive the necessary training prior to entering the job market."

This partnership is the first of its kind in Bangladesh, where a financial institution has co-created a certificate curriculum with a university to develop talent for an area that is important for the entire financial sector, it said.

To this end, Standard Chartered Bangladesh and BRAC University signed a memorandum of understanding (MoU) at the bank's head office in Dhaka.

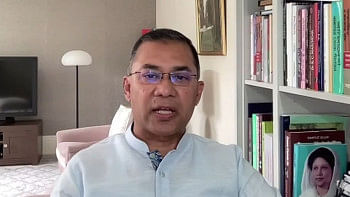

Naser Ezaz Bijoy, chief executive officer of Standard Chartered Bangladesh; Vincent Chang, vice chancellor of BRAC University; and other executives were present for the MoU signing event.

Addressing the event, Bijoy said, "Tackling financial crime is an integral part of Standard Chartered's mission and operations. Working together with organisations to share knowledge and act swiftly in response to evolving threats better prepares us all to identify and thwart financial crime."

"Financial crimes are a significant ongoing challenge for institutions and individuals. This industry-academia partnership will help us better examine the extent and costs of the deceptions alongside major regulatory and criminal justice policy options," Prof Chang said.

"Eventually, it can play a vital role in taking further measures that need to be in place to both protect institutions and individuals and achieve regulatory compliance."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments