Raging inflation chokes FIXED-INCOME GROUP

All people are suffering except the upper class or upper middle class. From this suffering, anger and frustration are increasing among them, especially those who are in the fixed-income group.

Shahed Alam made a hole in his savings to meet the additional costs of essentials. Parveen Sultana shifted to a comparatively cheaper flat. Shahnaz Parveen has let go of her child's tutor.

Despite living in different parts of the country, these fixed-income people are fighting an identical battle: raging inflation amid no adjustments in salaries.

Along with hundreds of thousands of people in Bangladesh, they are experiencing a severe form of inflation. Daily essentials are going beyond their reach. Price hikes have trumped their monthly salaries following the increase in fuel prices, pushing up commodity prices, transport cost, medical expenses, and education expenditures.

The fixed-income groups are particularly at a far higher risk than other income groups as their pay remains the same despite rising living costs.

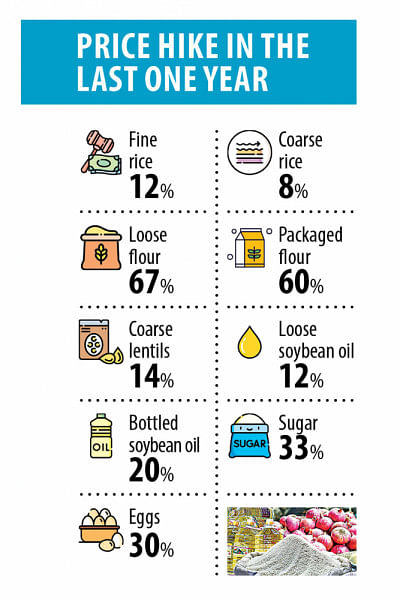

State-owned Trading Corporation of Bangladesh data show that in the last one year, the price of fine rice increased by 12 percent, coarse rice 8 percent, loose flour 67 percent, packaged flour 60 percent, coarse lentils 14 percent, loose soybean oil 12 percent, bottled soybean oil 20 percent, sugar 33 percent and eggs 30 percent.

Banker Akram Hossain has to change rickshaw and buses thrice to go to his office from Mirpur to Gulshan. After the increase in fuel prices, it costs him Tk 90-100 more than before every day.

He used to take ride sharing services for office work. On average, one has to pay Tk 240-280 more a day for that. Akram has stopped availing ride sharing services.

He said everything is now more costly -- transport fare, rice, pulse, oil, fish, meat, vegetables, spices, you name it.

Even the retail prices of fast-moving consumer goods are also increasing.

A well-known brand of bath soap weighing 150 grams sold for Tk 58 a year ago. It costs Tk 75 now. A 500-gram packet of detergent that cost Tk 60 in January now sells for Tk 90. In April-May this year, a 100-gram toothpaste sold for Tk 70-75, which now costs Tk 85-95, Akram said.

A well-known brand of bath soap weighing 150 grams sold for Tk 58 a year ago. It costs Tk 75 now. A 500-gram packet of detergent that cost Tk 60 in January now sells for Tk 90. In April-May this year, a 100-gram toothpaste sold for Tk 70-75, which now costs Tk 85-95.

In Dhaka, they are a family of four. Eight to nine months ago, the couple would go for a walk and eat outside on Fridays. They have stopped this altogether for now.

Even at the beginning of this year, Akram used to send Tk 7,000-8,000 per month to his parents. It has reduced to Tk 4,000 now.

His wife Nasreen Zaman started a tuition for Tk 3,500 a month.

With this money, she pays for vegetables and some other household expenses. In this way, they are trying to survive in Dhaka even though it is difficult.

"In the past, I could save Tk 3,000 every month. Now I cannot save any money," she said.

Shahed Alam, who once used to work in Kaumi Jute Mill Sirajganj, became unemployed like the other workers after the government shut it down for incurring losses.

By taking loans from a bank, he bought an auto-rickshaw. He earns Tk 500 per day. But due to the hike in prices of commodities it is not possible for Alam to make both ends meet with that income. So, he has to use up his savings to meet the additional costs.

Alam said everything has become so costly in recent months that it is now very difficult to feed his family with four kids.

Parveen Sultana and her husband used to work in private companies in Dhaka. They could save up some money after meeting all the expenses.

For her commute, she used office transport; this would save her some transport cost. This way she was able to support her parents living in Brahmanbaria.

At the beginning of the year, her office stopped the transport service. In May, the company sacked her along with some others to cut costs.

"It has become difficult for my husband to run the family alone. Already we have shifted to a cheaper flat to minimise the pressure," she said.

Inflation has been on an upward trend over the past several months amid global supply chain disruptions and uncertainties stemming from the Russia-Ukraine war.

Sultana said she has no brother. So, she has to look after her elderly parents as an older child of the family.

With no income of her own, she supports her parents with her savings.

Talking to The Daily Star, a number of bankers said depositors have already turned away from banks due to high inflation, and many are forced to chip away at savings to cope with the rising cost of living.

Shahnaz Parveen, a school teacher in Dangapara at Natore draws a salary of Tk 22,000. After meeting her family expenses, she could afford a tutor for her child. Recently, she has let go of the tutor to reduce expenses.

Her husband has stopped using his bike to save fuel cost. She now plans to rent a house beside her school to save some money.

"All people are suffering except the upper class or upper middle class. From this suffering, anger and frustration are increasing among them, especially those who are in the fixed-income group," said Golam Rahman, president of Consumers Association of Bangladesh.

"The government should take steps to increase people's income. The market monitoring system should be strengthened to reduce inflation," he said.

Selim Raihan, executive director of the South Asian Network on Economic Modeling (SANEM), said in the last one-year, food and non-food expenditure of fixed-income group has increased a lot. But their income did not.

In this situation, they have to cut costs on entertainment, education and medical treatment. By doing so, they are moving far away from their living standard. This will result in negative and intergenerational impacts.

Price hike in the last one year

Bangladesh Bank data show deposit growth in the banking sector fell to 9.35 per cent in June this year from 13.80 per cent in June last year.

People in rural areas were hit harder by food and non-food inflation than those in urban areas over the last two months, with the overall inflation surging to a 10-year high of 9.52 percent in August.

It however fell to 9.10 percent in September, but people in rural areas continued to feel the pinch as non-food inflation was close to 10 percent that month, according to data released by Bangladesh Bureau of Statistics.

The weighted average rate of deposits -- which is calculated based on the interest rate of all types of deposits offered by banks -- stood at 4.07 percent in August. This means the real interest rate was negative -- 5.45 percent -- as inflation was 9.52 per cent that month.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments