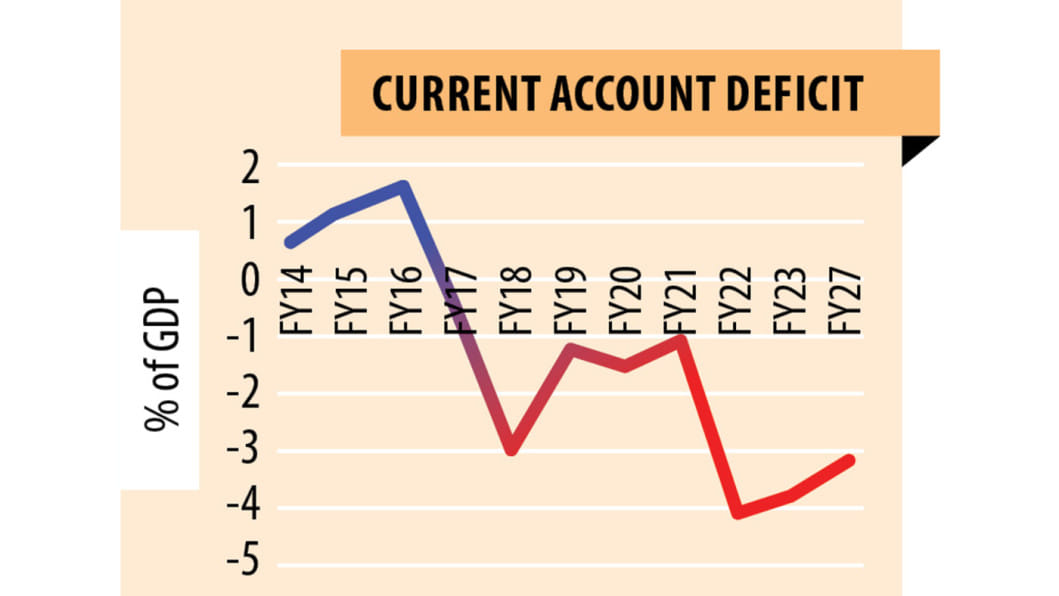

Current account balance: Deficit to remain high till 2027

Bangladesh will continue to see high deficit in its current account balance till 2027, predicts the International Monetary Fund.

This indicates the strain on the country's foreign currency reserves will not go away anytime soon.

The current account deficit will be 3.8 percent of the GDP in the current fiscal year, compared to 4.1 percent in the last fiscal year, according a recent IMF projection.

The current account balance is part of a country's financial inflow and outflow record. It's part of the balance of payments, the statement of all transactions made between one country and another, according to Investopedia.

And negative balance mainly indicates higher import value compared to exports and remittance earnings.

Bangladesh Bank data shows the country's current account deficit shot up to $18.7 billion in fiscal 2021-22 from $4.57 billion in fiscal 2020-21 due to high import.

It caused the foreign currency reserves to fall from around $48 billion in August 2021 to $41.82 billion on June 30 this year. The reserves continued to slide and stood at $35.98 billion as of October 19.

Bangladesh's current account deficit would be 3.2 percent in 2027, according to the IMF Global Economic Outlook Report published on October 12.

The deficit hovered between 0.5 and 1.5 percent of the GDP till fiscal 2020-21, except for fiscal 2017-18 when it was 3 percent, the report said.

Earlier this month, the World Bank projected that the deficit would be 3.6 percent of the GDP in the current fiscal year and 3.3 percent in the next fiscal year.

Economists say Bangladesh needs loans as budget support from different multilateral lenders, including the IMF, to overcome this.

In July, Dhaka sought a $4.5 billion loan from the IMF in the form of budgetary support to shore up its depleting foreign currency reserves.

An IMF delegation, led by its Mission Chief to Bangladesh Rahul Anand, arrives in Dhaka today to discuss the loan.

The team will discuss with the Bangladeshi authorities economic and financial reforms and policies during its stay till November 9, reads an IMF statement issued on October 21.

The team's objective is to achieve progress towards a staff-level agreement on a prospective Extended Credit Facility/Extended Fund Facility programme and access under the newly created Resilience and Sustainability Facility in the coming months, the statement said.

Talking to The Daily Star, Zahid Hussain, former lead economist of World Bank, said prices of different products, including fuel, have soared due to the Russia-Ukraine war. International experts forecast economic recession due to high inflation, rising interest rates and volatile markets.

"The economic impact of the war will continue this year. Our export will suffer due to the global recession. This abnormal situation is likely to prevail till fiscal 2024-25."

He mentioned that if a big deficit in the balance of payments persists, the pressure on the foreign currency reserves would continue.

"The deficit, according to the World Bank and IMF projections, would be around $15-16 billion this fiscal year," he said, adding that the government can tackle the situation provided that it arranges foreign loans of $10-12 billion as budget support annually.

The government should prepare a comprehensive deficit financing plan for the next two to three years so that it can seek loan support from the IMF, the WB and other lenders such as the Japan International Cooperation Agency (JICA) and the Asian Development Bank.

"If the government can do that, the pressure on reserves will ease."

The government should have an appropriate exchange rate policy, Zahid said, adding that multiple rates for export, import and remittance would not relieve the pressure on forex reserves.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the reserves are falling every month. Export and remittance also declined in September. In such a situation, if the government can secure loans from the IMF, it will help maintain macroeconomic stability.

He pointed out that the recent announcement of an IMF loan programme for Pakistan buoyed the exchange rate of its rupee against the US dollar.

"Our situation is not as bad as that of Pakistan. But we are also not in a good position…"

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments